Equity Crowdfunding’s Adverse Selection Myth Is Collapsing Under Data

For much of the last decade, equity crowdfunding under Regulation Crowdfunding (Reg CF) has been regarded with skepticism in traditional capital markets. Critics argued that equity crowdfunding was a “last resort” for companies unable to secure institutional backing—home to underperformers, overstatements, and inflated hopes. In short, they saw it as a marketplace for lemons.

But new, comprehensive data from Crowdfund Capital Advisors (CCA), which tracks every SEC-compliant Reg CF offering through its CCLEAR dataset, paints a very different picture. The evidence suggests that the equity crowdfunding landscape has matured dramatically—and the arguments of adverse selection no longer hold.

Myth: Only desperate startups turn to equity crowdfunding

Reality: The profile of companies using equity crowdfunding has fundamentally changed—and the financials prove it.

When Regulation Crowdfunding launched in 2016, 62% of issuers were pre-revenue, and 73% were less than three years old. In short, the market was dominated by early-stage, high-risk ventures, many of which had unproven ideas and minimal operating history.

Today, the landscape looks very different. As of 2025, 64% of Reg CF issuers are now post-revenue, and only 46% are considered startups (under three years old). The shift isn’t just qualitative—it’s quantifiable.

In 2016, the median revenue for issuers was effectively zero, and average revenue stood at just $277,000. By 2025, those figures have surged to $439,741 (median) and nearly $2.7 million (average). (Keep in mind this includes debt issuers who historically are smaller cash-flowing enterprises.) These are not fly-by-night ventures or idea-stage prototypes. Today’s issuers are often operating businesses with substantial revenue, market traction, and growth plans.

Additionally, 22.9% of offerings in 2025 are follow-on rounds, meaning companies are returning to Reg CF for additional capital—not as a last resort, but as part of a repeatable capital strategy. These issuers are leveraging equity crowdfunding not just to raise funds but to activate their customer base, build brand equity, and drive sales.

This evolution in issuer maturity reflects a broader trend: equity crowdfunding has become a viable channel for established companies to scale with community support. The myth of desperation has been decisively replaced by a reality of growth-stage engagement.

Myth: Crowdfunded startups fail more often

Reality: Equity crowdfunding businesses are more resilient than the national average.

According to the Bureau of Labor Statistics, roughly 50% of all U.S. businesses fail within five years. Yet, CCLEAR’s longitudinal analysis shows that only 25.5% of crowdfunded companies have gone out of business—even after several years of market exposure. “This is a significant finding that underscores the viability and strength of investment crowdfunding as a funding mechanism,” notes Sherwood Neiss, principal at Crowdfund Capital Advisors.

This performance comes despite the fact that many of these firms began without traditional institutional capital or venture backing. In fact, equity crowdfunding has emerged as a proving ground for companies that subsequently go on to attract follow-on investment.

Myth: Issuers can easily misrepresent their quality

Reality: Equity crowdfunding campaigns operate in a highly transparent and increasingly rigorous environment—both from a regulatory and reputational standpoint.

Unlike informal fundraising or private placements, Reg CF offerings must be filed with the Securities and Exchange Commission (SEC) via Form C, which includes detailed disclosures on the business model, financials, use of funds, risks, and ownership structure. These filings are publicly accessible and legally binding.

But regulatory disclosure is just the beginning. The offering pages themselves have become battlegrounds for credibility. Prospective investors—many of whom are industry insiders, engineers, analysts, or former founders—routinely scrutinize the viability of the idea, intellectual property claims, total addressable market (TAM), and especially valuation. These campaigns are not private conversations behind closed doors. They are real-time negotiations with thousands of stakeholders, often played out in public comment sections, Discord channels, and live Ask Me Anything (AMAs).

Entrepreneurs who cannot defend their assumptions quickly lose the confidence of the crowd—and with that, their raise. It’s not uncommon to see campaigns stall or collapse if the founders fail to justify their projections or if red flags are surfaced during the vetting process.

This interactive, transparent vetting process doesn’t just weed out weak campaigns; it reinforces trust in successful ones. When entrepreneurs are able to stand behind their disclosures with clear, defensible logic, they often emerge with a stronger cap table, higher investor loyalty, and a community of engaged supporters.

In short, transparency isn’t just a requirement—it’s a competitive advantage. And that reality sharply undercuts the idea that adverse selection or low-quality signaling is endemic to Reg CF.

Myth: Top startups avoid the space

Reality: Equity crowdfunding is no longer a sideline activity—it’s becoming a strategic tool used by leading startups and embraced by venture capital.

In just the past month, nearly 30% of Reg CF offerings included a venture or institutional investor on the issuer’s cap table. That’s not a fluke—it’s a signal that traditional investors are rethinking their stance on equity crowdfunding. What was once considered a cap-table complication is increasingly viewed as a strategic advantage.

Venture capitalists now understand that having hundreds or even thousands of retail investors—many of whom are customers or subject-matter advocates—can strengthen a company’s market position, deepen loyalty, and drive sales. These crowdfunders aren’t passive shareholders. They’re engaged stakeholders, grassroots marketers, and sometimes even product evangelists.

This is particularly powerful in consumer-facing or B2B segments where early traction and brand trust are essential. Founders are using equity crowdfunding to build momentum and prove market fit in parallel with institutional capital, rather than in conflict with it. The result is a collaborative financing model where VCs benefit from broad-based community validation, and retail investors gain exposure to deals that previously would have been out of reach.

And if venture firms are as skilled at diligence and identifying winners as they claim to be, then the crowd co-investing alongside them is not a sign of weakness—it’s a positive signal of alignment.

Equity crowdfunding is not a “last stop.” Increasingly, it’s part of the go-to-market strategy for top startups—and a growing number of institutional investors are along for the ride.

Myth: Crowdfunding is too opaque to be taken seriously

Reality: The best-informed players in private capital already rely on equity crowdfunding data—they just don’t always admit it.

For years, one of the perceived drawbacks of the crowdfunding market was a lack of visibility—fragmented disclosures, inconsistent reporting, and no centralized data source. That narrative is now outdated.

The CCLEAR dataset, maintained by Crowdfund Capital Advisors, is the only 100% complete, structured, and daily-updated source of Regulation Crowdfunding data in the United States. It captures over 10,000 SEC-compliant offerings by more than 8,400 companies, totaling nearly $3 billion in capital commitments, with over 5 million structured data points spanning investor behavior, valuations, financials, and compliance.

This data isn’t just useful—it’s becoming essential. Venture firms, asset managers, family offices, and hedge funds are increasingly consuming CCLEAR insights, whether through direct data access, internal dashboards, or regular engagement with published research and market reports. If capital is increasingly flowing into early-stage private markets, then understanding those markets is no longer optional.

The simple truth is: in any market, the best data wins. And in the world of online capital formation, there is only one comprehensive source. Whether you’re deploying capital, evaluating trends, or identifying breakout sectors, the ability to benchmark and forecast using CCLEAR’s proprietary dataset is a clear advantage.

The Rise of the Investomer

At the core of this transition is the concept of the Investomer—a customer who becomes an investor. Unlike traditional capital sources, investomers bring both capital and conviction. They evangelize brands, offer feedback, and drive organic growth. For many companies, this dual-role stakeholder is far more valuable than an arms-length VC.

Equity crowdfunding is no longer a novelty or fringe financing option. It is becoming a mainstream capital strategy with a fundamentally different—and increasingly powerful—economic logic.

