A Mirror Into the Crowd

In public markets, sentiment is measured in index swings and trading volumes. In investment crowdfunding under Regulation Crowdfunding (Reg CF), sentiment is revealed in the most fundamental signal of all: checks written. Each check represents more than capital — it reflects belief, trust, and conviction. Having helped co-create this industry nearly a decade ago, I’ve seen firsthand how check volume serves as a barometer for early-stage optimism.

Eight years of data tell a story that is as much about the crowd as it is about the economy itself. In 2025, the message is clear: investors are still writing checks, but they’re asking harder questions — and they’re committing differently.

The Arc of Investment Crowdfunding Investor Sentiment (2016–2025)

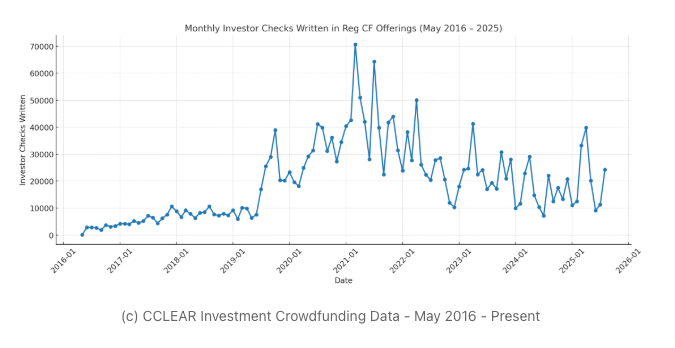

When Reg CF went live in May 2016, a few thousand believers stepped forward. From that modest beginning, check counts grew steadily through 2021, mirroring the rise of fintech adoption and the democratization of investing through investment crowdfunding.

The pandemic proved to be an unlikely accelerant. In 2020 and 2021, despite global uncertainty, checks surged. Stimulus capital, retail empowerment, and the shift to digital all contributed to record participation. By 2021, the number of monthly checks written was several multiples higher than those in the early months of 2016.

Then came retrenchment. In 2022 and 2023, macroeconomic headwinds — inflation, interest rate hikes, and banking shocks — cooled enthusiasm. Check counts fell. But importantly, they didn’t collapse. The crowd stayed engaged, albeit more cautiously.

By late 2024, optimism returned. Investor checks climbed again as inflation slowed and rate expectations stabilized. In early 2025, however, we see wobbling: check volumes remain healthy, but the size of each check is shifting dramatically.

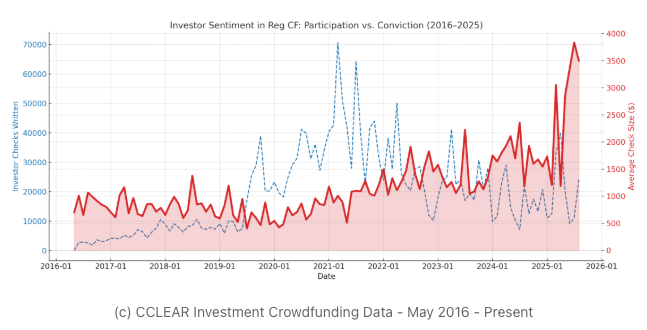

Volume vs. Value: A Tale of Two Sentiments

The overlay of check counts with average check size tells the deeper story. In the early years, thousands of small checks defined investment crowdfunding. As the market matured, average check size steadily grew — and in 2025, it has accelerated sharply, even as the number of investors has softened.

This divergence reveals a market dynamic worth underscoring: fewer investors are writing larger checks. It’s a sign of selective conviction. The crowd hasn’t disappeared — it’s consolidating around issuers that demonstrate traction, storytelling, and trust.

What Moves the Crowd in Investment Crowdfunding?

Investment crowdfunding sentiment has proven highly sensitive to macro and geopolitical events:

- COVID-19 (2020): Initial dip followed by a sharp rebound as digital adoption accelerated.

- Stimulus and frothy public markets (2021): Record-breaking checks.

- Fed rate hikes and inflation (2022): Significant retrenchment.

- Banking turbulence (2023): Hesitation but not collapse.

- Election year and geopolitical tension (2025): Fewer investors, bigger bets.

The lesson? The crowd reacts quickly to uncertainty, but it doesn’t retreat completely. Unlike institutional capital, retail conviction is resilient — it simply shifts shape.

Case Study: Legion M and the Power of Community

Few issuers embody this evolution better than Legion M Entertainment. Since its first investment crowdfunding raise in 2016, Legion M has attracted over 58,000 investors across eight offerings, raising more than $25 million. In its most recent round alone, the company brought in $2.9 million from 5,800 investors. Today, Legion M generates over $1 million in annual revenue.

Why does this matter? Because Legion M proves the power of the investomer — the customer who becomes an investor. In their case, moviegoers aren’t just buying tickets; they’re buying ownership in the films they love. That’s why, even in a cautious 2025, they can continue to rally thousands of checks.

(c) Legion M

For Issuers: Raise or Wait?

So what does this mean for founders considering an investment crowdfunding raise in 2025?

Raise Now If: You’re post-revenue, can activate your community, and are prepared to market your campaign. Investor checks are there, and committed investors are writing bigger ones.

Wait If: You’re pre-revenue, lack traction, or hope the crowd will fund you without strong storytelling. In today’s market, conviction must be earned.

Investor sentiment isn’t gone. It’s simply growing up. Checks are fewer, but bigger. The crowd is cautious, not absent.

Conclusion: A Market Maturing

The story of investment crowdfunding checks is the story of retail conviction. From May 2016’s tentative beginnings to 2025’s selective commitment, one thing has remained true: the crowd invests in what it believes in.

This year, issuers who understand that — who treat their investors as partners, customers, and champions — will find that the crowd still has plenty to give.

For a deeper look at how to turn customers into investors, I explore this concept in my book Investomers. Because in the end, checks aren’t just capital — they’re community.