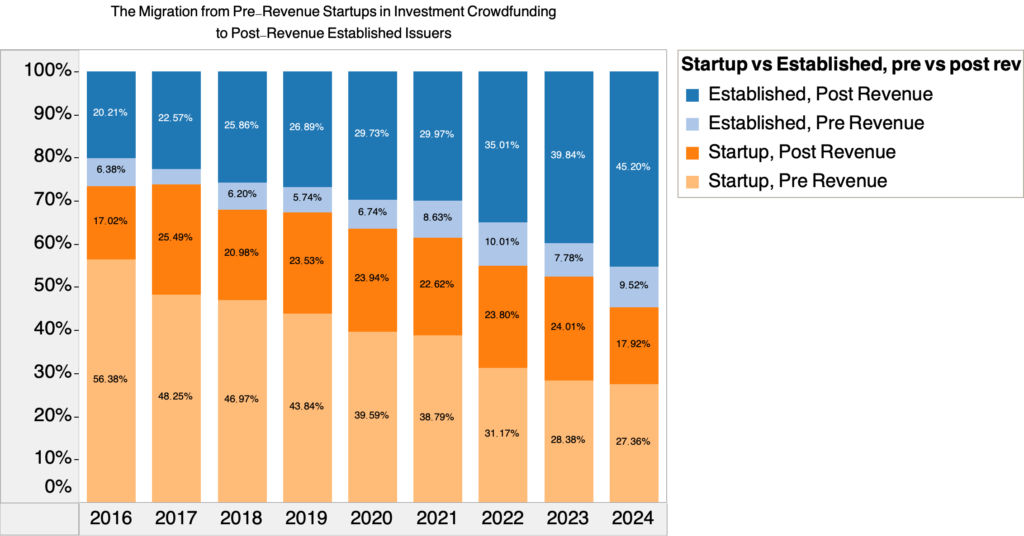

When Regulation Crowdfunding (Reg CF) was introduced in 2016, it created a new path for businesses to raise capital, connecting entrepreneurs with a broader pool of investors. Initially dominated by early-stage, pre-revenue startups, the industry has matured significantly over the past eight years. A closer look at the data reveals a striking trend: post-revenue issuers—both startups and established companies—have steadily grown their share of the market, culminating in 2024, where their combined total is at an all-time high.

The Data Tells a Story of Growth

The numbers show a profound shift in the composition of crowdfunding campaigns. In 2016, post-revenue issuers (startups and established) accounted for a combined 37.2% of all offerings. By 2024, that figure had climbed to an unprecedented 63.1%, representing a nearly 70% increase over eight years.

For established post-revenue issuers, the growth has been especially remarkable, doubling from 20.2% in 2016 to 45.2% in 2024. Post-revenue startups, while less dominant, have maintained a consistent presence, peaking at 25.5% in 2017 before settling at 17.9% in 2024. Together, these groups now form the majority of offerings, marking a dramatic pivot from the industry’s earlier reliance on pre-revenue startups.

Meanwhile, pre-revenue startups—the early pioneers of crowdfunding—have seen their share dwindle from 56.4% in 2016 to 27.4% in 2024. This reflects both the diversification of the crowdfunding ecosystem and the increasing competition for investor attention.

Why the Shift?

Several forces have driven this transformation:

- Crowdfunding Matures into a Serious Capital Source: The increase in the funding cap from $1 million to $5 million in 2020 allowed more established businesses to participate. These companies bring operational track records and revenue streams, making them more attractive to investors seeking reduced risk.

- Economic Conditions and Market Dynamics: A tightening venture capital market has pushed businesses to explore alternative funding sources. Crowdfunding, with its community-focused approach and flexible structures, has provided a lifeline for post-revenue businesses seeking growth capital or bridge financing.

- Savvier Investors: Crowdfunding investors are no longer the speculative pioneers of 2016. They’ve grown more sophisticated, favoring campaigns from businesses with clear revenue models and paths to profitability. This has naturally shifted demand toward post-revenue issuers.

- Platform Innovation: Crowdfunding platforms have adapted to accommodate larger, more complex issuers. Enhanced tools, better marketing strategies, and improved investor relations services have made it easier for post-revenue companies to engage successfully with the crowd.

The Implications of This Growth

The rise of post-revenue issuers has significant ramifications for investors, issuers, and the crowdfunding ecosystem at large:

- Lower Risk, Broader Appeal: Post-revenue businesses, particularly established ones, often present less risk to investors. This shift toward more stable issuers broadens the appeal of crowdfunding to a wider audience, including more conservative investors.

- A New Pathway for VCs: As venture capital markets ease, crowdfunding can act as a proving ground. Investors can observe which post-revenue issuers survive economic headwinds, providing VCs with vetted opportunities.

- The $20 Million Question: The current $5 million funding cap may soon become a bottleneck for larger issuers entering the space. Raising this cap to $20 million would open the door for even more mature companies to leverage crowdfunding for substantial growth initiatives.

- A Balanced Ecosystem: The industry’s evolution doesn’t mean the end for startups. Pre-revenue issuers still play an essential role in the ecosystem, providing innovation and high-risk, high-reward opportunities for investors. However, they must now compete in a more diverse, mature marketplace.

Looking Forward

The growth of post-revenue issuers—startups and established businesses alike—signals that crowdfunding is entering a new phase of maturity. In 2024, the combined dominance of these issuers highlights the platform’s potential as a mainstream funding mechanism. For investors, this means access to less risky opportunities with proven track records. For issuers, it demonstrates that crowdfunding can compete with traditional financing at every stage of business development.