As the data mounts, one thing is clear: the adverse selection argument no longer matches the reality of who’s raising capital—and who’s succeeding—in the equity crowdfunding economy.

Investment Crowdfunding Issuers Prove More Resilient than Traditional Companies

In the ever-changing business world, longevity is often dictated by access to capital, market demand, and the ability to adapt. Traditional funding models—venture capital, bank loans, and private equity—have long been considered the gold standard for financing a company’s growth. Yet, new data challenges this assumption, revealing that businesses funded through investment crowdfunding under Regulation Crowdfunding (RegCF) are surviving and thriving at rates that defy conventional wisdom.

The latest Crowdfund Capital Advisors (CCA) analysis presents a compelling counterargument to the outdated perception that investment crowdfunding is a last-resort option for struggling businesses. Instead, the data suggests that RegCF-funded companies outperform traditionally funded businesses regarding survival rates, reinforcing the idea that crowdfunding-backed companies may represent a stronger, more resilient class of businesses.

Investment Crowdfunding Companies Defy National Failure Rates

For decades, research has shown that half of all new businesses fail within their first five years, a sobering statistic reported by the U.S. Bureau of Labor Statistics (BLS). However, an analysis of nearly 8,000 issuers funded through investment crowdfunding tells a very different story:

“The Bureau of Labor Statistics reports that approximately 50% of all new businesses fail within five years. Yet, our analysis of nearly 8,000 companies engaged in investment crowdfunding tells a different story. Here, only 25.5% of funded companies have gone out of business, a stark contrast to the national average,” says Sherwood Neiss, Principal at Crowdfund Capital Advisors. “This is a significant finding that underscores the viability and strength of investment crowdfunding as a funding mechanism.”

The failure rate for businesses funded within the past five years drops even further to just 20.7%, demonstrating the sustainability of crowdfunded ventures over time.

This data challenges assumptions and demands a reassessment of how we measure business success. Investment crowdfunding is not a dumping ground for companies that couldn’t raise capital elsewhere. Instead, it may be one of the best-kept secrets for business longevity.

Chart: Business Survival Rate by Year Issuer Raised Capital

What About Companies That Failed to Raise Capital?

If RegCF-funded companies are proving to be twice as resilient as the average business, what about those that attempted but failed to secure funding through investment crowdfunding?

Interestingly, even unsuccessful issuers that launched offerings but did not meet their funding targets still outperformed the average business tracked by the Bureau of Labor Statistics. Among issuers that failed to raise capital, the survival rate drops to 59.7%, bringing it closer to traditional failure rates.

This insight is critical for two reasons. First, it suggests that businesses that do not secure capital are naturally more vulnerable, reinforcing the importance of adequate funding for long-term success. Second, even these unsuccessful issuers still perform slightly better than the broader business population tracked by the BLS. This suggests that companies willing to seek external funding—whether they secure it or not—may already have characteristics that make them more resilient than the average small business.

The data challenges the misconception that only “weak” businesses turn to crowdfunding. In reality, companies that successfully raise capital through RegCF emerge as some of the strongest players in the private market.

Chart: Percent of Companies Still in Business: Startup (less than 3 years old) vs Established

The Data Speaks: Longevity and Revenue Correlations

Beyond survival rates, the data reveals a direct correlation between revenue, capital raised, and long-term business viability. Companies that secure larger investment crowdfunding rounds or generate higher revenue tend to last longer.

Businesses with revenues over $5 million have a staggering 96.3% survival rate, while those under $1 million have a still-respectable 77.2% survival rate. Similarly, companies that raised over $1 million through RegCF have a 90.3% survival rate, compared to 74.8% for companies that raised under $250,000.

This reinforces a clear takeaway:

“Higher funding targets correlate with better business resilience,” says Neiss. “When companies raise enough capital, they have the runway to execute their vision. This underscores the importance of giving RegCF issuers more flexibility to raise larger sums, rather than capping them at an arbitrary $5 million.”

Investment Crowdfunding vs. Traditional Startups: A Risk Perspective

Startups have long been considered high-risk ventures, yet the data suggests that investment crowdfunding startups defy this assumption. Startups funded through crowdfunding boast a 74.8% survival rate, far exceeding expectations and reinforcing that crowdfunding-backed businesses have a higher chance of success than many of their traditional counterparts.

Established companies over three years fared even better, with an 85.5% survival rate. This indicates that investment crowdfunding is also being leveraged by more mature businesses seeking capital to scale further.

Perhaps most compellingly, the success of women’s and minority-led businesses in RegCF suggests that crowdfunding is not just a funding tool but a mechanism for fostering diversity and inclusion in entrepreneurship.

- 83.8% of women-led companies remain operational, compared to 86% of male-founded companies.

- 85.1% of minority-founded businesses continue to operate, closely mirroring non-minority-founded firms at 85.6%.

“These numbers don’t just prove that RegCF works,” says Neiss. “They prove that when given equal access to capital, diverse founders perform just as well—if not better—than the traditional business landscape.”

A Call for Policy Change: Raising the Cap to $20 Million

Given the remarkable survival rates of RegCF-funded businesses, Neiss argues that the current $5 million fundraising cap for Regulation Crowdfunding is unnecessarily restrictive.

“Far from being a haven for ‘bad seeds,’ these platforms appear to be nurturing businesses with a higher propensity for survival,” Neiss explains. “It’s a testament to the power of community support, due diligence, and the democratization of funding.”

He believes the next logical step for policymakers is to raise the RegCF cap to $20 million, enabling more companies to secure the capital they need to sustain long-term growth.

“If the numbers show that RegCF-backed businesses outperform traditionally funded startups, why are we arbitrarily capping their growth potential?” Neiss asks. “Raising the cap would allow more businesses to scale, create jobs, and contribute to the economy—without relying on traditional gatekeepers.”

———-

Follow the investment crowdfunding data: cclear.ai

How the Crowd Is Filling Venture Capital’s Early-Stage Funding Vacuum

When venture capital pulled back from early-stage startups, it left behind more than ghosted pitch decks. It left a hole in the early stage funding landscape—one that institutional money hasn’t returned to fill.

And yet, the startups never stopped forming.

In 2022, as markets reeled from interest rate hikes, declining valuations, and a frozen IPO window, many assumed the venture slowdown was temporary. But now, nearly three years later, new data suggests something more lasting: early-stage VC hasn’t paused. It’s migrated.

According to PitchBook, just 41% of venture capital deals in 2016 were classified as late stage. By 2025, that number has grown to 61%. Measured by dollars, the shift is even sharper: 96% of VC capital now flows to later-stage rounds, up from 89% nine years ago.

“It’s not a downturn anymore. It’s a structural reset,” says Sherwood Neiss, a co-architect of the JOBS Act and general partner at the early-stage fund D3VC. “VC is doing what public markets did—consolidating around safe bets. But that leaves a lot of overlooked potential.”

A New Path for Early Stage Funding—and a New Class of Investor

In the vacuum left behind, a parallel market has emerged. Quietly at first, then with increasing velocity, founders began raising capital under Regulation Crowdfunding, or Reg CF—a provision of the 2012 JOBS Act that allows private companies to raise up to $5 million annually from the public via SEC-registered platforms.

