At Crowdfund Capital Advisors, we are committed to ensuring that small businesses and startups across the United States have the capital they need to grow and thrive. Today, we’re proud to support the Empowering Main Street in America Act of 2024, a critical piece of legislation that will help expand access to capital for underserved entrepreneurs, especially women and minority founders who continue to face barriers in the financial system.

This new bill builds on the bipartisan success of the JOBS Act of 2012, which transformed the way small businesses raise funds through mechanisms like Regulation Crowdfunding (Reg CF). As a tool that democratizes capital formation, Reg CF has been a game-changer for many entrepreneurs who have been historically excluded from traditional funding networks, such as venture capital (VC) and banks.

Who We Are: The Data Behind Our Insights

At CCA, we conduct extensive research, analysis, and reporting on the crowdfunding industry through our proprietary data platform, CCLEAR. CCLEAR allows us to gather comprehensive data on crowdfunding campaigns, track success rates, and monitor the performance of businesses using Reg CF. This data is crucial to understanding how Reg CF is affecting the landscape of entrepreneurship in the U.S., especially for those who have historically struggled to access capital.

Our research shows that women and minority entrepreneurs, in particular, have thrived under Reg CF. In the past year alone, 40.7% of all Reg CF campaigns involved at least one woman or minority founder. Not only are these entrepreneurs participating at higher rates, but they are also seeing strong success. Women-led campaigns, for example, boast a 66.6% success rate, higher than white male and minority male founders. This success translates into real economic impact, with these businesses driving job creation and revenue growth in communities across the country.

Why the Empowering Main Street Act is Important

The Empowering Main Street Act of 2024 addresses one of the biggest challenges facing small businesses today: access to capital. While venture capital is often concentrated in specific regions and networks, Reg CF has made it possible for entrepreneurs from all backgrounds and regions to connect with investors and raise the funds they need to grow. This bill strengthens that ecosystem by reducing regulatory barriers, increasing transparency, and ensuring that investors are protected.

The bill is particularly important for women and minority entrepreneurs, who are some of the most underserved groups in the financial system. Venture capital, for example, allocates only 2% of its funds to women and minority founders, compared to the 23.5% of Reg CF funds directed toward these groups over the past year. This stark disparity highlights why Reg CF—and by extension, the Empowering Main Street Act—is so vital.

In addition to expanding access to capital, this bill promotes community-driven investment. Research shows that 80% of investors in Reg CF campaigns come from an issuer’s first-degree network—meaning that many of the people investing in these businesses are customers, community members, and supporters who are directly connected to the company’s mission. This approach fosters strong ties between businesses and their communities, giving entrepreneurs not only financial backing but also a dedicated base of support. This is particularly impactful for women and minority founders, who often face systemic barriers to accessing traditional investor networks.

Real Economic Impact

Real Economic Impact

The data is clear: businesses funded through Reg CF are not only raising capital—they are creating jobs and contributing to local economies. Over the past year, 31.2% of all jobs created by Reg CF-funded companies came from businesses led by women and minority founders. These businesses also saw average revenue growth of 19%, showing that when given the opportunity, underrepresented founders have the ability to grow and sustain thriving businesses.

Even more impressive is the long-term success of Reg CF-funded businesses. Only 6.5% of women- and minority-led companies funded through Reg CF have closed within their first five years, compared to 17.8% of all Reg CF companies and 50% of U.S. companies overall, according to the Bureau of Labor Statistics. Furthermore, 24.4% of women- and minority-led companies have gone on to raise follow-on financing, proving that these businesses are not just surviving—they’re excelling.

Moving Forward: A Call to Action

The Empowering Main Street in America Act of 2024 is a vital piece of legislation that will further strengthen the ability of all entrepreneurs—especially women and minority founders—to access the capital they need to succeed. By supporting this bill, Congress will ensure that more Americans have the opportunity to grow their businesses, create jobs, and contribute to the overall health of the U.S. economy.

At CCA, we will continue to advocate for policies that promote inclusive capital formation and work to close the funding gap for underserved entrepreneurs. Through CCLEAR, we will keep gathering the data needed to provide insights and highlight the impact of crowdfunding on the broader economy.

We urge Congress to pass the Empowering Main Street in America Act, a bill that will have a lasting impact on the future of American entrepreneurship.

For over 15 years, Shark Tank has captured the imagination of millions worldwide, featuring entrepreneurs pitching their innovative ideas to a panel of seasoned investors—also known as the “Sharks.” Since its debut in 2009, the show has become a global phenomenon, sparking versions in countries like Canada, Australia, and beyond. More than just a TV show, Shark Tank has built a reputation as a launchpad for aspiring businesses to gain national exposure, strategic partnerships, and often the necessary capital to scale their operations.

But what happens after these businesses secure a deal—or don’t? Increasingly, we are seeing Shark Tank companies turn to Regulation Crowdfunding (Reg CF) as a follow-up financing option. Reg CF allows these businesses to raise capital from a broad base of investors, including everyday people who want to be part of the companies they believe in.

