It’s Time to Raise the Regulation Crowdfunding Cap to $20 Million

Today, Crowdfund Capital Advisors submitted a formal petition to SEC Chairman Paul Atkins requesting a significant change to Regulation Crowdfunding: raising the maximum offering limit from $5 million to $20 million, with automatic inflation indexing.

This isn’t just a policy wish list item. It’s backed by nearly a decade of transaction-level data showing that the current cap is fragmenting capital formation without providing meaningful investor protection benefits.

The Current Cap Is a Ceiling, Not a Safeguard

When the $5 million limit was set in 2021, it made sense for a nascent market that had proven itself beyond the initial $1 million cap. But Reg CF has matured dramatically. We’ve now tracked over 8,800 issuers and more than $3.2 billion in capital formation through our CCLEAR database—the most comprehensive transaction-level dataset on Regulation Crowdfunding in existence.

What does that data tell us? Companies hitting the cap aren’t stopping. They’re coming back.

The Numbers Tell the Story

Our analysis of issuers that approached the current cap (raising $4–5 million in a single offering) reveals a clear pattern:

- 40.3% returned to the Reg CF market for follow-on offerings

- 20 months was the median time to first follow-on—consistent with normal business growth cycles

- $3.1 million was the median additional capital raised after hitting the cap

- $214+ million has been raised in aggregate by issuers who initially maxed out

- 29.4% of these companies raised at least $1 million more in subsequent Reg CF rounds

This isn’t evidence of issuers being appropriately constrained. It’s evidence of artificial fragmentation—companies forced to run multiple offerings when a single, consolidated raise would be more efficient for everyone involved.

Why $20 Million (Not $10 Million)

A modest bump to $10 million would simply recreate the same problem at a higher threshold. The companies most constrained by the current cap are often post-revenue, customer-rich, and operationally mature. They’re seeking $10–20 million to fuel growth—capital that’s increasingly difficult to access through traditional venture channels given continued market pullback.

Reg CF’s unique advantage is that it lets companies raise from their customers and communities. That advantage scales with company maturity. A $20 million cap would enable Series A and smaller Series B-scale raises while keeping the existing disclosure, intermediary, and investor-protection framework fully intact.

A Decade of Investor Protection Success

Let’s be clear about what hasn’t happened: systemic fraud, widespread investor harm, or regulatory disaster. Reg CF has operated for nearly ten years with rare enforcement actions and no evidence that retail investors are being systematically victimized.

The standardized disclosures under Form C and Form C-AR create transparency that simply doesn’t exist in other exempt markets. Expanding Reg CF extends these benefits rather than diminishing them.

A Note on Data Quality

One reason we’re confident in these findings: we built the infrastructure to track it properly. The SEC’s publicly reported statistics rely on EDGAR filings, including Form C-U progress updates. But Form C-U compliance has been inconsistent since day one, creating systematic underreporting.

CCLEAR corrects for this by tracking every offering and investment at the transaction level, including instances where issuers run concurrent exempt offerings (like combining Reg CF with Rule 506(c)) as part of a single financing round. This gives us a more accurate picture of how companies are actually raising capital—and why the current cap is forcing unnecessary complexity.

What We’re Asking For

The petition requests two straightforward changes:

- Increase the Reg CF offering limit to $20 million in any 12-month period

- Index the limit to inflation to preserve its real value over time

The SEC has clear authority under Section 3(b) of the Securities Act to make this adjustment. The data supports it. The market is ready for it.

Read the Full Petition

You can read our complete petition to the SEC here. We’ve laid out the empirical case, the regulatory rationale, and the path forward for a more efficient capital formation framework that continues to protect investors while giving growing companies the room they need.

Sherwood Neiss is Principal at Crowdfund Capital Advisors, co-author of the JOBS Act crowdfunding framework, and creator of the CCLEAR database tracking Regulation Crowdfunding market activity.

We Submitted a Proposal to the SEC for Secondary Trading of Tokenized Securities

We Submitted a Proposal to the SEC for Secondary Trading of Tokenized Securities

December 10, 2025

This morning, GUARDD submitted a comment letter to the SEC’s Crypto Task Force proposing a framework that could unlock secondary liquidity for tokenized and exempt securities.

The proposal responds directly to SEC Chairman Paul Atkins, who last week delivered two speeches signaling a significant shift in how the Commission thinks about disclosure requirements and on-chain markets.

GUARDD Comment Letter 12102025What Chairman Atkins Said

At the New York Stock Exchange on December 2, Atkins called for disclosure requirements that “scale with a company’s size and maturity” and are “rooted in the concept of financial materiality.” He noted that the last comprehensive reform of large and small company thresholds was in 2005—and that a company with $250 million in public float is currently subject to the same rules as one 100 times its size.