But this growth also underscores the need for policy updates. With the industry attracting larger players, raising the funding cap to $20 million would unlock its full potential, enabling crowdfunding to serve as a vital tool for scaling businesses.

As we move into the next decade, it’s clear that crowdfunding is no longer just a stepping stone for startups—it’s a foundation for business growth and innovation across all stages.

Interested in the data behind this story? Reach out to data@theccagroup.com with your inquiry!

With Donald Trump’s anticipated return to the White House, there’s growing curiosity in the investment crowdfunding space. Industry stakeholders are wondering: what could another Trump administration mean for startups, small businesses, and the alternative investment landscape? As a data-driven entity, our team at Crowdfund Capital Advisors and CCLEAR has tracked every offering and daily transaction in the investment crowdfunding space since its inception in 2016. Leveraging this data, we can make informed projections on what this administration might bring to the industry—and the future looks promising.

Learning from History: The Impact of Trump’s First Term on Investment Crowdfunding

The investment crowdfunding industry saw substantial growth during Trump’s previous term, with policies favoring deregulation and reduced corporate taxes creating a positive environment for alternative funding. These policies allowed startups and small businesses to access capital more easily. From 2016 to 2020, the percentage of successful campaigns grew from 49% to over 70%, while the average amount raised per successful campaign nearly doubled, from $185,639 in 2016 to $292,755 by 2020. Investor participation also surged, with investor checks increasing from 21,750 in 2016 to 360,702 by 2020, demonstrating a marked rise in retail investor interest.

While it’s true that investment crowdfunding has grown as part of broader trends in alternative investments, data shows that it grew disproportionately during years with favorable policy shifts, including during Trump’s administration. For example, from 2019 to 2020, the industry saw a jump in total funds raised from $133 million to $247 million, correlating with Trump’s tax policies and deregulation efforts. In comparison, traditional VC investments saw a less steep growth trajectory in these years. This suggests that while economic factors contributed to growth, specific Trump-era policies also played a significant role. We wouldn’t be surprised to see total Regulation Crowdfunding investments jump from an estimated $563 million in 2024 to nearly $750 million in 2025 under similar circumstances.

Projecting a Positive Narrative for Startups and Small Businesses

Investment crowdfunding is uniquely positioned to thrive under an administration focused on stimulating small businesses. Trump has frequently spoken about his intention to reduce regulatory burdens and enhance tax incentives for U.S.-based companies—especially startups and small businesses, which are the backbone of the American economy.

If these pro-business policies are enacted, we anticipate a ripple effect throughout the investment crowdfunding space. When startups have fewer regulatory barriers and better tax incentives, they’re more likely to seek funding and find success on online investment platforms. We’ve already seen this correlation: in years with favorable policies, investment volumes, campaign activity, and investor participation have all increased. For example, in 2021, the number of retail investors participating in crowdfunding reached an all-time high of 529,000, reflecting heightened enthusiasm and accessibility for retail investors.

However, in recent years, investor participation has slowed, as economic uncertainties and regulatory challenges created a more cautious environment. We expect that a Trump administration, with its focus on deregulation and pro-business policies, would help bring back more retail investors, rejuvenating the investment crowdfunding space. Renewed retail participation would provide startups and small businesses with the grassroots support they need to grow, while giving everyday investors the chance to participate in entrepreneurial ventures that align with their values and financial goals.

VC Resurgence and the Path to M&A and Follow-on Investment

Another encouraging factor is the likelihood of increased VC (venture capital) activity. After years of economic uncertainty, VC investor participation, according to PitchBook, peaked at 25,133 in 2021, but it has since declined to 11,425 as of Q3 2024. A pro-business administration could help revive VC interest, creating a more dynamic funding ecosystem where investment crowdfunding serves as a crucial bridge for startups seeking initial capital before moving on to larger VC rounds.

A recovering VC market would create more opportunities for Reg CF-backed companies to secure follow-on investments or achieve exits through mergers and acquisitions. Our data shows that with more VC involvement, crowdfunded companies have a higher likelihood of securing these follow-on investments, which can accelerate their growth. This “ladder effect” in funding helps startups scale, benefiting both the early retail investors who participate in crowdfunding and the VC investors who enter later.

While we acknowledge that external economic factors will continue to affect VC activity, historical trends suggest that pro-business policies—such as those seen during Trump’s first term—do encourage a more robust investment environment. A return of VC participation could renew the flow of capital, leading to further scaling opportunities for crowdfunded companies.

The SEC Chair’s Departure: A Breath of Fresh Air for the Industry

The anticipated departure of SEC Chair Gary Gensler marks another positive development for the industry. Gensler’s tenure saw heightened scrutiny of alternative investments, which many in the industry viewed as restrictive for startups and small businesses relying on investment crowdfunding. A shift in leadership could mean reforms that align with the industry’s growth needs, including streamlined regulations and expanded opportunities for issuers.

Three critical areas for reform under the new administration and SEC leadership are as follows:

- Increasing the Reg CF Cap: Raising the maximum amount issuers can raise under Reg CF from the current $5 million cap to $20 million. This increase would allow more companies to secure substantial funds and scale. This would fill the void that Tier 1 of Regulation Crowdfunding left for issuers seeking to raise up to $20 million through a qualified offering.

- Tax Incentives: Adding tax incentives and credits for investment crowdfunding to the next iteration of the Tax Cuts and Jobs Act (TCJA) could provide same-year deductions on a percentage of an investor’s contribution and remove capital gains taxes on these investments. These measures would attract more investors without removing any investor protections.

- Establishing a $2 Billion Co-Investment Fund: This fund would allow the government to co-invest alongside retail investors, bolstering the economic impact of crowdfunding while mitigating risk for individual investors.