Since its launch, more than 10,000 offerings have raised capital using Reg CF, attracting over $2.9 billion from retail and professional investors alike. The average investor isn’t a fund manager. It’s a customer, a fan, or a founder who sees promise in a product before the institutions ever do.

While still nascent compared to traditional VC, the Reg CF ecosystem is no longer fringe. On any given day, over 400 active offerings are live across more than 100 platforms—creating new early stage funding opportunities that didn’t exist a decade ago.

And they’re coming from places the venture capital establishment has historically overlooked.

Not Silicon Valley—Sheridan, WY

One of Reg CF’s most significant shifts has been geographic and demographic decentralization. Founders in places like Atlanta, Phoenix, or Detroit are raising capital from their communities, bypassing the usual gatekeepers in New York and San Francisco.

Roughly half of successful Reg CF campaigns today are led by women or minority founders—a figure that far outpaces the averages reported by institutional venture firms. According to Neiss, that’s not just a social story—it’s a financial one.

“You’re seeing first-mover capital flow into companies that never would’ve made it into a coastal fund’s pipeline,” he says. “And some of those are now getting follow-on rounds at higher valuations. That’s a signal. The crowd is becoming the new filter for early stage funding.”

Access Doesn’t Equal Clarity

Still, for all its momentum, Reg CF is not without challenges. Chief among them: information asymmetry.

Platform disclosures are inconsistent. Deal terms vary widely. And with hundreds of live campaigns, investors struggle to separate marketing from momentum.

“There’s data everywhere,” Neiss says, “but it’s noise unless you know how to read it.”

That’s where firms like CCLEAR come in.

Launched to bring structure to the fragmented world of Reg CF, CCLEAR tracks over 5 million data points across every offering in the space. The dataset includes campaign filings, terms, traction, and—most critically—real-time investor sentiment: how many investors are writing checks, in what sectors, and at what velocity.

The firm’s insights have already been adopted by family offices, fund managers, and fintech firms trying to identify signals in the market’s earliest stages.

The New Stack: Data, Signals, and Funds

For investors seeking early stage funding opportunities, this market now offers four ways to participate:

- Do the work manually, tracking individual campaigns across platforms.

- Subscribe to structured datasets like CCLEAR for daily intelligence.

- Follow the signals, such as CCLEAR’s Capital Pulse report, which applies AI/ML to flag top-performing live deals.

- Or invest through funds like D3VC, which use algorithmic models to identify early-stage opportunities—and are already seeing follow-on rounds at higher valuations.

The first approach is time-consuming. The fourth may be the most efficient.

What Happens Next?

If the post-2022 market was a test, Reg CF has passed. The structure is there. The capital is flowing. And in a world where early-stage venture looks more like late-stage private equity, the crowd may be where venture truly begins again.

The private capital markets may not be democratized yet—but they’re being rerouted. And the investors who recognize that shift early are already finding their advantage in early stage funding alternatives.

To explore the full dataset and strategy:

Beyond the Raise: Rethinking Post-Investment Crowdfunding Strategy for Founders and Platforms

In the ever-evolving world of investment crowdfunding, success doesn’t end when the funding goal is met—it’s only the beginning. Yet, one of the most persistent challenges in this space is what happens after the campaign closes. Let’s explore three critical aspects of the post-raise investment crowdfunding landscape in Regulation Crowdfunding (Reg CF): communication drop-offs, best practices from top campaigns, and how platforms are (or aren’t) supporting issuers beyond the raise.

Where Is the Biggest Drop-off in Founder-Investor Communication?

The most significant communication gap appears immediately after a successful raise. Founders, often exhausted from the intense marketing sprint of their campaign, shift gears to execution—building products, fulfilling orders, or scaling teams. Unfortunately, this transition often sidelines investors, who may feel left out despite being part-owners in the venture.

According to Investomers – A practical guide to launching, optimizing, and winning in the world of investment crowdfunding, post-raise communication is pivotal in investment crowdfunding campaigns. When issuers neglect consistent updates, they lose not only transparency but also the momentum of their newly activated investor base. These “investomers”—investors who are also customers—can be a founder’s greatest brand advocates if nurtured properly.

The drop-off isn’t just a missed opportunity; it’s a risk. Many investors may begin to question the company’s legitimacy or prospects when they don’t hear back within the first 60 to 90 days post-raise—a key window to build loyalty and trust.

What Do the Most Successful Investment Crowdfunding Campaigns Do After Hitting Their Goal?

The best investment crowdfunding campaigns understand that closing a round is just Act I. Successful founders deploy three core strategies post-raise:

Structured Communication Cadence: They send regular investor updates—monthly or quarterly—outlining milestones, challenges, and ways to help. These aren’t generic newsletters; they invite action (e.g., “Share this launch,” “Beta test this feature,” or “Refer us to a retailer”).

Activate Advocacy Programs: As seen in the Investomers framework, founders who turn investors into ambassadors—offering referral rewards, exclusive perks, or early access—create powerful organic marketing loops.

Prep for Follow-On Rounds Early: Top-performing campaigns use their crowd as a base for future raises. With 29.8% of offerings now being follow-on rounds, maintaining strong investor relationships becomes a strategic asset, not just good practice.

Do Investment Crowdfunding Platforms Offer Meaningful Post-Raise Support?

This remains a notable blind spot across most platforms. While platforms excel at onboarding issuers and facilitating raises, they fall short in systematic post-raise engagement. As highlighted in Investomers, most platforms lack structured tools to help founders maintain investor relations, prepare for financial disclosures, or leverage their crowd in future growth initiatives.

That said, some platforms are experimenting with value-add services. For example:

Republic offers post-raise dashboard analytics and investor CRM tools, but adoption is uneven.

StartEngine has introduced a secondary trading platform (StartEngine Secondary), offering some liquidity for investors but little support for founders in ongoing engagement.

Wefunder provides minimal structured support beyond closing the raise, relying heavily on founders to self-manage post-round communication.

In contrast, the CCLEAR dataset reveals a consistent pattern: issuers who thrive post-raise are those who don’t rely solely on the platform to maintain investor momentum—they own the relationship themselves.

Conclusion: Post-Raise Is the New Frontier

If the first decade of investment crowdfunding focused on raising capital, the next will be about sustaining it—through transparency, engagement, and community-building.

Founders who treat investors as long-term stakeholders—not just check writers—gain an unfair advantage. Platforms that integrate tools for ongoing communication, compliance, and loyalty building will define the next generation of Reg CF success.

Want more actionable data and strategic guidance on the future of investment crowdfunding? Visit Investomersbook.com

What the SEC Misses in Equity Crowdfunding Data

Last week, the SEC released its latest report on equity crowdfunding under Regulation Crowdfunding activity (see release). But its Regulation Crowdfunding numbers rely on Form C-U filings — and issuer compliance with those forms has historically been low.

The result? Incomplete and inconsistent data about one of the fastest-growing corners of private capital markets.

At CCLEAR, we’ve built the industry’s first comprehensive, transaction-level dataset for equity crowdfunding under Regulation Crowdfunding (RegCF) – covering both equity and debt offerings. We track every campaign, every platform, and every investment — day by day — across the full lifecycle of each offering.

It’s not estimated. It’s not sampled. And it doesn’t rely on issuers to follow up after the fact.

What follows are five charts that show the depth, precision, and insight this dataset delivers — insight the SEC and other data providers simply can’t replicate.