Two days later, at the Investor Advisory Committee meeting, Atkins turned to tokenization. His assessment was blunt: “Tokenized shares risk becoming nothing more than conversation pieces if their owners cannot trade them competitively in liquid on-chain environments.”

He then asked Commission staff to recommend how the SEC might use its exemptive authority to enable on-chain innovation—with a framework that is “cabined, time limited, transparent, and anchored in strong investor protections.”

Our Proposal: Qualified Disclosure Publishers

We took him up on it.

Our letter proposes that the SEC use its exemptive authority under Section 36 of the Securities Exchange Act to establish a framework recognizing “Qualified Disclosure Publishers” (QDPs). These would be entities that meet specified standards for collecting, verifying, and publicly disseminating issuer information.

Under this framework:

- Broker-dealers could rely on QDP-published information to satisfy Rule 15c2-11 requirements

- Alternative Trading Systems could list securities with current QDP disclosures without additional information availability concerns

- Tokenized securities could trade on registered venues with compliant disclosure infrastructure already in place

The criteria we proposed cover four areas: information standards (tracking Rule 15c2-11(b) requirements plus token-specific data), update requirements (material changes, quarterly confirmations, annual financials), public accessibility (searchable, machine-readable, historical records), and operational standards (written procedures, data integrity controls, Commission examination).

Why This Matters

The JOBS Act transformed primary capital formation for emerging companies. Regulation Crowdfunding and Regulation A+ have enabled thousands of issuers to raise capital from everyday investors.

But secondary liquidity hasn’t kept pace. Investors in exempt offerings often find themselves holding securities with no practical way to sell them. The infrastructure for compliant secondary trading exists—Rule 15c2-11, the Manual Exemption, registered ATSs—but the pathway is complex, expensive, and lacks clear regulatory guidance.

The result is exactly what Chairman Atkins described: tokenized securities that are technically transferable but practically illiquid.

A QDP framework would change that. By establishing clear standards for disclosure publishers and confirming that broker-dealers and ATSs can rely on published information, the SEC could enable compliant secondary markets without requiring private company issuers to assume full Exchange Act reporting obligations.

GUARDD as Proof of Concept

We didn’t propose this framework in the abstract. GUARDD has been operating it since 2021.

We’ve processed disclosures for over 560 securities across Regulation A+, Regulation Crowdfunding, and Regulation D offerings. Our disclosures are published through Mergent’s National Securities Manual, recognized for Manual Exemption purposes in 43 states. We’ve integrated with registered Alternative Trading Systems.

The framework works. What’s missing is regulatory clarity that would give the broader market confidence to build on this foundation.

We’re not asking to be the exclusive Qualified Disclosure Publisher. We’re asking the SEC to recognize that this model is viable, establish clear standards, and let the market develop.

What Happens Next

The Crypto Task Force is actively reviewing submissions and meeting with industry participants. We’ve requested a meeting to discuss the proposal in more detail.

Chairman Atkins has set a clear direction: scaled disclosure, materiality-based requirements, and practical pathways for on-chain markets. Our proposal offers one way to get there.

GUARDD enables secondary trading compliance for exempt securities through standardized disclosure published via Mergent’s National Securities Manual. For more information, visit www.guardd.com. GUARDD is a sister company of Crowdfund Capital Advisors.

SEC Chairman’s Call for Scaled Disclosure Has Implications for Private Securities—And a Framework Already Exists

On December 2, SEC Chairman Paul Atkins stood at the New York Stock Exchange and delivered a speech that could reshape how private companies approach disclosure requirements. While much of the media coverage focused on his critique of regulatory overreach and nod to crypto-friendly policies, one section of his remarks deserves closer attention from the investment crowdfunding and private securities community.

Atkins outlined two core principles for reforming SEC disclosure rules: first, that requirements should be “rooted in the concept of financial materiality,” and second, that they “must scale with a company’s size and maturity.”

For anyone watching the secondary trading space for Regulation Crowdfunding, Regulation A+, and Regulation D securities, these aren’t abstract policy musings. They strike at the heart of a structural problem that has constrained liquidity for years.

The Secondary Trading Bottleneck

Here’s the challenge. When a company raises capital through an exempt offering, the securities issued are generally restricted. Investors who want liquidity before an exit event face a maze of compliance requirements—most notably, Rule 15c2-11 under the Exchange Act and the patchwork of state Blue Sky laws that govern secondary transfers.

For a company to have its shares trade on an Alternative Trading System, current financial and company information must be publicly available. Historically, that meant either becoming a public reporting company (expensive and burdensome) or filing with one of two National Securities Manuals—Mergent or OTC Markets—neither of which was designed for small private issuers.