These reforms would not only support entrepreneurship and job creation but would also have a measurable economic impact. According to our data at CCLEAR, every dollar invested in startups through crowdfunding translates to $5.70 in economic output through corporate expenditures. Given the total funding raised in recent years—$526 million in 2023 alone—raising the cap could see even more capital deployed into job-creating companies.

Investment Crowdfunding as a Tool for Revitalizing U.S. Manufacturing

Investment crowdfunding has a unique role to play in Trump’s vision for reviving U.S. manufacturing. Many of the companies raising funds through crowdfunding platforms are local manufacturers, producers, and innovators looking to grow on U.S. soil. By supporting these companies, investment crowdfunding can help rebuild domestic manufacturing, a priority Trump has often emphasized.

Not only does this keep jobs in America, but it also supports supply chain resilience and strengthens local economies. For example, several recent crowdfunding campaigns have successfully funded small manufacturing businesses in states like Michigan and Ohio, contributing to Trump’s stated goal of a manufacturing resurgence. If the administration recognizes the value of investment crowdfunding in building U.S. manufacturing, it could incentivize locally focused projects on these platforms. This would be a win for both the industry and Trump’s broader economic agenda, creating a symbiotic relationship where small businesses, local communities, and the American economy all stand to benefit.

A Vision for the Future: More Jobs, More Growth, and More Opportunity

In summary, a second Trump administration holds great promise for the investment crowdfunding industry. With the right combination of policy shifts—such as increased funding caps, reduced regulatory burdens, and tax incentives for startups—investment crowdfunding could continue its upward trajectory, supporting job creation and local economic growth nationwide. As venture capital activity picks up and SEC reform allows for more expansive crowdfunding opportunities, the industry is well-positioned to become a cornerstone of America’s small business and manufacturing revitalization.

By backing this narrative with the data we’ve gathered at CCLEAR, we can confidently say that the incoming administration has an opportunity to amplify the positive impact of investment crowdfunding. If leveraged correctly, this sector can become a powerful tool for U.S. economic growth and innovation, driving meaningful change for startups, small businesses, and the investors who believe in them.

The life sciences sector—spanning healthcare, biotechnology, and medical research—has become one of the most dynamic areas in investment crowdfunding. Companies are not only turning to crowdfunding to raise capital but are also building engaged communities of supporters who become advocates and brand ambassadors. As healthcare innovation becomes increasingly capital-intensive, crowdfunding offers an alternative path to growth, allowing life sciences firms to achieve critical milestones and attract investor attention in a meaningful way.

“Healthcare is one of the most popular industries within investment crowdfunding,” says Sherwood Neiss, Principal at Crowdfund Capital Advisors. “These issuers are turning to their followers not just  for capital, but also for marketing and brand awareness. This approach helps them grow a community of advocates, making it easier to hit funding goals, generate visibility, and attract future venture capital.”

for capital, but also for marketing and brand awareness. This approach helps them grow a community of advocates, making it easier to hit funding goals, generate visibility, and attract future venture capital.”

More than 840 Life sciences issuers have raised over $300 million, indicating a strong appetite from investors who are increasingly drawn to high-impact projects in health and biotechnology. The average raise reached $486,000, reflecting a trend toward higher-value campaigns as investors focus on companies with tangible growth potential.

The Crowdfunding Advantage for Pre-VC Life Sciences Companies

For many healthcare companies, crowdfunding serves as a pre-VC stage, helping them prove their concepts, attract early supporters, and generate data on market demand. By the time these companies reach venture capital, they have a track record, a clear set of goals, and demonstrated investor interest—key factors in securing additional funding. This trend reflects a shift in how early-stage companies approach fundraising, using crowdfunding as a springboard to reach more established funding avenues.

Exploring the Data and Trends Behind Life Sciences Crowdfunding

Our latest Life Sciences Investment Crowdfunding Report offers a comprehensive look at sector performance, valuation trends, and investor behavior. For industry professionals, investors, and entrepreneurs, it provides invaluable insights into one of the fastest-growing segments of the crowdfunding landscape. This report is also part of our larger effort to track emerging trends in investment crowdfunding, helping stakeholders understand where the market is headed. (Also available, for a limited time, is a list of all Life Science issuers within Investment Crowdfunding since the industry launched).

As life sciences companies continue to redefine how they grow and raise funds, this report underscores the sector’s potential to drive both economic impact and transformative health innovation. Whether you’re directly involved in the industry or simply curious about new funding models, life sciences crowdfunding is worth a closer look.

Crowdfund Capital Advisors (CCLEAR) reports that investment crowdfunding deal values rose in October 2024, signaling renewed activity in the sector despite a complex economic backdrop. While one month’s data does not define a trend, October’s results reflect positive momentum for companies leveraging crowdfunding to fuel innovation and growth.

Although deal values increased, the number of new crowdfunding deals saw a slight decline, with 112 deals in October, down from 129 in September and 115 in October 2023. The industry saw $55.3 million in commitments, marking the third-highest month for deal values this year. Equity offerings continued to dominate as investors showed a strong preference for established, post-revenue companies over debt offerings, which captured only 5.7% of total capital raised.

Year-to-date, 49 crowdfunding platforms or broker-dealers have facilitated investment rounds, though platform participation has decreased compared to last year. The food service, healthcare, biotechnology, life sciences, and beverages sectors were among the most active, with key players like StartEngine and Wefunder securing substantial deal flow and capital. A robust crowdfunding market provides crucial support to small and emerging businesses, fueling innovation, job creation, and economic prosperity in an uncertain economic climate.