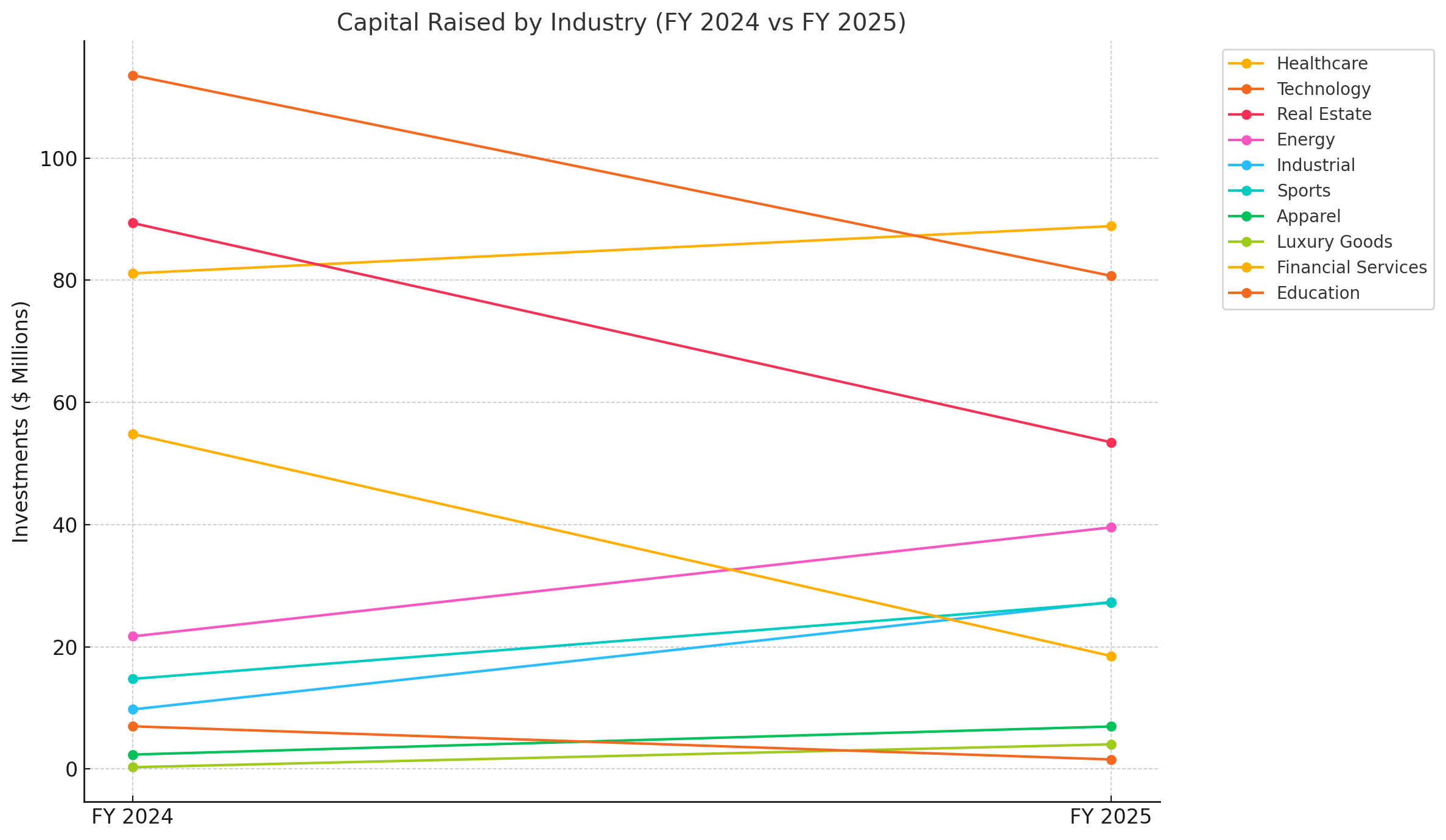

🏭 Capital Raised by Industry: FY 2024 vs. FY 2025

This chart compares capital allocation by industry across the trailing 12 months — from June to May, year-over-year. In other words:

- FY 2024 = June 2023 – May 2024

- FY 2025 = June 2024 – May 2025 (the most recent 12 months)

Unlike the SEC’s Regulation Crowdfunding report, which relies on delayed and incomplete Form C-U filings, our data is live. We track investment activity daily, across every open campaign, platform, and security type — with no need to wait months for quarterly updates or year-late federal reporting.

🔍 What It Shows:

- Healthcare, Energy, and Industrial & Manufacturing sectors saw significant growth in FY 2025, suggesting a shift toward real-world solutions and harder tech.

- Technology, Financial Services, and Real Estate experienced notable declines — likely driven by macro trends and valuation resets.

- Emerging consumer sectors — like Luxury Goods, Apparel, and Sports — posted modest gains, signaling niche investor interest.

This kind of time-sensitive, sector-level analysis is only possible with complete, real-time investment tracking — not static form-based filings.