Download the full report AND the list of all Shark Tank Issuers/Offerings:

The Appeal of Regulation Crowdfunding

What makes Reg CF so attractive to Shark Tank businesses? For many, it’s not just about capital. While shows like Shark Tank provide an excellent opportunity to secure large investments from well-known entrepreneurs, Regulation Crowdfunding offers something equally powerful—crowd advocacy.

With crowdfunding, these businesses don’t just gain funds; they gain a community of investors who are also customers, brand advocates, and ambassadors. These are people who believe in the mission of the business and are more likely to promote the product or service, providing a lasting, loyal customer base. This added layer of advocacy can help drive long-term success.

Kevin O’Leary’s Role in Crowdfunding

Interestingly, one of the Sharks—Kevin O’Leary—has become a leading voice in the crowdfunding space. As a strategic advisor and spokesperson for StartEngine, one of the top platforms for Reg CF, O’Leary has leveraged his Shark Tank influence to promote the benefits of equity crowdfunding. StartEngine has hosted many high-profile campaigns, though it faces competition from platforms like Wefunder, which has raised more capital for Shark Tank issuers to date.

The Shark Tank Effect on Reg CF

There’s no doubt that Shark Tank fame can provide a significant boost to a company’s crowdfunding efforts. Many businesses that appear on the show, regardless of whether they secure a deal, experience a massive surge in public interest—a phenomenon known as the “Shark Tank effect.” This heightened visibility positions them well for Reg CF, allowing them to capitalize on public excitement while engaging a broader network of potential investors.

Over time, we’ve seen numerous Shark Tank companies continue their fundraising journeys via crowdfunding platforms, achieving considerable success. Not only do they raise millions in follow-up funding, but they also increase their valuation and expand their market reach. By inviting regular investors into their companies, they foster stronger ties with their customer base, ensuring that these backers are deeply invested in their success, both financially and emotionally.

What Does This Mean for Entrepreneurs?

For entrepreneurs who have appeared on Shark Tank, Regulation Crowdfunding offers a powerful tool to maintain momentum post-show. Whether they close a deal with a Shark or not, crowdfunding gives them the opportunity to continue building capital while turning fans into investors. As more Shark Tank alumni turn to Reg CF, it’s clear that crowdfunding is becoming a critical part of the growth strategy for these businesses.

If you’re a business owner considering crowdfunding or an investor interested in the companies behind Shark Tank, keep an eye on this evolving trend. The future of fundraising is changing, and Shark Tank companies are leading the charge in merging traditional capital raising with the power of the crowd.

September 2024 marked an intriguing month for the crowdfunding sector, as markets adapted to shifting macroeconomic conditions while continuing to show signs of resilience. The Federal Reserve’s decision to implement a 50 basis point rate cut—its first in over four years—helped ease financial conditions, and this move was well-received by both traditional markets and the crowdfunding space. Despite geopolitical tensions and slowing growth signals, there are key takeaways you won’t want to miss from September’s crowdfunding landscape.

Deal Flow and Commitments

Crowdfunding deal flow continued to rise, with 126 new deals launched in September across 102 cities. The industry secured $38.2 million in commitments, though this was a step down from August’s higher totals. Automotive and gaming companies stood out, with deals like Olympian Motors and Orange Comet raising significant capital.

Debt vs. Equity Trends

While debt offerings made up 35.7% of all deals, equity remained dominant in terms of capital raised. Debt deals are raising larger sums than before, despite representing a smaller portion of overall capital commitments.

Platform Leaders

Platforms like Honeycomb and StartEngine saw notable growth, with Honeycomb leading the market in new deals. Established platforms such as Wefunder retained their market share, though their commitments have begun to show signs of pressure.

For a deeper dive into September’s market trends—including detailed analysis of valuations, platform performance, and key investor trends—subscribe to our full report and stay ahead in the evolving crowdfunding landscape!

We’re excited to announce the release of our August 2024 report, providing deep insights into the state of Investment Crowdfunding, with a special focus on the coffee and tea industry!

Since its inception in 2016, coffee and tea issuers have emerged as one of the most compelling segments within crowdfunding. With 211 deals completed and nearly $55 million invested, this sector is rapidly evolving. Our August report uncovers key trends, including the rise in median valuations, the role of top platforms like Honeycomb, Wefunder, and StartEngine, and how investor interest has shifted in 2024.

But the numbers only tell part of the story. Our report dives deeper into the economic impact, revealing how coffee and tea companies have contributed $1.7 billion to the U.S. economy and created over 13,200 jobs in 116 cities nationwide. This growing market isn’t just about coffee and tea—it’s about community, innovation, and investment opportunities.

Ready to explore the full report? Whether you’re interested in the broader crowdfunding landscape or specifically focused on coffee and tea issuers, we’ve got you covered with several options:

- Subscribe to our Monthly Reports: Get all industry insights delivered straight to your inbox for just $34 per month.

- One-Time Report Purchase: Buy the August 2024 Industry/Coffee & Tea report for $49.95.