“With the outcome of the November election, we expect the investment crowdfunding market to see substantial gains,” said Sherwood Neiss, principal at Crowdfund Capital Advisors. “This would be a positive boost for the economy, as every dollar invested in a successful crowdfunding company equates to $5.70 of economic stimulus, according to CCLEAR data.”

This trend illustrates the growing role of crowdfunding in channeling capital to a segment of the private markets where venture activity has slowed, but businesses are ready to drive significant economic impact.

Subscribe to the monthly reports here.

In recent years, investment crowdfunding has become essential for democratizing access to capital, allowing small businesses and startups to realize sustainable growth. For consulting firms focused on innovation, economic policy, and small business development, investment crowdfunding represents a pivotal strategy for fostering local economic resilience and fueling entrepreneurship.

Management consulting firms play a crucial role in driving transformative strategies that enable startups to thrive, foster innovation, and create new jobs. While traditional funding avenues remain vital, investment crowdfunding offers an alternative pathway for entrepreneurs, connecting them directly with investors who believe in their vision. This channel empowers companies, particularly those in underserved markets, to gain visibility and access to capital on a scale previously out of reach.

The Strategic Role of Regulation Crowdfunding

The Jumpstart Our Business Startups (JOBS) Act and the subsequent Regulation Crowdfunding (Reg CF) rules have opened doors for smaller investors to support early-stage companies in exchange for equity. Crowdfund Capital Advisors’ research shows substantial growth in crowdfunding-backed companies across regions and industries. Consulting firms like Bain & Company, IBM (IBM Garage), Deloitte (Deloitte Catalyst), Accenture (Accenture Ventures), and EY-Parthenon can align their services with this trend, advising clients on leveraging crowdfunding as an innovative source of capital to build stronger, more resilient businesses.

Investment Crowdfunding: Empowering Economies at the Local Level

Investment crowdfunding levels the playing field for businesses in smaller cities and diverse communities by facilitating capital inflows that would otherwise be inaccessible. For consulting firms, guiding clients through crowdfunding helps achieve broader economic resilience goals. For instance, Bain & Company’s Bain Innovation Exchange (BIE) provides startups with the tools and networks to scale effectively. Through initiatives like the “Innovation Kickstarter,” Bain supports business model development tailored specifically to startup needs.

Similarly, IBM Garage collaborates with businesses to identify operational pain points and rapidly develop and launch solutions, making it an ideal partner for tech-oriented startups needing streamlined digital infrastructure and robust security measures. These services empower startups to transform their business models using IBM’s deep technology expertise in AI, automation, and supply chain management.

Why Consulting Firms Should Embrace Crowdfunding for Clients

As a tool for economic revitalization, investment crowdfunding offers firms like Deloitte Catalyst and Accenture Ventures unique opportunities to support small businesses and drive sustainable growth. Deloitte Catalyst provides startups with end-to-end services across the entrepreneurial lifecycle, connecting them to a vast network and expediting market entry. Accenture Ventures, with its Project Spotlight, helps startups accelerate their growth by integrating them into larger enterprise ecosystems, providing tools and resources essential for navigating complex market landscapes.

Additionally, EY-Parthenon is renowned for its strategic consulting expertise, assisting startups in technology, healthcare, and financial services with tailored growth plans and scaling strategies. EY-Parthenon’s global network and vast resources make it an attractive option for fast-growing companies aiming to expand quickly and efficiently.

A Future-Focused Approach to Investment

Investment crowdfunding is a valuable tool that complements consulting firms’ broader goals of economic empowerment and job creation. By supporting startups in navigating crowdfunding campaigns, consulting firms can help these businesses thrive in today’s competitive landscape. Firms like Bain & Company, IBM, Deloitte, Accenture, and EY are well-positioned to adopt crowdfunding as a strategic growth lever, driving long-term economic resilience and innovation.

We invite consulting leaders to explore the opportunities investment crowdfunding provides, especially for startups and small businesses that prioritize community-centered growth. Crowdfund Capital Advisors remains dedicated to providing the insights and data needed to make crowdfunding a powerful resource for clients nationwide. For more information on how investment crowdfunding can enhance client growth strategies, visit us at www.CrowdfundCapitalAdvisors.com.

In a rapidly shifting economic landscape, the time has never been better for businesses to leverage Regulation Crowdfunding (Reg CF) to secure funding and build loyal investor communities. Several recent developments underscore this unique opportunity for potential Reg CF issuers to stand out in the market and raise capital effectively.

1. Private Markets Have Bottomed Out

With the private markets hitting recent lows, investors are eager to seize opportunities to support resilient and high-potential businesses. As many in the private market look to rebuild their portfolios with promising assets, Reg CF issuers stand to benefit from this increased interest. In these conditions, Reg CF becomes an attractive entry point for investors looking for value and growth in the recovery cycle.

2. Favorable Monetary Policy: Fed Reduces Interest Rates

A lower interest rate environment, fostered by recent Federal Reserve cuts, translates to more accessible capital and reduced borrowing costs for businesses. This also means investors have fewer options for strong returns in traditional investments like bonds, which could encourage them to diversify into alternative assets like equity crowdfunding. With reduced returns elsewhere, community-backed ventures via Reg CF can appear especially attractive.

3. Soft Economic Landing Encourages Investor Confidence

According to insights from leading financial institutions like Goldman Sachs, the economy’s soft landing has mitigated fears of a severe recession. This stability brings more confidence to investors, who may now be more willing to participate in new ventures without as much risk aversion. The renewed investor confidence presents a favorable environment for businesses seeking to raise capital through Reg CF.

4. VC Trends Create a Unique Opportunity for Reg CF Issuers

The recent trend of venture capital (VC) firms shifting upstream toward later-stage investments has left a noticeable void in the early-stage investment landscape. This gap creates a unique opportunity for Reg CF issuers to engage with local communities and raise essential seed capital. For entrepreneurs and small business owners, Reg CF provides a platform to attract investors who believe in their mission and are eager to see them succeed.