This created an odd asymmetry: the JOBS Act made it easier to raise capital, but did little to address what happens after the raise when investors want out.

A Framework That Already Exists

What’s notable is that a disclosure framework scaled for private company secondary trading already exists and is recognized by 43 states through the Manual Exemption.

GUARDD, a compliance platform launched in 2020 by several architects of the original JOBS Act crowdfunding framework, was designed specifically for this gap. The platform enables Regulation A+, Regulation Crowdfunding, and Regulation D issuers to publish ongoing disclosures that satisfy both Rule 15c2-11 requirements and state Blue Sky laws, allowing their securities to trade on ATSs.

The disclosure requirements are calibrated for private companies—covering material company and financial information without the volume demanded of public filers. Companies like Masterworks and Collectable have used the service to enable secondary trading of fractionalized alternative assets.

Atkins’ Vision Aligns With What’s Already Working

Chairman Atkins’ critique of disclosure “unmoored from materiality” and his call for requirements that scale with company size describes, in policy terms, what the Manual Exemption and platforms like GUARDD have operationalized in practice.

Consider his remarks about the current regime: disclosure rules have been “hijacked to require information unmoored from materiality,” resulting in “reams of paperwork that can do more to obscure than to illuminate.” His proposed solution—a “minimum effective dose of regulation”—mirrors the approach private company disclosure frameworks have already adopted by necessity.

Atkins also signaled interest in building on the JOBS Act’s “IPO on-ramp” concept, potentially extending accommodations for emerging growth companies. For the exempt securities market, this suggests an appetite for revisiting how disclosure scales across the capital formation lifecycle—from initial offering through secondary liquidity.

Issuers Don’t Need to Wait

The policy debate will unfold over months or years. Rulemaking is slow. But for issuers who raised capital under Regulation Crowdfunding, Regulation A+, or Regulation D and want to offer investors a path to liquidity, the infrastructure already exists.

The Manual Exemption provides a recognized pathway in 43 states. Ongoing disclosure platforms have processed hundreds of securities. Alternative Trading Systems are operational and accepting listings from compliant issuers.

Whatever emerges from the SEC’s reform agenda, companies that establish disclosure practices now will be positioned ahead of the curve—and their investors won’t have to wait for Washington to act before they have options.

The exempt securities market has long operated in the gap between policy aspiration and regulatory reality. Chairman Atkins’ speech suggests that gap may narrow. In the meantime, the market has already built its own solutions.

The Data That’s Hiding in Plain Sight: What 4,358 Crowdfunded Companies Reveal About Startup Survival

There’s a persistent narrative in venture capital: crowdfunding is where companies go when they can’t raise “real” money. The crowd is dumb money. The valuations are inflated. The companies fail.

I spent the last several months testing that assumption with data. What I found challenges everything the institutional investment world thinks it knows about Regulation Crowdfunding.

The Market

Investment crowdfunding has quietly become a $3.2 billion market. Since 2016, over 10,300 offerings have been filed with the SEC, with more than 7,180 successfully funded. Unlike traditional venture deals negotiated behind closed doors, every RegCF offering includes financial disclosures—many reviewed or audited by third parties—valuation data, and ongoing progress reports. All public record.

At CCLEAR, we’ve aggregated this data into what may be the most comprehensive database of early-stage private company performance ever assembled.

The Dataset

For this analysis, we applied rigorous filters: equity offerings only, funded offerings only (those that hit their minimum target), and we excluded withdrawn offerings and project-based raises (individual real estate deals, solar installations, etc.). We also separated parallel offerings to isolate RegCF investment amounts from 506(c) components.

The result: 4,358 unique companies with standardized, comparable data. Approximately 60% of these companies had financials reviewed or audited by a third party.

And the numbers tell a story that surprised even me.

85% Survival Rate

Of the 4,358 companies that successfully completed RegCF offerings, 3,708—or 85.1%—are still operating today. Only 649 (14.9%) have shut down.

Compare this to the oft-cited statistic that 90% of startups fail. Even accounting for methodological differences, the crowdfunding cohort is dramatically outperforming expectations.

Why? One theory: companies that successfully mobilize hundreds or thousands of individual investors have already proven something. They’ve demonstrated the ability to build community, communicate a vision, and convert interest into capital. These are the same muscles required to build a lasting business.

The Multi-Round Signal

Here’s where it gets interesting. Of those 4,358 companies, 699 came back for a second (or third, or fourth) round of crowdfunding. These repeat issuers provide a unique window into company trajectory—something almost impossible to track in traditional venture.