- Exclusive Coffee & Tea Analysis: For $99.95, gain access to a detailed analysis of coffee/tea companies that have successfully raised capital, complete with offering links, amounts raised, # of checks written, financials, valuations, and more.

Don’t miss out on this opportunity to stay ahead of the curve in the fast-growing world of investment crowdfunding!

Given we are based in Denver, we thought it would be interesting to cover the impact of investment crowdfunding on Colorado’s economy. Since the 2016 launch of this innovative capital-raising method, 252 issuers in Colorado have turned to investment crowdfunding, with an impressive 71.8% success rate. These businesses have collectively raised $55.1 million from nearly 55,000 investors, 80% of whom are likely Coloradans. These companies have a collective value of $1.78 billion, indicating the potential for tremendous wealth creation. This local involvement demonstrates the power of community-driven investment and highlights the strength of crowdfunding as a tool for economic empowerment.

Investment crowdfunding, a financial model that allows companies to raise up to $5 million annually from the public through online platforms, has been transforming how businesses access capital. What makes this model so impactful is its inclusivity—anyone can invest, which democratizes access to both funding for businesses and investment opportunities for individuals. This movement is sweeping the nation, with Colorado emerging as a leader in this space. Sherwood Neiss, Principal at Crowdfund Capital Advisors, emphasizes: “Investment crowdfunding is more than just a funding mechanism. It’s a powerful tool that connects local businesses with the communities they serve, allowing everyday people to become stakeholders in the economic future of their region.”

Colorado’s diverse industries have been major beneficiaries. The top sectors utilizing crowdfunding include healthcare, food services, and technology. Denver leads the way with 62 deals, raising over $164 million from 23,000 investors. Prominent companies such as McSquares, which raised $1.43 million from 2,587 investors, and Colorado Sake Co., which raised $728,395 from 754 investors, exemplify how local businesses can thrive through crowdfunding. Boulder follows closely with 31 deals, raising $11 million. The successful companies in Boulder include HobbyDB, which raised over $1.5 million from 3,623 investors.

Interestingly, according to the Crowdfunding Genome, a tool that ranks cities based on their investment crowdfunding activity and performance, Denver/Boulder ranks 20th in the nation. This indicates that while the region is making strides, there is still room for improvement. Cities with higher rankings have typically seen more deal flow, greater diversity in industries, and stronger investor engagement. Enhancing Denver and Boulder’s crowdfunding ecosystem could help propel these cities into the top 10, driving even more economic growth.

Beyond the capital raised, the economic ripple effects of investment crowdfunding are substantial. Colorado businesses that raised funds through this method have contributed an estimated half a billion to the state’s economy, spending that largely flows back to other local companies providing goods and services. This creates a sustainable cycle of growth and development within the state.

Moreover, investment crowdfunding promotes inclusivity, with 17.1% of all Colorado issuers having a women or minority founder. This helps diversify the entrepreneurial landscape, offering opportunities to historically underrepresented groups.

As crowdfunding continues to grow, Colorado is poised to benefit further. This model empowers individuals to invest in businesses they believe in, fostering stronger ties between companies and their communities. The state’s economic future is being shaped not only by the businesses that innovate but also by the residents who choose to invest in them. In the words of Sherwood Neiss, “The future of local economic development is being driven by those who see the potential in their neighbors’ businesses and choose to invest in their success.”

You said:

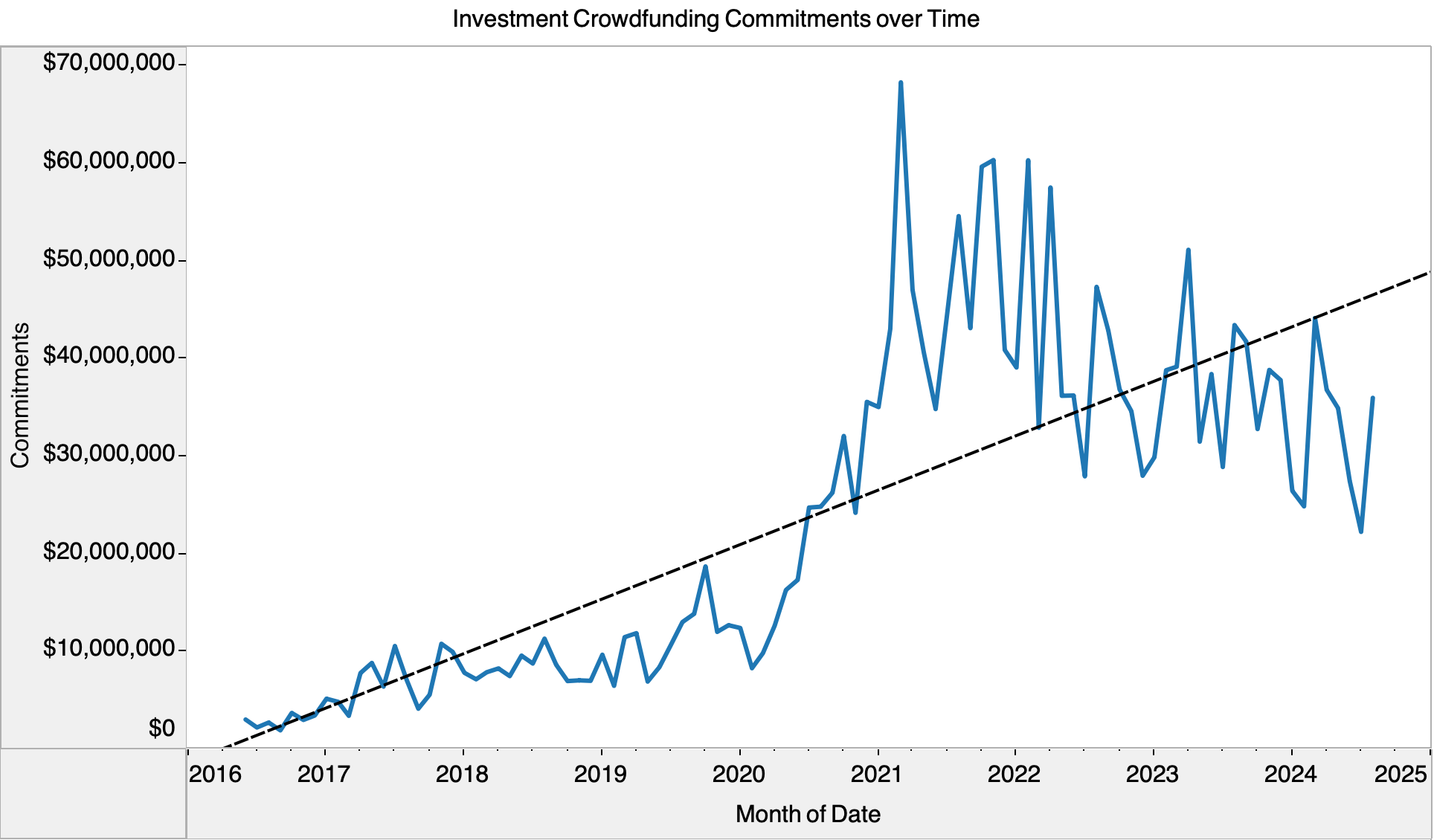

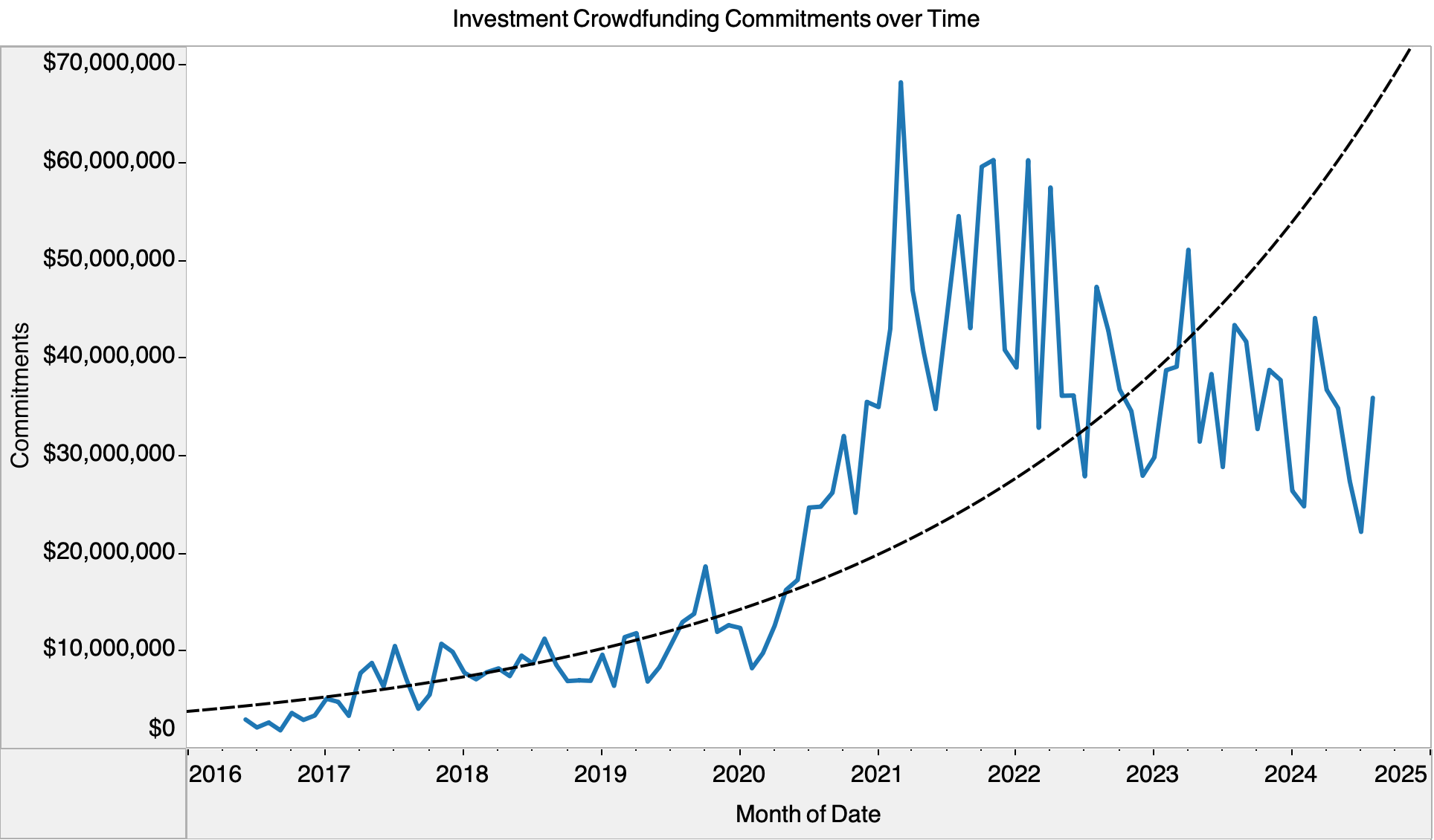

As Regulation Crowdfunding continues to gain traction as a viable method for startups and small businesses to raise capital, it’s crucial to understand the underlying trends that drive investment in this space. Recent analyses of investment commitments have provided valuable insights into how this market is evolving and what the future might hold. Below, we explore three different trendline models to paint a comprehensive picture of the growth in Regulation Crowdfunding.

Linear Growth: A Steady Increase Over Time

Our first analysis utilized a simple linear trend model to examine the growth of commitments over time. The results were clear: there has been a consistent and statistically significant increase in investment commitments, with an R-squared value of 0.61. This suggests that as time progresses, more capital is being funneled into Regulation Crowdfunding, highlighting the growing confidence in this fundraising method. On average, commitments increased by approximately $15,272 each month, indicating a steady rise in investor interest.

Exponential Growth: Accelerating Momentum

The second model took a logarithmic approach, applying a natural log transformation to the sum of commitments. This model revealed an even more striking trend: investment in Regulation Crowdfunding appears to be growing at an accelerating rate. With an R-squared value of 0.76, this model demonstrates that commitments are not just increasing—they are doing so at an exponential pace. The results underscore the rapidly increasing appeal of Regulation Crowdfunding, as more investors flock to this space, attracted by its potential.

Polynomial Growth: Signs of a Maturing Market?

Finally, we explored a polynomial trend model, which added a quadratic term to the analysis. This model revealed a more nuanced picture. While there is still clear growth, the negative coefficient on the quadratic term suggests that the rate of increase in commitments might begin to slow over time. With an R-squared value of 0.65, this model hints at the possibility that the market may be approaching a saturation point, where growth could start to level off.

The Impact of Parallel Offerings on This Analysis