Moreover, as the private market cycle progresses, Reg CF issuers have a chance to use this funding period as a bridge to more significant investments down the line. Companies can build their traction now with community investors, positioning themselves strategically for when VC firms return to earlier-stage investments.

5. Reg CF Continues to Thrive Despite Market Volatility

Unlike traditional capital markets, Reg CF has demonstrated remarkable resilience throughout recent market fluctuations. Capital commitments in Reg CF have remained strong, nearly matching the record numbers seen in 2021. The 2023 Year in Review indicates that interest in Reg CF offerings has not waned, and the volume of active deals, despite slight contractions, continues to reflect a robust investment climate.

“For potential Reg CF issuers, this convergence of economic stability, supportive monetary policy, and favorable market dynamics creates a prime moment to launch a crowdfunding campaign,” says Sherwood Neiss, Principal at Crowdfund Capital Advisors. “With a community-driven financing model, issuers can not only raise funds but also foster a loyal base of advocates and potential customers. Now is the time to harness this moment—align with investors eager to participate in your growth journey and take advantage of Reg CF’s community-powered potential.”

For continued insights on market trends and investment crowdfunding strategies, subscribe to the CCA newsletter for direct updates.

As the latest PitchBook-NVCA Venture Monitor highlights, the venture market may have bottomed out, but it hasn’t yet shown signs of a strong recovery. Venture capital (VC) firms are proceeding with caution, many leaving the market altogether or tightening the terms of investment to reduce risk. In this environment, startups backed by VCs should consider investment crowdfunding as a viable bridge financing option, providing the capital they need to sustain and grow while sidestepping the slower, more restrictive VC process.

Let’s dive into why investment crowdfunding is particularly well-suited to meet this need and why it’s worth considering in today’s venture landscape.

What is Investment Crowdfunding?

Investment crowdfunding, enabled by the JOBS Act of 2012, allows companies to raise capital from a large number of investors via online platforms. Unlike traditional VC, which often limits investment to accredited investors (those meeting specific income or net worth criteria), Regulation Crowdfunding (Reg CF) opens the door for anyone to invest, empowering communities, customers, and other non-traditional investors to support companies they believe in.

Through SEC-regulated portals like Wefunder, StartEngine, and Republic, companies can launch campaigns to attract investors by offering equity or other forms of securities. Investment crowdfunding campaigns run under clear regulations to protect both issuers and investors and have proven successful in helping early-stage companies meet funding goals quickly and effectively.

Why Consider Investment Crowdfunding as a Bridge Financing Tool?

In today’s capital market, Reg CF offers distinct advantages, especially for companies that already have some VC backing but need capital quickly. Here’s why it’s particularly effective now:

1. Contextualizing the Venture Capital Slowdown

The venture market remains in a cautious state. While on pace to exceed $175 billion in investments this year, liquidity challenges have limited a more substantial recovery, causing many VC firms to reevaluate their strategies. This slowdown has driven some VCs to enforce more stringent protections in term sheets, while others have left the market altogether. For VC-backed startups, this climate presents challenges in securing follow-on funding, meaning additional financing alternatives are essential for continued growth.

2. Investment Crowdfunding as an Efficient Bridge

Crowdfunding offers a quicker alternative to traditional VC rounds, which can often take upwards of nine months to finalize. With Reg CF, the average campaign length is around 195 days—significantly shorter and more manageable for companies needing bridge financing without lengthy delays. This timeline efficiency makes crowdfunding particularly attractive, allowing companies to secure capital on a shorter schedule and remain agile in their growth trajectory.

3. Data on Series A Companies Using Crowdfunding

Series A-backed companies have shown that they can successfully raise additional capital through investment crowdfunding, with average raises hovering around $1 million. This trend underscores that crowdfunding can be a powerful tool for companies that have already attracted VC support, providing a reliable supplement to previous funding rounds without extensive terms renegotiation or delays.

4. Flexibility and Broad Investor Access

Unlike VC rounds, which often limit participation to accredited investors, Reg CF campaigns can draw from a much wider base, including non-accredited investors. This inclusivity allows companies to engage directly with their customer base and communities, generating not only financial support but also fostering loyalty and advocacy. The broader investor pool means companies can raise funds from individuals who are also potential customers, providing a dual benefit of financial capital and brand visibility.

5. Building a Community of Advocates

Crowdfunding campaigns offer more than just financing—they build a community. Investors in a Reg CF campaign tend to feel a sense of ownership and are more likely to promote the business, refer others, and support product launches. This level of customer engagement is invaluable, as it creates a loyal network that may provide continued support and advocacy well beyond the initial funding campaign.

6. Reduced Pressure on Terms and Investor Control

In contrast to the tightened control and rigorous due diligence that VCs are implementing in today’s market, crowdfunding offers a more flexible path with typically less restrictive terms. This provides startups with a greater degree of control over the funding process and the freedom to focus on their business rather than intensive renegotiations or compliance with stringent conditions.

How Investment Crowdfunding Works: A Step-by-Step Guide

For companies new to investment crowdfunding, here’s how a typical campaign works:

- Campaign Setup: Start by selecting a platform (like Republic, StartEngine, or Wefunder) and creating a campaign page. This will include business details, the funding goal, financials, and the offering type (equity, convertible notes, etc.).

- Compliance and Disclosures: Reg CF requires that companies meet certain SEC disclosure standards. This ensures transparency for investors and helps foster trust. Common disclosures include financial statements, business risks, and goals for the capital raised.