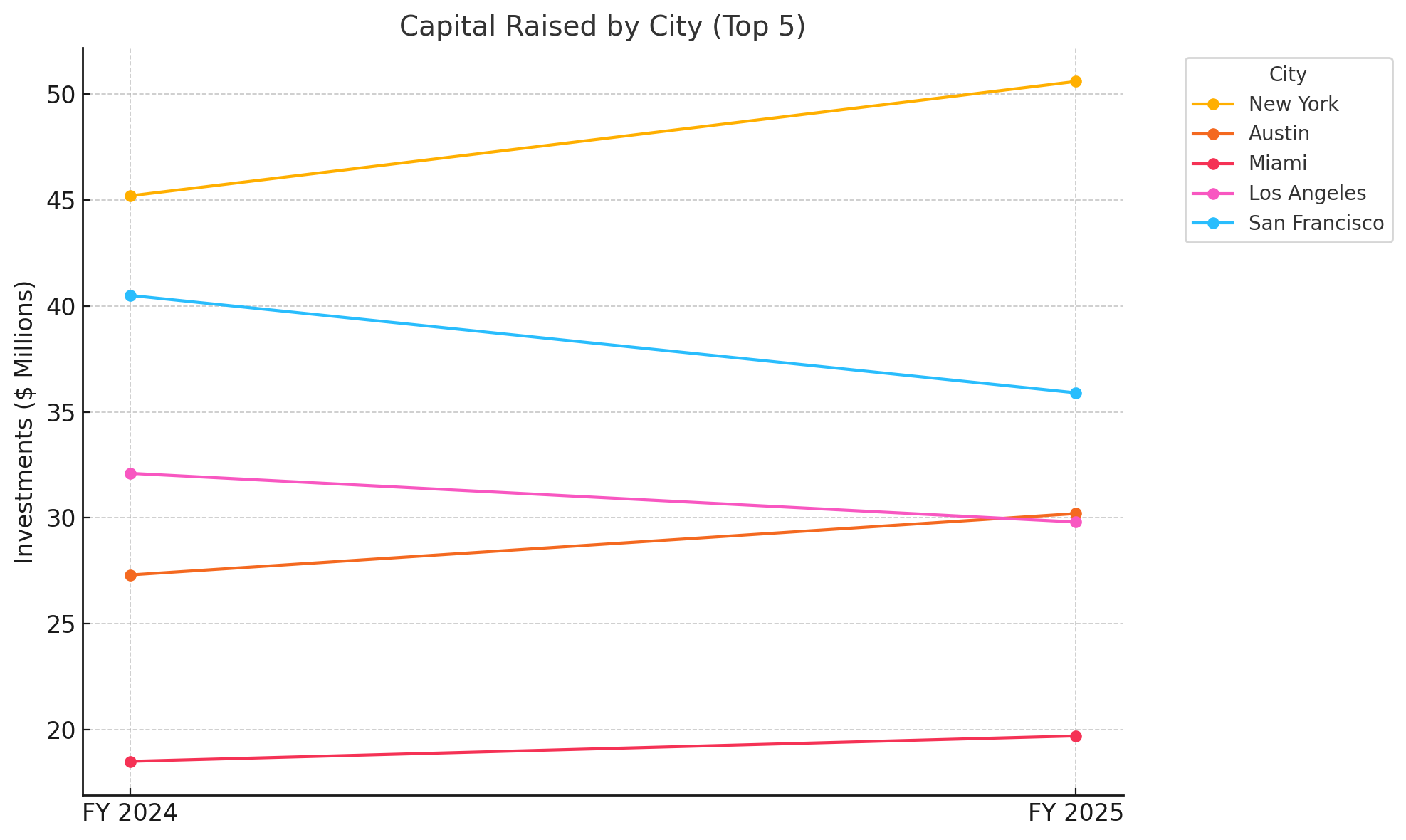

🌆 Where Regulation Crowdfunding Capital Is Really Flowing: City-Level Crowdfunding Trends

The SEC reports capital by state. That’s a start — but it misses the dynamics driving this market. This chart shows where equity crowdfunding capital actually landed, broken out by city (not just state). Because CCLEAR tracks every transaction daily and geolocates each issuer by zip code, we can show investment flows at the metro level — not just aggregated rollups.

🔍 What It Shows:

- Over this past year, Austin, Miami, and New York City led all cities in capital raised — with each growing year-over-year, even as overall market volume softened.

- Los Angeles and San Francisco, by contrast, saw year-over-year declines, reflecting shifting founder activity and possible investor fatigue in legacy tech hubs.

This level of detail is essential for:

- Economic development teams aiming to support local startup ecosystems

- Data platforms looking to map innovation geography in real time

- Policy analysts interested in regional trends in retail capital access

You won’t find this in the SEC’s annual releases — and you won’t have to wait for incomplete filings.

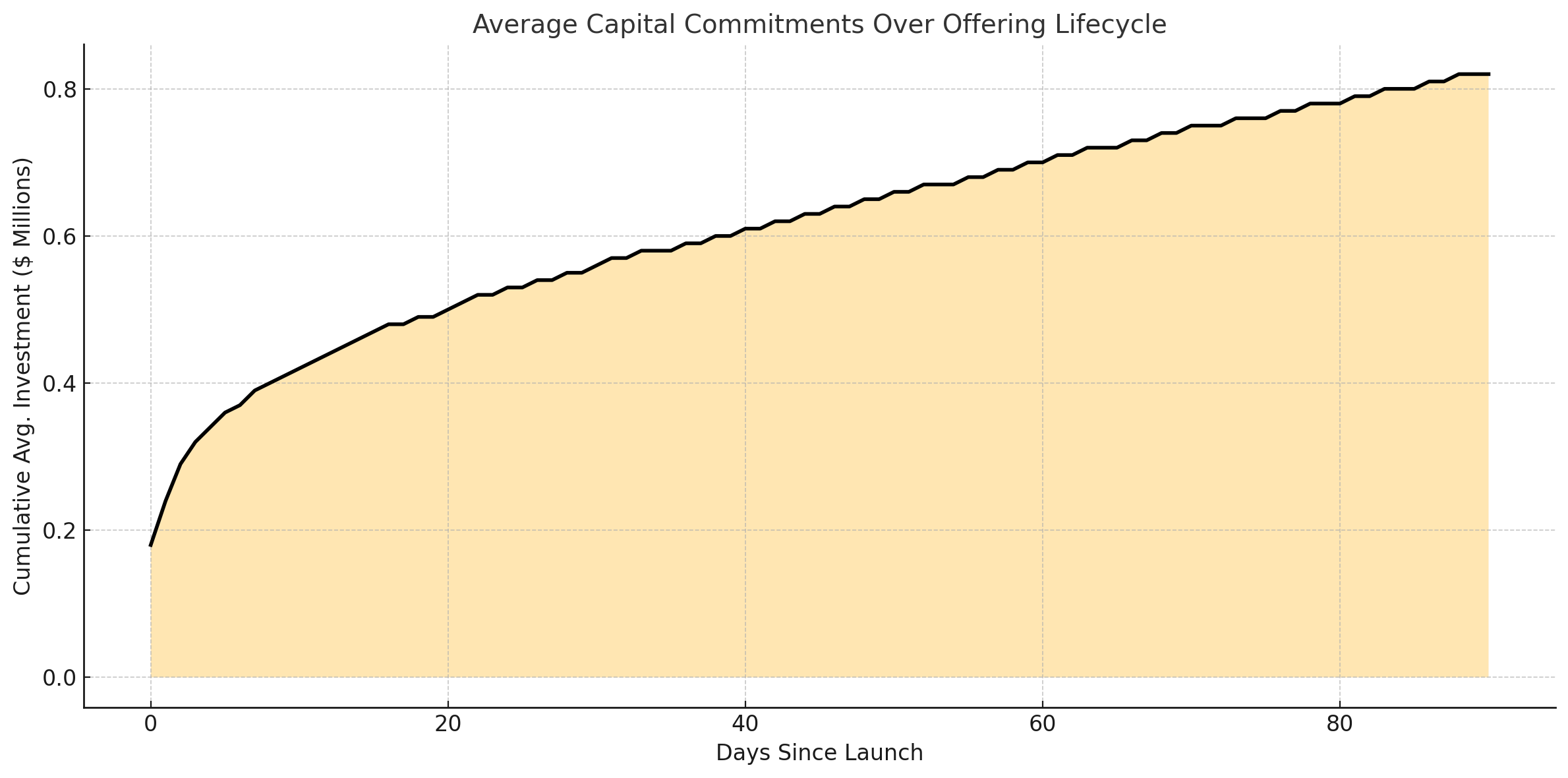

📈 How Campaigns Actually Raise Capital: Daily Velocity Over Time

Most reports, including the SEC’s, focus on how much an offering raised in total — but not how it was raised.

This chart shows the average cumulative investment per offering, day by day, across a 90-day Reg CF campaign lifecycle. It’s powered by CCLEAR’s daily tracking of every transaction, across every open campaign.

🔍 What It Shows:

- Most campaigns follow a predictable shape: a strong open, a mid-campaign plateau, and a final-days push — often driven by deadline urgency.

- By Day 10, the average offering has raised nearly half its eventual total.

- The final 30 days deliver steady incremental growth, but rarely explosive gains — highlighting the importance of early marketing.