It’s important to note that this analysis only considers the capital raised specifically through Regulation Crowdfunding. However, many offerings today include parallel offerings that aggregate additional capital from accredited investors in a Rule 506(c) offering or offline in a Regulation D offering at the same terms. If these amounts had been included in the analysis, the total capital raised would have been significantly higher.

Including this additional capital, particularly in more recent periods where the use of parallel offerings has increased, would likely have had a substantial impact on the results. Specifically, it could have:

- Increased the overall sum of commitments: This would likely have elevated the linear growth model’s trendline, reflecting even stronger confidence in crowdfunding mechanisms.

- Exacerbated the exponential growth trend: The logarithmic model, which already indicates accelerating growth, would have shown an even steeper trajectory, further emphasizing the compounding effect of additional capital.

- Altered the polynomial model’s curve: The presence of more capital might have delayed or reduced the degree to which the growth rate appeared to taper off, potentially indicating a longer period of robust growth before any signs of market saturation.

The combined insights from these three models suggest that Regulation Crowdfunding is experiencing robust growth, driven by increasing investor confidence. However, it’s also clear that the inclusion of capital from parallel offerings could have further amplified these trends, especially in recent periods. For stakeholders, this means continuing to innovate and adapt as the market matures, while also considering the broader landscape of capital-raising strategies.

As we move forward, these trends will be critical to watch. They offer a roadmap for investors and issuers alike, helping to navigate the evolving landscape of Regulation Crowdfunding. Whether you’re a seasoned investor or a startup looking to raise capital, understanding these growth dynamics—and the potential impact of parallel offerings—can provide a strategic edge in a competitive market.

Sherwood Neiss, Principal at Crowdfund Capital Advisors, highlights the significance of these findings: “The market for Regulation Crowdfunding is still in a strong growth phase, with potential signs of hypergrowth in certain areas. This represents an incredible opportunity for issuers seeking capital and investors looking to diversify into alternative assets.”