- Promotion and Community Engagement: Successful campaigns leverage social media, customer networks, and email marketing to attract interest and build a community of supporters. Engaging directly with customers and potential investors throughout the campaign is key to success.

- Funding Goal and Timeline: Crowdfunding campaigns typically have set minimum and maximum funding goals and operate on an “all-or-nothing” model. This means the company only receives the funds if it meets the minimum target by the campaign’s end.

- Capital Disbursement and Post-Campaign Engagement: Once the goal is met, funds are disbursed to the company (minus platform fees), and the startup can begin deploying the capital as outlined in the campaign. Keeping investors informed and engaged post-campaign strengthens relationships and promotes long-term support.

Ready to Consider Investment Crowdfunding? Let’s Talk!

For venture-backed companies navigating today’s venture landscape, investment crowdfunding offers an accessible, flexible, and community-driven financing alternative. Whether you’re seeking bridge financing to extend your runway or aiming to expand customer engagement, Reg CF can help you meet those goals.

Contact us (sales@theccagroup.com) today to discuss how investment crowdfunding could be the right fit for your company. Our team has the expertise to guide you through every step of the process, from campaign setup to post-campaign engagement, ensuring you leverage crowdfunding to its fullest potential. Let’s explore how you can use the power of the crowd to sustain and grow your business!

As the 2024 presidential election comes to a head, both major parties are focusing on economic policies—but neither has fully embraced the potential of investment crowdfunding to fuel local growth. Republicans continue to push for tax cuts aimed at stimulating corporate investment, while Democrats advocate for tax hikes on wealthy individuals and corporations to fund social programs. Yet both approaches miss a crucial point: the true engine of the U.S. economy is small business, and fostering local investment in these businesses could transform our economy from the ground up.

Sherwood Neiss, Principal at Crowdfund Capital Advisors, offers an insightful perspective: “On one end, we have one party using tax cuts to stimulate business growth, while the other uses tax hikes to create more opportunity. In reality, both should focus their attention on the segment of our population that represents the majority of businesses and creates nearly half of the U.S. economy—small businesses. Attention here would be a first in decades, refreshing in its approach and appealing to Main Street Americans. It would build a much stronger America than either party’s current plans.”

Why Investment Crowdfunding Matters: The Data

Our data analysis shows that Democratic districts are particularly benefiting from investment crowdfunding, outperforming Republican districts in significant ways:

- 2.67x more deals are launched in Democratic districts compared to Republican districts.

- Why it matters: This shows that more entrepreneurs are turning to crowdfunding in Democratic districts to access capital, resulting in more business creation and innovation in these areas.

- For every $1 invested in a Republican district, $3.36 is invested in a Democratic district.

- Why it matters: Greater investment volume means stronger local economic growth, with more capital being funneled into communities for hiring, expansion, and local spending.

- Nearly 3x more investors are found in Democratic districts.

- Why it matters: This indicates broader community engagement, where individuals are financially supporting local businesses, leading to a more dynamic and resilient economy.

- 4.2x more jobs are created in Democratic districts.

- Why it matters: Jobs are a direct indicator of economic health. These figures demonstrate how crowdfunding directly impacts employment growth, a vital component of local economic stability.

- Democratic districts experience 4.86x more economic stimulus.

- Why it matters: This shows that investment crowdfunding creates a ripple effect, stimulating local spending and reinvesting in communities at a significantly higher rate than in Republican districts.

What Current Policies Miss

Republicans’ emphasis on tax cuts primarily benefits large corporations, especially those in manufacturing, but leaves small businesses without direct support. Democrats’ push to raise corporate taxes is intended to increase federal revenue for social programs but may reduce corporate investment, impacting job creation and wages. Neither approach focuses on supporting small businesses, which according to the Small Business Administration make up 99.9% of all U.S. businesses and contribute 43.5% of the nation’s GDP.

Investment Crowdfunding: A Policy Solution

Investment crowdfunding offers a unique solution that bypasses the need for broad tax cuts or hikes by directly empowering local investors to support their communities. To maximize its potential, policymakers should promote tax incentives that encourage more people to invest in crowdfunded businesses. Possible incentives include:

- Capital gains exemptions for investments in crowdfunded small businesses.

- Tax credits for reinvesting profits locally.

- Co-investment funds, where the government matches private investment to further boost local businesses. We discussed this in a policy paper recently.

The 2024 election provides an opportunity for both parties to rethink their economic strategies. Rather than relying solely on corporate tax cuts or hikes, lawmakers should focus on investment crowdfunding as a direct means to stimulate local economies. As Neiss says, “Crowdfunding is not just a financial tool; it’s a pathway to economic resilience, diversity in entrepreneurship, and stronger communities,” says Neiss. “It’s time for the political conversation to catch up.”

Crowdfunding offers more than just capital—it creates a long-term relationship between entrepreneurs and their investors. When you run a successful campaign, your supporters become more than financial backers; they can turn into advisors, customers, and brand advocates. Managing this dynamic, however, requires careful attention to communication. Entrepreneurs must engage their crowd beyond the initial fundraising phase by providing regular updates, addressing concerns, and maintaining transparency.

Boxabl, a well-known startup in the tiny-home industry, serves as a cautionary tale. The company raised millions from thousands of investors through crowdfunding to manufacture its innovative foldable homes, generating significant buzz. However, the excitement began to wear off as Boxabl experienced production delays and mounting losses. Investors became increasingly concerned when reports emerged about high executive spending, casting doubt on the company’s management practices. The lack of transparent communication from the leadership team left many backers frustrated and uncertain about their investments.