This kind of lifecycle-level insight is only possible with continuous, high-frequency data collection. With CCLEAR, you can model campaign velocity, predict outcomes, and time promotional activity — none of which is visible in the SEC’s static filings

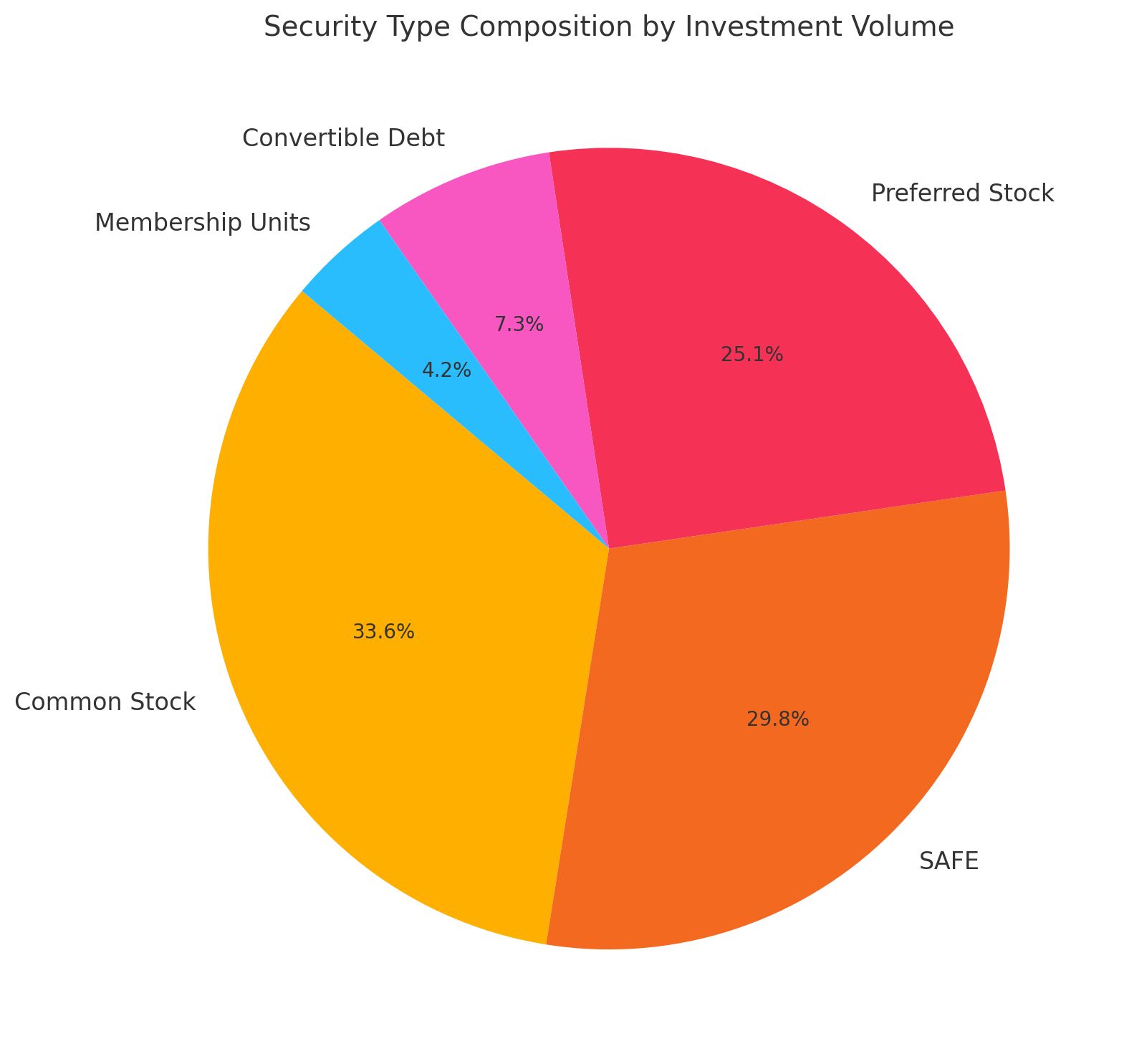

🧾 What Investors Are Actually Buying: Security Type Breakdown

The SEC’s equity crowdfunding reports the existence of securities — but not how much capital is actually flowing into each one. This chart shows the total investment volume raised by each major security type across all Reg CF offerings in our dataset.

Unlike static filings or post-close summaries, CCLEAR captures every transaction by instrument as it happens — whether it’s equity, debt, revenue share, or hybrid instruments.

🔍 What It Shows:

- Common Stock and SAFEs (Simple Agreements for Future Equity) dominate the market — together accounting for a majority of all Reg CF capital raised.

- Preferred Stock is also widely used, particularly for larger, later-stage raises.

- Convertible instruments, membership units, and revenue shares make up a smaller but important part of the capital stack — reflecting campaign structure experimentation across sectors.

This data is critical for:

- Legaltech and compliance platforms analyzing securities trends

- Market analysts studying private market standardization

- Investment platforms optimizing campaign structuring for investor appeal

No guesswork, no lag — just a clean, real-time view into how the capital is structured.

💬 Retail Crowdfunding Investors Are Pulling Back — But Writing Bigger Checks

This chart shows investor sentiment for Reg CF offerings, across fiscal years (June–May), with parallel 506(c) amounts removed for a clean look at true retail crowdfunding activity.

🔍 What It Shows:

- The number of investors peaked in FY 2021 at over 515,000, then declined consistently through FY 2025 (down to ~233,000).

- Meanwhile, the average check size has grown since FY 2020’s low, climbing from $689 to over $1,700 in FY 2024, and holding steady in FY 2025.

🧠 What It Means:

This pattern aligns with macro and venture market trends:

- Venture capital slowed dramatically post-2021, rippling into Reg CF as fewer campaigns launched and investors grew cautious.

- Inflation, supply chain uncertainty, and rate hikes suppressed casual retail participation.

- But those who remain are writing larger, more confident checks — signaling a shift toward experienced or higher-conviction backers.

This isn’t speculation or modeling — it’s based on every investment transaction, traced back to each open campaign.

📬 Build Smarter With a Complete Equity Crowdfunding Dataset

The Reg CF market is no longer a rounding error in private capital — it’s a multi-billion-dollar pipeline of early-stage innovation, investor behavior, and retail capital formation.

With CCLEAR, you don’t have to rely on partial filings, backward-looking reports, or incomplete disclosures.

We offer:

- Full coverage of every Reg CF campaign, platform, and security

- Daily transaction tracking, not just closing summaries

- Investor-level trends, campaign pacing, and capital velocity

If your team works in market intelligence, private capital research, investment strategy, or economic analysis, this is the data infrastructure you’ve been waiting for.

Let’s connect — we’d love to show you what’s possible.

Why the SEC’s Crowdfunding Report Falls Short — and What CCLEAR Can Do About It

This week, the SEC’s Division of Economic and Risk Analysis (DERA) released its long-awaited update on investment crowdfunding under the JOBS Act. It’s encouraging to see the Commission acknowledge how far this market has come.

But let’s talk about the elephant in the room: data integrity.

In their 11-page analysis, the SEC states:

“Based on the analysis of EDGAR filings… there were 3,869 offerings where issuers reported approximately $1.3 billion in proceeds. This is likely to be a lower-bound estimate due to variance in Form C-U filing practices.” — SEC, May 2025 Report on Crowdfunding

That understatement conceals a massive blind spot.

In reality, over the same time period, our CCLEAR dataset—which collects data directly from the platforms, offering pages, and disclosures – not self-reported filings—shows:

- 6,564 successful offerings

- $2.83 billion in capital commitments

That’s 70% more offerings and over double the proceeds than what’s captured in the SEC’s report.

Why the Difference Matters

The SEC’s reliance on Form C-U filings, which are often missing, late, or incomplete, creates a systemic underreporting problem. And that affects how regulators, media, and institutional stakeholders perceive the entire industry.