Date: September 25, 224

Date: September 25, 224

Time: 9:30 AM – 11:00 AM

Location: 1700 Lincoln St. 17th Fl. Denver, CO 80203

The world of venture capital is undergoing a significant transformation, driven by the explosive growth of investment crowdfunding. With over $84 billion in pent-up liquidity, this dynamic sector is providing new opportunities for startups, particularly those led by women and minority founders, to bridge the infamous “valley of death” and secure the funding they need to thrive. On September 25th, we’re hosting an exclusive event to explore these developments and discuss how you can tap into this burgeoning market.

Event Overview

At this event, you’ll gain unparalleled insights into the world of investment crowdfunding from one of the industry’s co-founders. Our host, who was instrumental in writing the very framework of Regulation Crowdfunding under the JOBS Act, will share his unique perspective on how the industry has grown to $2.5 billion in investments. His credentials are unmatched—he worked closely with the SEC and FINRA on the final rules, was present at the White House during the bill signing ceremony, and has since launched the industry’s first complete data aggregator. This aggregator, which represents a 100% complete dataset, forms the basis of the CrowdFinance50 Index, the only index tracking the top 50 investment-worthy companies in the crowdfunding space.

What You Will Learn

Attendees will delve deep into the evolution of investment crowdfunding, from its inception to its current state as a transformative force in venture capital. You will learn:

- The $84B Opportunity: Understand the immense liquidity available in the crowdfunding market and how it’s solving the “valley of death” for startups.

- Crowdfunding Success in Colorado: Explore how Denver/Boulder is performing in this sector, with a focus on local success stories and areas for improvement.

- Supporting Diversity and Inclusion: Discover how investment crowdfunding is funding a greater percentage of women and minority founders than traditional venture capital.

- Practical Strategies for Involvement: Learn how you can engage with crowdfunding platforms, utilize data and analytics, or diversify your portfolio through a venture fund focused on this rapidly growing industry.

Event Agenda

- 9:30 AM – 9:45 AM: Registration and Networking

- 9:45 AM – 9:50 AM: Welcome and Introduction

- 9:50 AM – 10:00 AM: Keynote Presentation – The Power of Investment Crowdfunding

- 10:00 AM – 10:15 AM: Colorado Focus – Investment Crowdfunding in Denver/Boulder

- 10:15 AM – 10:35 AM: Transforming the Investment Landscape

- 10:35 AM – 10:50 AM: Q&A Session

- 10:50 AM – 11:00 AM: Closing Remarks

Why You Should Attend

This event is a must-attend for venture capitalists, private equity professionals, family offices, angel investors, and entrepreneurs who are eager to explore new opportunities in the investment landscape. Whether you’re looking to diversify your investment portfolio, support underrepresented founders, or simply stay ahead of industry trends, this event will provide the insights and connections you need to succeed.

Register Now

Space is limited, and this is an opportunity you won’t want to miss. Register here!

Join us at WeWork on September 25th to unlock the potential of investment crowdfunding and discover how you can be part of the future of venture capital.

Since the introduction of Regulation Crowdfunding (Reg CF) under the JOBS Act of 2012, the landscape of capital raising for small businesses has dramatically transformed. While equity offerings initially dominated the space, debt offerings have increasingly gained traction. This shift reflects broader economic trends and evolving investor preferences. In this post, we explore the growing role of debt in Reg CF, the reasons behind this trend, and who stands to benefit the most.

The Rise of Debt Offerings

When Regulation Crowdfunding was first implemented in 2016, debt offerings were a relatively minor market component. In the early days, debt deals accounted for only about 14% to 36% of total offerings. Fast forward to 2023 and 2024, and the landscape has shifted dramatically—debt offerings now comprise a significant portion of the market, with figures as high as 46.9% in early 2024.

This growth is not accidental. Several factors have contributed to the rising prominence of debt crowdfunding:

- Tightening Bank Lending Standards: As traditional lenders have become more conservative, many small and medium-sized enterprises (SMEs) have found it increasingly difficult to secure bank loans. This tightening of credit has driven businesses to seek alternative financing sources, with debt crowdfunding emerging as an attractive option.

- Attractive Interest Rates: Investors have increasingly turned to debt offerings in the Reg CF space due to the competitive interest rates offered. With median interest rates ranging from 6% to 14% over the years, debt offerings provide an appealing alternative to traditional investments, particularly in low-interest-rate environments.

- Favorable Conditions for Cash-Flowing Businesses: Debt crowdfunding is particularly suited for businesses with strong cash flows that can support regular interest payments. This includes companies in industries like retail, services, and other sectors where consistent revenue generation is key.

Median Interest Rates Over Time

The data on median interest rates for debt offerings underscores why both businesses and investors are drawn to this segment of Reg CF. Interest rates have fluctuated over the years, with notable trends:

- In the early stages (2016-2017), median interest rates ranged from 6% to 14%, reflecting the market’s infancy and a broad spectrum of business risk profiles.

- By 2019-2020, median rates generally settled between 9% and 13.25%, indicating a maturing market with more stable and predictable returns.