This growing unease ultimately led to an investigation by the SEC. Although the SEC concluded its investigation without recommending enforcement action, the episode highlighted a key lesson for all crowdfunded businesses: transparent, consistent communication is crucial to maintaining investor trust and avoiding reputational damage.

Crowdfunded ventures must not only meet their funding goals but also manage the expectations of their investors. Clear communication about setbacks, realistic timelines, and financial transparency can prevent misunderstandings and keep backers engaged and supportive. Entrepreneurs who treat their crowd as key stakeholders, rather than just financial contributors, are more likely to sustain long-term success.

Boxabl’s experience serves as a powerful reminder that crowdfunding is as much about managing relationships as it is about raising capital. Success hinges on the ability to communicate effectively with your crowd, turning them into long-term allies of your business.

(References: Boxabl’s story on Business Insider and Boxabl’s SEC Investigation)

October 17, 2024 – Denver, CO – Crowdfund Capital Advisors (CCA), a global leader in crowdfunding data and advisory services, has announced a strategic partnership with InvestmentX, a premier investment analysis platform. Through this collaboration, InvestmentX will leverage CCLEAR, the comprehensive data arm of CCA, to bring unparalleled insights into the investment crowdfunding market directly to its subscribers. This partnership highlights the growing demand for data-driven decision-making tools within investment crowdfunding and aims to equip retail and professional investors alike with the resources needed to make well-informed choices.

Launched in 2016, CCLEAR has established itself as a trusted source of investment data within the crowdfunding space. The platform currently tracks over 1.4 million data points, encompassing critical financial metrics such as company sales, cash positions, receivables, and investor sentiment. By incorporating CCLEAR’s proprietary data methodologies, InvestmentX subscribers will have access to a range of predictive analytics, including “velocity of money,” to gauge real-time traction in live crowdfunding campaigns.

“This partnership is about empowering investors with the real-time data they need to make smarter, more confident investments,” said Sherwood Neiss, Principal at Crowdfund Capital Advisors. “Investment crowdfunding is not only about compelling stories but also hard numbers. CCLEAR brings the level of transparency and detailed analytics to early-stage investing that historically has been reserved for the public markets. We are thrilled to work with InvestmentX to support their audience in navigating this dynamic sector.”

InvestmentX’s platform will now include real-time updates on top-performing crowdfunding campaigns, enhanced by CCLEAR’s cutting-edge data capabilities. CCLEAR’s unique analytical approach combines raw financial data with investor sentiment and market trends, offering predictive insights that are crucial for identifying promising investment opportunities at an early stage.

Through this collaboration, Crowdfund Capital Advisors and InvestmentX are united in their mission to broaden access to investment insights, reinforcing the impact of Regulation Crowdfunding in democratizing access to capital for startups and emerging businesses. Both firms look forward to further developing tools that support informed investing while fostering a sustainable investment crowdfunding ecosystem.

For further information, please contact:

About Crowdfund Capital Advisors

Crowdfund Capital Advisors (CCA) is a global advisory and consulting firm specializing in crowdfunding and early-stage finance. CCA provides data-driven insights, regulatory guidance, and ecosystem development for governments, organizations, and investors. CCLEAR, the data division of CCA, is the industry-leading source of investment crowdfunding data.

About InvestmentX

InvestmentX is an investment analysis and financial media company, offering insights and tools for retail and professional investors seeking to navigate emerging investment opportunities. The platform is dedicated to promoting informed, data-backed investment strategies in both traditional and alternative asset classes.

As we approach the final stages of the 2024 election, both political campaigns are focused on the economy. Yet, a key piece of the puzzle is often missing in these discussions: small businesses and startups, the true drivers of job creation and innovation in America. Whether you’re a business owner, an entrepreneur, or just someone passionate about the future of the U.S. economy, this is the moment to highlight the role of investment crowdfunding.

Investment Crowdfunding: A Game-Changer for Startups

Investment crowdfunding democratizes access to capital, allowing everyday Americans to invest in startups and small businesses through online platforms. This approach, first introduced under the JOBS Act of 2012, opens doors that were traditionally reserved for the wealthy or institutional investors. Over $2.5 billion has already been raised through investment crowdfunding, helping small businesses thrive and create jobs in a range of industries.

This method benefits both campaigns’ objectives. On one hand, it supports Vice President Harris’ focus on fostering innovation and offering greater opportunities for women and minority entrepreneurs. On the other hand, it aligns perfectly with President Trump’s goals of boosting U.S. manufacturing, reducing taxes, and spurring domestic job creation. By strategically co-investing alongside the public, the government amplifies the success of these small businesses without taking unnecessary financial risks.

Key Benefits of Investment Crowdfunding:

- Immediate Access to Capital: Startups can raise funds when they need it most, without waiting for years to become profitable. This addresses the cash flow crisis that many new businesses face.

- Supporting Underserved Entrepreneurs: Women and minority entrepreneurs, who have traditionally struggled to access venture capital, have been significant beneficiaries of investment crowdfunding.

- Strategic Government Co-Investment: The proposed $1B equity and $1B debt funds ensure that the government is not giving away money but is strategically co-investing alongside everyday Americans, targeting businesses with real growth potential.

Why Both Campaigns Should Embrace This Proposal

Investment crowdfunding offers a bipartisan solution to some of the nation’s biggest economic challenges. It encourages job creation, supports diverse entrepreneurs, and strengthens the backbone of the American economy—our small businesses. By integrating targeted tax incentives and leveraging AI-powered partnerships with venture funds, this approach amplifies economic growth while minimizing risk.

Ready to Learn More?

Download the full Investment Crowdfunding Proposal and discover how this initiative can drive innovation and job creation nationwide. Download the Proposal

For more insights on investment crowdfunding and its impact, visit Crowdfund Capital Advisors.