That’s why we built CCLEAR from the ground up—to fill in those gaps and go far beyond them. Our dataset is the only one in the market that is:

✅ 100% complete

✅ Transaction-level accurate

✅ Enriched with structured fields like:

- Investor sentiment

- Valuation benchmarks

- Industry classifications

- Securities type and terms

- Geographic distribution

- And much more

Our Report vs. Theirs

The SEC’s report is 11 pages.

Our Annual State of Investment Crowdfunding report is 210 pages—and that’s not filler. It’s the detailed analysis the industry needs to make informed decisions, benchmark performance, and identify emerging trends.

We’re grateful to see the Commission turn its attention to this market. But if we want to fully understand how Regulation Crowdfunding is transforming early-stage capital formation in the U.S., we need more than partial filings.

We need complete data. We need CCLEAR.

A Broken Patchwork: Why State-by-State Manual Exemption Fails, and What We Must Do Next

The recent release of NASAA’s Principles for SEC Crypto Asset Regulation underscores the growing urgency to bring digital asset markets into compliance—but misses a key point: state-by-state blue sky compliance for secondary trading simply doesn’t work in today’s market environment.

At GUARDD, we’ve been on the front lines, building the infrastructure to enable lawful secondary trading of exempt, freely transferable securities—including tokenized assets. We’ve helped dozens of issuers publish structured disclosures. But when we tried to get our system accepted on a state-by-state basis under the outdated “manual exemption” model, we hit a wall. The system is fragmented, slow, and opaque—despite our platform offering better transparency and automation than the printed directories regulators still rely on.

It’s time for a new approach.

We urge NASAA and its members to consider a unified state standard for structured disclosures—one that qualified platforms like GUARDD could support. Without it, issuers are left in limbo, investors face liquidity barriers, and innovation continues to be throttled by regulatory friction. Alternatively, Congress or the SEC must step in to establish or authorize a central registry for exempt securities disclosure, akin to EDGAR, but tailored for secondary trading compliance.

We’re ready to help build this future. But we can’t do it alone.

Misfiled and Misunderstood: Why Form C-TR Might Be Your Reg CF Compliance Blind Spot

If you’re a founder who raised capital under Regulation Crowdfunding (Reg CF) and thought your SEC reporting obligations ended after your campaign closed—or after filing one annual report—you’re not alone. But if you filed a Form C-TR to end those obligations, there’s a good chance you did it too soon or didn’t qualify to file it at all.

That’s a growing problem.

What Is Form C-TR?

Form C-TR is the termination of reporting notice. It’s how a Reg CF issuer formally tells the SEC and investors: “We’re done filing annual reports.”

But you can’t file it just because your campaign ended. Under Rule 203(b)(2) of Reg CF, you can only file Form C-TR if:

You’ve filed at least one Form C-AR, and

One of these conditions is met:

You have fewer than 300 shareholders of record,

You’ve repurchased all Reg CF securities, or

Your company is no longer in business.

That’s it. There are no other valid reasons to file a C-TR.

⚠️ The Common Mistakes

Many issuers mistakenly assume they can file a Form C-TR:

Shortly after their raise closes, without understanding the ongoing reporting requirements,

Without checking whether they have fewer than 300 shareholders or have repurchased all Reg CF securities,

Or while still actively operating, thinking that the end of the raise automatically ends their obligations.

These assumptions often lead to premature or invalid Form C-TR filings, leaving issuers out of compliance without realizing it, which can:

Disqualify them from future offerings, and

Damage credibility with platforms, investors, and regulators.

📌 Filing Another Form C After a C-TR? You Just Reopened the Reporting Obligation.

If you previously filed a C-TR and then launch a new Reg CF offering, your reporting obligation restarts. That means:

You must file new Form C-ARs annually starting with the next fiscal year-end,

And you must file another C-TR later if you want to terminate reporting again—once you qualify.

Filing one C-TR doesn’t exempt you forever.

✅ What to Do Now

Check your last Form C-TR. Did you meet the conditions?

If you’re still operating or have >300 shareholders, you likely filed too soon.

Coordinate with your platform or legal advisor to assess whether a new Form C-AR is required to get back into compliance.

Form C-TR is not just a formality—it’s a legal step with strict eligibility criteria. Filing it incorrectly could invalidate your compliance record and block future capital raises.

We’re here to help Reg CF issuers and platforms navigate these traps. For more guidance or to audit your reporting history, visit CrowdfundCapitalAdvisors.com or reach out directly to info@theccagroup.com.

👉 And if you missed it, check out our recent article on Form C-AR non-compliance, another major issue catching founders off guard.

The Hidden Compliance Crisis in Reg CF: Why So Many Issuers Are Failing at Form C-AR

If your company has raised capital through Regulation Crowdfunding (Reg CF), chances are you’ve filed a Form C to launch your campaign. But what many issuers don’t realize—or overlook—is the obligation that follows: filing a Form C-AR, your annual report.

And here’s the uncomfortable truth: a significant number of issuers are currently out of compliance with this basic but critical requirement.

💡 What Is Form C-AR?

Form C-AR is the annual report that Reg CF issuers are required to file with the SEC and make publicly available to investors. It includes updated financials and a narrative about the business. Its purpose is simple: to ensure investors receive ongoing transparency after they invest.

Under Rule 202(b)(1) of Reg CF, issuers must file this report no later than 120 days after the end of their fiscal year. For companies with a calendar year-end, that means April 29 is your annual deadline.

🧾 Why So Many Are Missing the Mark

In theory, the rules are straightforward. In practice, many issuers:

Don’t realize they need to file Form C-AR at all;

Assume the obligation ends when the offering closes;

Believe a single filing is enough;

Or file late, rendering the filing non-compliant.

Even more concerning, some companies continue raising on Reg CF while already out of compliance—a clear violation of SEC rules.

❌ The Risks of Non-Compliance

If you’re not current on your C-AR filings, the SEC considers you non-compliant. The consequences include:

Being barred from future Reg CF offerings (until compliance is restored);

Loss of investor trust;

Potential regulatory scrutiny;

Risk to your platform’s reputation.

Per Rule 100(b)(7), you cannot raise capital via Reg CF if you haven’t filed all required ongoing reports.

✅ What You Should Do Now

Check your last Form C-AR filing date. If it’s been over a year and you’re still active, you likely owe a new one.

Know your fiscal year-end. Your 120-day deadline is based on it.

File Form C-AR even if your offering ended. The obligation doesn’t automatically disappear.

Work with your platform or compliance advisor to create a simple reporting calendar.

If your company is unsure about its status or needs help filing, don’t wait. Falling out of compliance can undo all the momentum you’ve built.

Reg CF is an incredible tool for democratized capital—but with it comes the responsibility of transparency. Filing your C-AR isn’t just a checkbox; it’s a signal to your investors and the market that you’re serious about accountability.

For more insights on Reg CF compliance, platform trends, and real-world fundraising data, visit cclear.ai or reach out directly.

👉 Stay tuned: we’ll publish a follow-up post about Form C-TR — the most misunderstood form in Reg CF reporting.

Why Angel Investors Need to Get on Board with Investment Crowdfunding

Reflections from the Angel Capital Association Annual Meeting – April 2025

Yesterday, I had the opportunity to speak at the Angel Capital Association’s Annual Meeting in Denver. As always, the room was full of experience, intelligence, and passion for early-stage investing. The panel underscored what I’ve heard from others in the community: there remains some hesitation among traditional angels when it comes to investment crowdfunding.