- Recent data from 2023-2024 shows median interest rates stabilizing around 11% to 12.5%, demonstrating that while the market is competitive, there are still attractive opportunities for investors seeking higher yields.

Who Wins in Debt Crowdfunding?

The growth of debt offerings presents clear advantages for both issuers and investors:

- Issuers: For companies with steady cash flows, debt crowdfunding provides an opportunity to raise capital without diluting ownership. This is particularly valuable for businesses that need capital to grow but want to maintain control.

- Investors: For those looking to diversify their portfolios with fixed-income investments, debt offerings in Reg CF present an opportunity to earn attractive interest rates, often higher than traditional savings accounts or bonds.

Sherwood Neiss, Principal at Crowdfund Capital Advisors, emphasizes the significance of this trend: “The growth in debt offerings within Reg CF is a clear signal that both businesses and investors are recognizing the benefits of this financing option. For businesses, it’s about accessing capital efficiently while maintaining ownership. For investors, it’s about finding yield in a market where traditional options may not be as rewarding.”

Conclusion

As we look ahead, the continued growth of debt offerings in Regulation Crowdfunding seems inevitable. This trend reflects broader economic shifts and the evolving needs of both businesses and investors. Whether you’re a business owner seeking capital or an investor looking for new opportunities, debt crowdfunding offers a compelling option that is likely to play an increasingly important role in the capital markets.

Looking for the data behind the charts? Contact sales@theccagroup.com.

As we move deeper into 2024, the investment crowdfunding landscape has shown promising opportunities and emerging challenges. The year began on a strong note, but as the months have passed, we’ve observed shifts that could signal broader changes in the market. Based on data from the Online Investment 50 Index, here’s what we’ve discovered about the current state of crowdfunding investments.

Q1 2024: A Strong Start

The first quarter of 2024 kicked off with remarkable momentum. Investor confidence was high, leading to significant capital inflows. The Online Investment 50 Index, which tracks the top 50 highest-raising companies under Regulation Crowdfunding and Rule 506(c), reflected some of the strongest performances since the index’s inception. This surge was likely driven by a combination of factors, including pent-up demand from late 2023, positive market sentiment, and high-profile deals that captured investor attention.

Q2 2024: Momentum Slows

However, as we transitioned into the second quarter, the pace began to slow. While the overall amount of capital invested remained substantial, the number of deals decreased. This shift indicates that while investors were still willing to commit large sums, they were doing so in fewer deals. This could suggest a more cautious approach, with investors focusing on what they perceive as safer or higher-potential opportunities.

This change in momentum may be tied to broader economic factors. Uncertainties in the global economy, rising interest rates, and concerns about market volatility could be contributing to a more selective investment environment.

Q3 2024: A Continued Decline?

As we look towards Q3, early indicators suggest that this cautious trend may continue. The number of new deals has not rebounded, and there is a palpable sense of hesitation among investors. While it’s too early to definitively say that Q3 will see a further decline, the signs point towards a market that is cooling off from its Q1 highs.

What Does This Mean for Investors and Startups?

For investors, this trend suggests a more selective market where due diligence and careful consideration of opportunities are more critical than ever. Large investment sums in a few select deals indicate a preference for perceived quality over quantity.

For startups and companies seeking crowdfunding, the message is clear: standing out in a cautious market requires more than just a good idea. Clear value propositions, strong business fundamentals, and robust investor relations will be key to attracting the necessary capital.

Looking Ahead: Will the Trend Continue?

While 2024 started with a bang, the subsequent slowdown raises questions about the future. Will we see a return to the robust investment activity of early 2024, or will the market continue to cool? Much will depend on the broader economic environment and how investors perceive risk versus opportunity in the coming months.

As always, staying informed and adaptable is crucial for both investors and startups in the ever-evolving crowdfunding landscape. We will continue to monitor these trends and provide updates as the year progresses.

Final Thoughts

The investment crowdfunding market is at an inflection point in 2024. While early signs were overwhelmingly positive, the mid-year slowdown suggests a market in transition. For those involved in this space, staying ahead of the trends and understanding the shifting dynamics will be essential for success.

In recent years, the landscape of investment has been undergoing a transformative shift. Traditional venture capital, once the predominant avenue for startup funding, is now sharing the stage with a more inclusive and democratized method: investment crowdfunding. The “Investment Crowdfunding Ecosystem Report 2024” sheds light on this phenomenon, revealing how crowdfunding is not only gaining traction but also redistributing capital across various regions of the United States. In this blog post, we delve into the report’s key findings to understand how investment crowdfunding is spreading and its impact on local economies.

A Shift from Traditional Venture Capital

Historically, venture capital has been concentrated in major tech hubs like Silicon Valley, New York, and Boston. This concentration has often left other regions struggling to access vital funding for startups and small businesses. However, the data from the “Investment Crowdfunding Ecosystem Report 2024” paints a different picture. Crowdfunding is breaking down these geographical barriers, enabling startups in almost 1,800 cities across the USA to raise billions from local investors. This democratized approach to capital allocation is fostering innovation and technological advances in diverse locations.