As venture capital (VC) firms face declining investor interest, leading to concerns over inactive “zombie funds,” investment crowdfunding tells a different story. While both sectors have experienced reductions in investor numbers, Reg CF continues to show resilience, maintaining broader participation compared to venture capital, despite a sharp drop in investors between 2023 and 2024.

Investor Participation: A 30.4% Drop from 2023 to 2024, but Still Dominating VC

In recent years, investment crowdfunding has seen a significant decline in the number of active investors. From 2023 to 2024, Reg CF is expected to experience a 30.4% drop in investors, falling from 316,608 to an estimated 220,404. This sharp decline mirrors the 25% decrease reported in VC participation in recent years, but there’s an important nuance: even with this steep drop, investment crowdfunding remains far more accessible and attracts significantly more investors than venture capital.

In fact, throughout the observed period, Reg CF investor numbers have consistently outpaced VC investors. For instance, in 2021, the number of Reg CF investors was 2,137% higher than VC investors on Pitchbook, and even in 2024, Reg CF still boasts a 1,929% higher investor base than VC. It’s worth noting that Reg CF only launched in May 2016, so its percentage increase would have been even more substantial had it been a full year. This difference highlights a key advantage of Reg CF: its accessibility. Reg CF investors are often friends, family, and customers of the businesses, making it easier to connect with them and engage their support. In contrast, VC investors are notoriously difficult to find, and securing their commitment requires navigating rigorous screening processes and multiple rounds of engagement.

In fact, throughout the observed period, Reg CF investor numbers have consistently outpaced VC investors. For instance, in 2021, the number of Reg CF investors was 2,137% higher than VC investors on Pitchbook, and even in 2024, Reg CF still boasts a 1,929% higher investor base than VC. It’s worth noting that Reg CF only launched in May 2016, so its percentage increase would have been even more substantial had it been a full year. This difference highlights a key advantage of Reg CF: its accessibility. Reg CF investors are often friends, family, and customers of the businesses, making it easier to connect with them and engage their support. In contrast, VC investors are notoriously difficult to find, and securing their commitment requires navigating rigorous screening processes and multiple rounds of engagement.

Capital Inflows: Investment Crowdfunding Remains Resilient

Despite the 30.4% decline in investor numbers between 2023 and 2024, the amount of capital raised through Reg CF platforms has remained robust. From just $19.71M in 2016, investment crowdfunding surged to $556.90M in 2021. Although there was a dip in 2022, with $498.24M raised, the market bounced back in 2023 to $526.52M. Looking forward to 2024, projections show capital inflows remaining strong at $540.06M.

This trend is striking when compared to VC, where investor numbers have also fallen significantly, and capital raised has seen greater volatility. Investment crowdfunding, on the other hand, has proven to be more resilient and inclusive, offering an avenue for startups to continue raising funds despite broader market challenges. Moreover, the current lack of VC investors is creating an opportunity for Reg CF investors to get in on deals where valuations have been reset and traditional capital sources are pulling back. This opens the door for retail investors to access promising companies at more attractive valuations, which could prove to be highly beneficial in the long run.

Conclusion: Investment Crowdfunding Still a Vital Option with Long-Term Potential

While the number of Reg CF investors is expected to drop by 30.4% from 2023 to 2024, investment crowdfunding continues to be a critical funding tool for startups and small businesses. The capital raised through these platforms remains strong, showing that while fewer investors may be participating, those that do are contributing meaningfully. With its democratized approach, Reg CF offers a compelling alternative to venture capital, which remains heavily reliant on fewer, larger investors.

Furthermore, the ongoing valuation resets and absence of traditional VC capital provide a unique window of opportunity for Reg CF investors. Though it’s a game of risk, the potential upside for those who take part in these investment rounds could be substantial when these companies reach an exit.

* The data in this report comes from CCLEAR, the industry’s only 100% complete dataset of all investment crowdfunding transactions that began when the industry launched on May 16, 2016. For more information, see cclear.ai or contact data@theccagroup.com

for capital, but also for marketing and brand awareness. This approach helps them grow a community of advocates, making it easier to hit funding goals, generate visibility, and attract future venture capital.”

for capital, but also for marketing and brand awareness. This approach helps them grow a community of advocates, making it easier to hit funding goals, generate visibility, and attract future venture capital.”

In fact, throughout the observed period, Reg CF investor numbers have consistently outpaced VC investors. For instance, in 2021, the number of Reg CF investors was 2,137% higher than VC investors on Pitchbook, and even in 2024, Reg CF still boasts a 1,929% higher investor base than VC. It’s worth noting that Reg CF only launched in May 2016, so its percentage increase would have been even more substantial had it been a full year. This difference highlights a key advantage of Reg CF: its accessibility. Reg CF investors are often friends, family, and customers of the businesses, making it easier to connect with them and engage their support. In contrast, VC investors are notoriously difficult to find, and securing their commitment requires navigating rigorous screening processes and multiple rounds of engagement.

In fact, throughout the observed period, Reg CF investor numbers have consistently outpaced VC investors. For instance, in 2021, the number of Reg CF investors was 2,137% higher than VC investors on Pitchbook, and even in 2024, Reg CF still boasts a 1,929% higher investor base than VC. It’s worth noting that Reg CF only launched in May 2016, so its percentage increase would have been even more substantial had it been a full year. This difference highlights a key advantage of Reg CF: its accessibility. Reg CF investors are often friends, family, and customers of the businesses, making it easier to connect with them and engage their support. In contrast, VC investors are notoriously difficult to find, and securing their commitment requires navigating rigorous screening processes and multiple rounds of engagement.