Among these 699 multi-round companies:

- 82% achieved up-rounds (higher valuation than their previous raise)

- 69% showed revenue growth between rounds

- 60% demonstrated both valuation AND revenue growth

- 90.3% are still in business (compared to 85% overall)

The median valuation increase between rounds was 90%.

This isn’t froth. When you can track both valuation growth and revenue growth across successive rounds, you’re seeing real business progress—not just hype cycles.

The Democratization Is Working

One finding deserves particular attention. Among multi-round companies, those with women or minority founders achieved up-rounds 83.2% of the time. Non-W/M founders achieved up-rounds 81.1% of the time.

Statistically identical.

In a venture ecosystem where funding disparities by gender and race remain stark, crowdfunding appears to be functioning as intended: letting the market decide based on merit, not pattern matching.

The “Graduation” Pattern

Perhaps the most significant finding is what happens after crowdfunding. We researched the top-performing RegCF companies to see if they “graduated” to institutional capital. The pattern was unmistakable:

Boxabl raised from over 50,000 crowdfunding investors and announced a $3.5 billion SPAC merger with FG Merger II Corp. (NASDAQ: FGMC) in August 2025, with the combined company expected to trade on Nasdaq under ticker “BXBL.”

EnergyX crowdfunded from thousands of investors, then closed a $50 million Series B led by GM Ventures in April 2023—a strategic investment from one of the world’s largest automakers.

Levels Health raised $5 million from crowdfunding investors (maxed out in under six hours), after securing a $12 million seed round from Andreessen Horowitz in 2020, followed by a $38 million Series A in 2023.

LiquidPiston raised over $25 million through crowdfunding, then secured a $35 million U.S. Air Force contract in October 2023 for hybrid power system development, plus additional Army contracts totaling over $17 million.

These aren’t outliers. They’re signals.

The Opportunity Nobody’s Tracking

Here’s the gap: this data exists. We’ve spent years aggregating it. But institutional investors are still flying blind on the fastest-growing segment of private markets.

Every quarter, hundreds of private companies file standardized disclosures with the SEC—revenue figures, valuation data, use of proceeds, business updates. It’s the most transparent window into early-stage company performance ever created. And it’s largely being ignored.

Consider the parallel to other asset classes. Capital IQ became the standard for public and private company financials. Preqin became the standard for alternative assets. iPREO became the standard for capital markets workflow.

Each recognized that fragmented, hard-to-access data could be aggregated, structured, and transformed into institutional-grade intelligence.

Investment crowdfunding now has thousands of companies, millions of data points, and a regulatory framework that mandates disclosure from the earliest stages of company formation. Congress and the SEC has handed the investment world a gift.

The infrastructure to make sense of it is only beginning to emerge.

What Comes Next

We’re continuing to build out this dataset—cross-referencing crowdfunding companies against Crunchbase, PitchBook, and SEC filings to track which ones raised institutional follow-on capital. Early results suggest the “graduation rate” from crowdfunding to VC is higher than anyone expected.

If you’re interested in the data, the methodology, or what this means for early-stage investing, I’d welcome the conversation.

Sherwood Neiss is the founder of CCLEAR, a venture partner at D3VC, and the author of INVESTOMERS. He co-created the regulatory framework for investment crowdfunding that became law as part of the JOBS Act.

Behind the Data: How Crowdfund Capital Advisors Writes Blog Posts That Challenge Conventional Wisdom

At Crowdfund Capital Advisors, we’ve built our reputation on one simple principle: let the data do the talking. But turning raw numbers from our CCLEAR dataset into compelling narratives that challenge Wall Street’s conventional wisdom doesn’t happen by accident. Here’s how we craft blog posts that cut through the noise and reshape how people think about investment crowdfunding.

It Always Starts With the Data

Every blog post we publish begins the same way—with a question sparked by our dataset. Sometimes it’s a pattern we’ve noticed. Other times, it’s a myth we keep hearing that contradicts what we’re seeing in the numbers.

“Investment crowdfunding is just for companies that can’t get real funding.”

“Crowdfunded startups fail at higher rates.”

“Only desperate entrepreneurs turn to the crowd.”

When we hear claims like these, our first instinct isn’t to argue—it’s to query our database. With over 10,000 SEC-compliant Regulation Crowdfunding offerings, 8,400+ companies, and 5 million structured data points, we have the most comprehensive view of this market that exists anywhere.

From Data Point to Story Arc

Once we’ve identified a compelling data insight, we face our biggest challenge: making numbers narratively powerful.

Raw statistics don’t persuade. Context does.