For many traditional angels, crowdfunding remains suspect—deals are too promotional, valuations are too high,and due diligence is too thin. I understand the skepticism. But I believe many are missing the broader shift happening in the private markets.

We are in the middle of a structural transformation in how startups raise capital—and how investors can and should participate. Three movements are driving this shift:

1. Regulation Has Expanded Access

With the passage of the JOBS Act and the creation of Regulation Crowdfunding (Reg CF) and Rule 506(c), companies now have legal avenues to publicly solicit investment from both accredited and retail investors. These tools have made capital formation more inclusive—and more transparent.

2. Technology Has Rewired the Capital Stack

Entrepreneurs are increasingly turning to online investment platforms as their first stop for raising capital. These platforms enable broader outreach, faster investor commitments, and rich data streams. For investors, this means easier access—but also a new set of filters to apply.

3. Traditional Capital Is Moving Later-Stage

We’re seeing a pullback from venture capital and traditional angels at the earliest stages. The risk appetite has narrowed. This has created a funding gap that is being filled by retail investors—over $3 billion to date—through regulated online platforms.

These changes are not theoretical. They are happening now. Every week, thousands of investors are committing capital to startups online—many of which would never have passed through a traditional syndicate.

Seeing the Wheat Through the Chaff

The common critique of investment crowdfunding is that it’s full of noise. And that’s true—there are many deals that aren’t investor-ready. But let’s be honest: traditional deal flow has the same issue. We all pass on deals that turn out to be winners. The crowd does, too.

The real shift is that we now have new tools to separate signal from noise—and they’re improving every day.

The Data Advantage

For the first time in early-stage investing, we have access to real-time, trackable data on deal performance, investor behavior, and market sentiment. Through platforms like CCLEAR, we can monitor:

Capital flow and investor participation across offerings

Momentum indicators like time-to-close and number of checks written

Follow-on activity and issuer performance over time

These are not just new metrics—they’re new ways to build conviction.

A Practical Path Forward

Investment crowdfunding doesn’t replace traditional angel investing—it enhances it. As angels, we have sector knowledge, pattern recognition, and networks that retail investors don’t. But the crowd brings data, scale, and community.

When we blend the two, we create a more robust, informed investing model. One that’s better suited for today’s decentralized, digital-first startup economy.

Angel investing is evolving. The companies we want to support are raising differently. The next generation of winning deals may not come through a warm intro or a pitch dinner—they may come through a platform, with traction already proven by a hundred small checks.

The train has left the station. The question isn’t whether to get on board—it’s how far behind you want to be.

CCA Sends Letter to Congress: Support for Investment Crowdfunding Legislation and a Call for Tax Incentives

On March 31, 2025, Crowdfund Capital Advisors submitted a letter to the House Financial Services Committee urging strong support for a series of bills aimed at expanding access to capital through investment crowdfunding.

These bills—particularly the Improving Crowdfunding Opportunities Act, the ACCESS Act, the SEED Act, and various proposals to modernize the accredited investor definition—represent practical, bipartisan steps to support entrepreneurship, innovation, and job creation without compromising investor protection.

We know this industry better than anyone. CCA co-authored the original investment crowdfunding framework alongside Congressman Patrick McHenry and spent more than 460 days in Washington D.C. helping pass the bipartisan JOBS Act in 2012. Since then, we’ve built the only 100% complete and continuously updated dataset tracking Regulation Crowdfunding—more robust than what even the SEC maintains.

Our data proves that this market is working exceptionally well:

- $3B+ raised by over 8,100 companies

- 2.1 million investments made

- 430,000+ jobs created or supported

- $14.7B in enterprise value built

- Over $27.1B in total economic stimulus

This is capital flowing into underserved communities, rural towns, and emerging startup cities—not just Silicon Valley or Wall Street.

What We’re Asking Congress to Do

The legislation under review would modernize Regulation Crowdfunding and remove key barriers to scale:

✅ Raise the Reg CF cap to $10M—or ideally, $20M

✅ Lower compliance costs for small businesses via the ACCESS Act

✅ Introduce the SEED Act for micro-offerings

✅ Enable secondary trading and support GUARDD as a national compliance framework

✅ Expand the accredited investor pool based on knowledge, not wealth

✅ Exempt trusted “finders” from broker-dealer registration

✅ Increase the Reg A+ cap to help scaled companies remain in compliant pathways

These updates reflect how the industry has matured: 60% of issuers are now post-revenue, demonstrating that Reg CF is attracting stronger, less risky companies.

But There’s One Big Thing Missing: Tax Incentives

We also proposed something not currently on the table—but urgently needed: the Early-Stage Investment Tax Incentive for Crowdfunding (ESTI-CF).

This proposed federal policy would allow investors to:

- Write off 50% of their investment in eligible Reg CF companies

- Deduct 100% of their investment if it’s in a distressed, rural, or opportunity zone

- Avoid capital gains tax if they hold the investment for at least 5 years

This model has proven successful in countries like the UK and Canada. It pays for itself through economic growth and ensures capital reaches regions and businesses that need it most.

We invite Members of Congress, regulators, and the public to read our full letter here and review our supporting materials:

Let’s not stall a working system. Let’s scale it.

If Congress is serious about revitalizing American entrepreneurship, now is the time to modernize Reg CF—and consider bold, pro-growth ideas like ESTI-CF.

For questions or support, contact us anytime. We’re proud to continue leading the data, policy, and advocacy agenda for this critical part of the U.S. capital markets.

How to Quickly File Your Form C-AR for FREE

Regulation Crowdfunding (Reg CF) offers an exciting avenue for startups and small businesses to raise capital directly from the public. However, success in a Reg CF offering comes with certain ongoing responsibilities, chief among them being the legal obligation to keep investors informed about the business’s progress and financial health. This is where the Form C-AR, or the annual report, becomes crucial.

Understanding Form C-AR

Form C-AR is an annual report that issuers who have successfully raised funds through Regulation Crowdfunding must file with the SEC. This document helps maintain transparency by providing investors and the public with up-to-date information on the company’s financial status and operational developments. It typically includes updated financial statements, a discussion of the business’s operations and financial condition, and details on the use of the funds raised.

Step-by-Step Guide to Filing Form C-AR for Free

Before Filing: Preparation is Key

- Gather Financial Statements: You will need to compile financial statements for the most recent fiscal year. If your total annual gross revenues or the total offering amount from all securities offerings in the past 12 months are less than $124,000, your company’s principal executive officer can certify them. If they are between $124,000 and $618,000, they must be reviewed by an independent public accountant. If they are over $618,000, they may need to be audited. Download the free step-by-step guide to see which category you fall in.

- Update Business Information:

- Summarize significant business activities and operational milestones achieved during the year.

- Discuss any known trends, demands, commitments, or events that are likely to affect your financial condition.

- Report on the progress of specific projects funded through the crowdfunding campaign.

- Outline the Use of Proceeds:

- Detail how the funds raised have been used in comparison to the previously disclosed plans.

- If there are deviations from the planned use of proceeds, provide a rationale for these changes.

Filing on EDGAR:

To continue, download the instructions for free.

Don’t want to do it yourself? Hire us! Our fee for this service is $450. Email: sales@theccagroup.com for more information.