Redistribution of Capital

One of the most striking insights from the report is the significant redistribution of capital through crowdfunding. Unlike venture capital, which is heavily skewed towards traditional tech centers, crowdfunding capital is more evenly spread. The report reveals that 53.8% of crowdfunding capital is invested outside of California, New York, and Massachusetts. This broader distribution is crucial for regional economic growth, as it provides startups in less traditionally funded areas with the resources they need to thrive.

Impact on Local Economies

The influx of crowdfunding capital into various regions is having a profound impact on local economies. By facilitating the growth of startups and small businesses, crowdfunding is driving job creation and stimulating economic activity. The report highlights that investment crowdfunding is supporting a wide range of industries, with over 600 categories benefiting from this funding model. This diversity not only strengthens local economies but also promotes resilience and adaptability in the face of economic shifts.

Success Stories from Crowdfunding Hubs

Several regions are emerging as significant hubs for investment crowdfunding, thanks to their supportive ecosystems and active investor communities. For instance, cities like Austin, Denver, and Raleigh are experiencing remarkable growth in crowdfunding activity. These cities exemplify how localized investment can lead to the creation of vibrant entrepreneurial ecosystems. The report shares success stories from these hubs, showcasing startups that have leveraged crowdfunding to scale their operations and achieve significant milestones.

Why Democratized Capital Matters

The democratization of capital through crowdfunding is more than just a redistribution of funds; it represents a fundamental shift in how businesses access and utilize financial resources. This model empowers a broader range of entrepreneurs, including those from underrepresented communities, to bring their ideas to life. It also allows local investors to directly contribute to the growth and development of their communities, fostering a sense of ownership and involvement in the local economy.

Conclusion

The “Investment Crowdfunding Ecosystem Report 2024” provides a comprehensive look at how crowdfunding is reshaping the investment landscape. By spreading capital more evenly across the country and supporting a diverse range of industries, crowdfunding is driving economic growth and fostering innovation in areas previously overlooked by traditional venture capital. As we move forward, the continued expansion and evolution of crowdfunding will undoubtedly play a pivotal role in creating a more inclusive and dynamic economic environment.

For more insights and detailed data from the “Investment Crowdfunding Ecosystem Report 2024,” visit CClear.ai or contact Yvan De Munck at yvan@cclear.ai.

In the world of investment crowdfunding, data is king. While valuable, publicly available data often lacks the depth and nuance required to truly understand the dynamics at play, our enriched data transforms raw numbers into actionable insights. Here’s how we go beyond the basics to offer a richer, more detailed picture of the investment crowdfunding landscape.

The Limitations of Public Data

Public data in the crowdfunding sector primarily stems from the mandatory disclosures on Form C, which provides information on the company’s location, minimum funding target, deadline to reach the goal, type of security offered, price, and current and prior year financial information. However, it falls short in several critical areas. It doesn’t include how much was raised by how many investors on a daily or aggregated basis. This lack of granularity limits the ability to gauge real-time investor sentiment and the ongoing progress of fundraising campaigns.

Enriching the Data: Our Approach

At CCLEAR, we take a comprehensive approach to data collection and analysis, adding layers of information that bring the data to life. Here are some of the key enhancements we provide:

- Investor Sentiment: Just as stock prices are tracked daily, we monitor daily investments and the number of checks written for pre-IPO issuers. This gives us real-time insights into investor behavior and sentiment.

- Valuation Tracking: We track company valuations over time, providing a clear picture of growth and investor confidence.

- Diversity and Inclusion: Our data includes tags for women and minority founders, highlighting the participation and success of underrepresented groups.

- VC Syndicated Deals: We tag deals that are syndicated with venture capital, offering insights into institutional investor interest and confidence.

By combining these enriched data fields with ongoing tracking of companies through follow-on rounds and annual reports, we provide a dynamic, evolving picture of the market.

Our reports, including the Genome, go beyond raw data to tell the stories behind the numbers. We analyze trends and patterns to answer critical questions such as:

- Where is investment activity most concentrated in the USA?

- How are women and minority founders benefiting from crowdfunding?

- Which industries are hot, and which are cooling off?

- Where are the seeds of AI being funded, and what does this technology mean for the future?

By contextualizing the data in this way, we help investors and companies alike understand the broader implications and opportunities in the market.

Why It Matters

Understanding the full scope of investment crowdfunding data is crucial for making informed decisions. Our enriched data provides deeper insights, revealing trends and opportunities that might otherwise be missed. This level of detail is invaluable for anyone involved in the crowdfunding space, from individual investors to companies seeking funding.

In a world where data is abundant but often superficial, we pride ourselves on offering a richer, more nuanced perspective. If you’re looking to make the most of your investment crowdfunding efforts, our data and insights are here to guide you every step of the way.

For more information and to stay updated with the latest insights, visit CCLEAR.ai and sign up for our newsletter. Or to speak to a salesperson email: sales@theccagroup.com.