This is where we transform from data analysts into storytellers. We ask ourselves:

- What’s the prevailing wisdom we’re challenging? (We always lead with the myth)

- What does our data actually show? (Then hit them with the reality)

- What does this mean for the future? (And close with implications)

Take our recent post on survival rates. The data showed that only 25.5% of crowdfunded companies had gone out of business—half the national average. But the real story wasn’t just the number. It was the implication: investment crowdfunding isn’t a dumping ground for weak companies. It’s actually selecting for more resilient businesses.

The Anatomy of a CCA Blog Post

If you’ve read several of our posts, you might notice a pattern. That’s intentional. Here’s our formula:

1. Lead With the Contrarian Claim

We open by acknowledging what “everyone knows” to be true. This immediately signals to readers that we’re about to challenge their assumptions.

Example: “For much of the last decade, equity crowdfunding has been regarded with skepticism…”

2. Introduce the Counter-Evidence

This is where CCLEAR enters the conversation. We don’t just cite our data—we explain why it’s uniquely positioned to answer this question.

Example: “But new, comprehensive data from Crowdfund Capital Advisors, which tracks every SEC-compliant Reg CF offering through its CCLEAR dataset, paints a very different picture.”

3. Build the Case Methodically

We structure our argument as a series of myth-versus-reality confrontations. Each section tackles one specific misconception, presents the data, and explains what it means.

This approach does two things: it makes complex analysis digestible, and it gives readers clear takeaways they can share.

4. Visualize When Possible

Data tables, charts, and graphs aren’t just decoration—they’re evidence. When we show ecosystem rankings or survival rate curves, we’re giving readers a way to see patterns their eyes can trust, not just numbers their brains have to process.

5. Close With Implications

We never end with “here’s what happened.” We end with “here’s what this means” or “here’s what should happen next.”

Often, this is where we make policy recommendations—like raising the RegCF cap to $20 million—because the data justifies bolder action.

Writing for Multiple Audiences

Our blog posts serve different readers with different needs:

For Entrepreneurs: We’re validating their decision to use crowdfunding and giving them ammunition when skeptics question their choice.

For Investors: We’re providing market intelligence that helps them make better allocation decisions and identify emerging opportunities.

For Policymakers: We’re building an evidence-based case for regulatory changes that will unlock the full potential of investment crowdfunding.

For VCs and Institutions: We’re challenging them to reconsider their assumptions and showing them how crowdfunding can complement (not compete with) their investment strategies.

This means we write clearly enough for any reader to follow, but rigorously enough that professionals take us seriously.

The Editing Process: Brutal Honesty

Before any post goes live, we ask ourselves hard questions:

- Does this claim have bulletproof data backing it?

- Are we cherry-picking numbers or showing the full picture?

- Could a skeptic find an obvious hole in this argument?

- Is our language precise or are we overstating?

We’d rather kill a post than publish something that can be easily debunked. Our credibility is our currency.

Why We Don’t Write Clickbait

You won’t see us writing “10 Crowdfunding Secrets VCs Don’t Want You to Know” or “This One Chart Will SHOCK Traditional Investors.”

Why? Because we’re playing a long game.

Our goal isn’t viral moments. It’s shifting industry perception through consistent, credible analysis. Every blog post is another data point in a larger argument: investment crowdfunding isn’t the future—it’s the present, and the numbers prove it.

When Senate staffers cite our research, when platforms share our analysis, when journalists quote our findings—that’s when we know we’ve succeeded.

The Secret Ingredient: Passion Backed by Proof

Here’s what might not be obvious from reading our posts: we genuinely believe in what we’re writing about.

Jason Best and Sherwood Neiss didn’t just study investment crowdfunding—they helped create the regulatory framework that made it possible. They co-authored the JOBS Act provisions that legalized equity crowdfunding in the United States.

So when we write about how crowdfunding is democratizing access to capital, reducing geographic inequality, and giving women and minority founders a fighting chance—we’re not just reporting data. We’re documenting the impact of something we helped build.

That passion could make us biased. That’s why we’re almost obsessive about letting the data lead. Our opinions follow the evidence, not the other way around.

What’s Next

As the investment crowdfunding market matures, our blog content will evolve too. We’re seeing new trends emerge:

- Liquidity and secondary markets for crowdfunding shares

- Institutional adoption as more VCs co-invest alongside the crowd

- International expansion as other countries adopt similar frameworks

- Technology integration with AI and blockchain

Each of these deserves the same rigorous, data-driven analysis we’ve applied to everything else.

The Bottom Line

Great blog posts aren’t written—they’re excavated from data, refined through analysis, and polished until they’re both accurate and accessible.

At CCA, we measure our success not by page views, but by changed minds. When someone reads one of our posts and thinks, “I had no idea the data showed that,” we’ve done our job.

Because in a world where opinions are cheap and narratives are everywhere, the truth backed by comprehensive data is the most powerful story you can tell.

Want to dive into the data yourself? Explore CCLEAR.ai or subscribe to our newsletter for the latest insights from the investment crowdfunding market.

Have a question about investment crowdfunding that you’d like us to tackle? Email us at info@theccagroup.com—your question might become our next blog post.

Checks and Imbalances: What 2025 Tells Us About Investor Sentiment in Investment Crowdfunding

A Mirror Into the Crowd

In public markets, sentiment is measured in index swings and trading volumes. In investment crowdfunding under Regulation Crowdfunding (Reg CF), sentiment is revealed in the most fundamental signal of all: checks written. Each check represents more than capital — it reflects belief, trust, and conviction. Having helped co-create this industry nearly a decade ago, I’ve seen firsthand how check volume serves as a barometer for early-stage optimism.

Eight years of data tell a story that is as much about the crowd as it is about the economy itself. In 2025, the message is clear: investors are still writing checks, but they’re asking harder questions — and they’re committing differently.

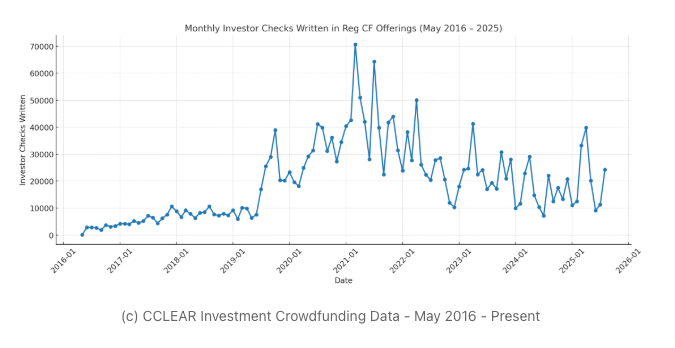

The Arc of Investment Crowdfunding Investor Sentiment (2016–2025)

When Reg CF went live in May 2016, a few thousand believers stepped forward. From that modest beginning, check counts grew steadily through 2021, mirroring the rise of fintech adoption and the democratization of investing through investment crowdfunding.

The pandemic proved to be an unlikely accelerant. In 2020 and 2021, despite global uncertainty, checks surged. Stimulus capital, retail empowerment, and the shift to digital all contributed to record participation. By 2021, the number of monthly checks written was several multiples higher than those in the early months of 2016.

Then came retrenchment. In 2022 and 2023, macroeconomic headwinds — inflation, interest rate hikes, and banking shocks — cooled enthusiasm. Check counts fell. But importantly, they didn’t collapse. The crowd stayed engaged, albeit more cautiously.

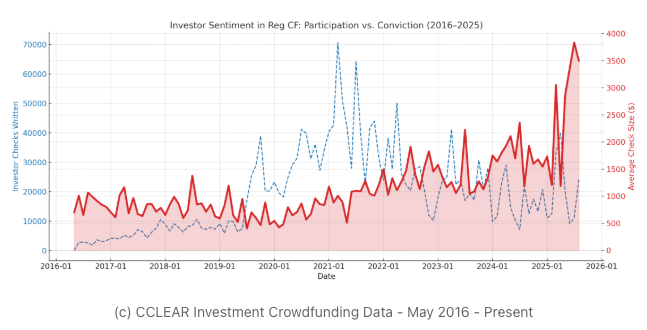

By late 2024, optimism returned. Investor checks climbed again as inflation slowed and rate expectations stabilized. In early 2025, however, we see wobbling: check volumes remain healthy, but the size of each check is shifting dramatically.

Volume vs. Value: A Tale of Two Sentiments

The overlay of check counts with average check size tells the deeper story. In the early years, thousands of small checks defined investment crowdfunding. As the market matured, average check size steadily grew — and in 2025, it has accelerated sharply, even as the number of investors has softened.

This divergence reveals a market dynamic worth underscoring: fewer investors are writing larger checks. It’s a sign of selective conviction. The crowd hasn’t disappeared — it’s consolidating around issuers that demonstrate traction, storytelling, and trust.

What Moves the Crowd in Investment Crowdfunding?

Investment crowdfunding sentiment has proven highly sensitive to macro and geopolitical events:

- COVID-19 (2020): Initial dip followed by a sharp rebound as digital adoption accelerated.

- Stimulus and frothy public markets (2021): Record-breaking checks.

- Fed rate hikes and inflation (2022): Significant retrenchment.

- Banking turbulence (2023): Hesitation but not collapse.

- Election year and geopolitical tension (2025): Fewer investors, bigger bets.

The lesson? The crowd reacts quickly to uncertainty, but it doesn’t retreat completely. Unlike institutional capital, retail conviction is resilient — it simply shifts shape.

Case Study: Legion M and the Power of Community

Few issuers embody this evolution better than Legion M Entertainment. Since its first investment crowdfunding raise in 2016, Legion M has attracted over 58,000 investors across eight offerings, raising more than $25 million. In its most recent round alone, the company brought in $2.9 million from 5,800 investors. Today, Legion M generates over $1 million in annual revenue.

Why does this matter? Because Legion M proves the power of the investomer — the customer who becomes an investor. In their case, moviegoers aren’t just buying tickets; they’re buying ownership in the films they love. That’s why, even in a cautious 2025, they can continue to rally thousands of checks.

(c) Legion M

For Issuers: Raise or Wait?

So what does this mean for founders considering an investment crowdfunding raise in 2025?

Raise Now If: You’re post-revenue, can activate your community, and are prepared to market your campaign. Investor checks are there, and committed investors are writing bigger ones.

Wait If: You’re pre-revenue, lack traction, or hope the crowd will fund you without strong storytelling. In today’s market, conviction must be earned.

Investor sentiment isn’t gone. It’s simply growing up. Checks are fewer, but bigger. The crowd is cautious, not absent.

Conclusion: A Market Maturing

The story of investment crowdfunding checks is the story of retail conviction. From May 2016’s tentative beginnings to 2025’s selective commitment, one thing has remained true: the crowd invests in what it believes in.

This year, issuers who understand that — who treat their investors as partners, customers, and champions — will find that the crowd still has plenty to give.

For a deeper look at how to turn customers into investors, I explore this concept in my book Investomers. Because in the end, checks aren’t just capital — they’re community.

BlackRock & OpenAI Validate D3VC’s Data-First Investment Crowdfunding AI Approach

Last week’s Affinity webinar featuring David Hefer from BlackRock and Rohan Sahigh from OpenAI delivered some striking validation of the investment thesis we’ve been executing at D3VC since our inception in the investment crowdfunding space.

The Writing Was on the Wall

Two standout quotes from industry leaders caught our attention:

“The firms pulling ahead are the ones building proprietary data pipelines…that creates a lasting moat, even as models evolve.” – Rohan Sahigh, OpenAI

“If you don’t control your own data sets, you can be replaced…those are critical factors in assessing whether an AI company is sustainable.” – David Hefer, BlackRock

These insights aren’t revolutionary to us—they’re exactly what we built D3VC around in the investment crowdfunding market.

D3VC: Ahead of the Curve in Investment Crowdfunding

While the early-stage venture industry is just beginning to recognize the critical importance of proprietary data in AI-driven investing, we’ve been living this reality for over two years in investment crowdfunding. Here’s what we saw coming:

Proprietary Data as Competitive Moat: We didn’t just talk about the importance of unique datasets—we built one. Our proprietary database comprises over 150 data points across more than 10,000 investment crowdfunding offerings (including daily commitments and the number of checks written), creating an unparalleled view into early-stage investment patterns.

AI-Native Investment Process: Starting in August 2021, we spent 18 months developing our state-of-the-art machine learning algorithm, training it on nearly a decade of meticulously labeled historical investment crowdfunding data we’d been collecting since 2016. But we didn’t stop there—our algorithm continuously learns from new data daily, adapting to market shifts in real-time. This wasn’t an add-on to our existing process—it became the foundation of how we identify success signals and forecast outcomes.

Data-Driven Deal Flow: While other firms are still figuring out how to integrate AI into their workflows, we built our entire investment thesis around it using investment crowdfunding data. Our algorithm doesn’t replace human expertise—it amplifies it by efficiently narrowing hundreds of potential investments down to the most promising opportunities for our investment committee.

The Validation Continues

The webinar revealed several trends that align perfectly with our investment crowdfunding approach:

Speed and Scale: Rohan highlighted how small AI-native teams are “doing more with less”—a dynamic we see from both sides. D3VC operates with lean efficiency while also evaluating companies that leverage AI to scale their business models with smaller teams. Our data reveals these AI/ML companies in the equity crowdfunding space are increasingly post-revenue and mature, demonstrating sustainable business models built on AI efficiency.

Research Transformation: David emphasized AI’s power in research and due diligence—precisely what our partnership with Crowdfund Capital Advisors and CCLEAR enables through comprehensive daily data collection and analysis of investment crowdfunding campaigns.

First-Mover Advantage: Both speakers stressed the importance of moving fast in the AI space. We didn’t wait for the industry to catch up—we’ve been leveraging AI for investment decisions in the investment crowdfunding market since before it became a talking point.

What’s Next

As BlackRock and OpenAI executives validate the critical importance of proprietary data and AI-first investment approaches, we’re already implementing the next phase of our strategy. Our diversified approach of investing in approximately 200 companies reflects our deep understanding of venture returns’ power-law distribution—knowledge derived from our unique investment crowdfunding dataset.

The convergence of data science and venture capital isn’t coming—it’s here. And we’ve been building it from day one.

The question isn’t whether AI will transform investing. The question is whether you’re building with proprietary data that creates a sustainable competitive advantage, or relying on tools everyone else has access to.

At D3VC, we made that choice years ago.

Interested in learning more about data-driven venture capital in investment crowdfunding? Visit D3VC.ai to explore how we’re leveraging AI and machine learning to transform early-stage investing.

Your Best Customers Could Be Your Biggest Investors Through Investment Crowdfunding (Here’s How)

Recently, I was a keynote at the SuperCrowd25 and had a chance to speak to an audience of entrepreneurs, investors and stakeholders about the future of investment crowdfunding. This is some of what I shared with them…

The Problem with Traditional Funding

Here’s a reality that every entrepreneur knows: traditional venture capital is broken for most businesses. VCs fund less than 3% of companies that apply to them. Banks require collateral that most startups don’t have. And even when you do get traditional investment, those investors have zero emotional connection to your brand. On top of that, the last few years have taught us that they have moved upstream to less risky deals where they can still deploy large checks, leaving a void in early-stage financing.

But what if I told you that your best funding source might already be buying your products?

Enter the “INVESTOMER”

Over the past decade, I’ve watched a quiet revolution unfold in early-stage finance through investment crowdfunding. Since the JOBS Act opened investment opportunities to everyday Americans in 2012, over $3 billion has been raised through investment crowdfunding.

But here’s what most people miss: this isn’t just another way to raise money. It’s the birth of an entirely new type of stakeholder—the INVESTOMER.

An investomer isn’t just an investor who writes a check and disappears. They’re not just a customer who buys and leaves. They’re both—someone who is financially invested AND emotionally invested in your success.

Why This Changes Everything

When customers become investors through investment crowdfunding, something magical happens. They don’t just provide capital—they become your marketing force.

Think about it: traditional investors might give you money and expect returns. But investomers? They:

- Share your story on social media (authentically, because they’re actually invested)

- Refer friends and family to your products

- Defend your brand during tough times

- Continue buying your products because they want to see strong company performance

This creates what I call the “multiplication effect”—where every dollar invested generates additional value through marketing, referrals, and loyalty that money simply can’t buy.

The Qnetic Case Study: From Customers to Advocates

Let me share an example from our own portfolio at D3VC. Qnetic, a flywheel energy storage company, launched their investment crowdfunding campaign on Wefunder to solve a critical problem: long-duration energy storage for renewable energy.

Here’s what made their approach brilliant: instead of just seeking investors, they activated their community of renewable energy enthusiasts, engineers, and environmentally conscious consumers who were already passionate about solving the climate crisis.

The result? Qnetic didn’t just raise capital—they built an army of advocates. Their investomers became their most credible validators when they secured over $110 million in signed Letters of Intent from major customers, including deals with AREVON (Tesla Megapack’s #1 customer).

These weren’t just financial investors—they were believers in the mission who helped spread the word, provided technical feedback, and opened doors to additional opportunities. When you have hundreds of investomers who genuinely believe in solving the energy storage challenge, that creates a network effect that traditional investors simply can’t provide.

The Investment Crowdfunding Data Tells the Story

The shift is already happening. When investment crowdfunding first launched in 2016, about 63% of deals came from pre-revenue companies—startups with just ideas. By 2024, that flipped completely: 65% of deals now come from post-revenue companies.

Why? Because businesses with existing customer bases consistently outperform. They have something that pre-revenue startups don’t: a community of people who already believe in their success.

How to Transform Customers Into Investomers

If you’re thinking about this investment crowdfunding approach, here’s what works:

Start with a foundation. You need paying customers first. This isn’t about ideas—it’s about proven businesses that customers already love.

Build community before you need capital. Use social media, email lists, and customer events to create genuine relationships. When you eventually offer investment opportunities, it shouldn’t feel like a surprise—it should feel like a natural next step.

Treat them like partners, not transactions. Send regular updates. Offer exclusive access. Celebrate wins together. Remember: their investment made your success possible.

Enable them to become “influvestors.” Give your investor-customers the tools to promote your brand. Provide shareable content, hashtags, and easy ways for them to spread the word. They’re your most credible marketing channel because they have real skin in the game.

Beyond the Initial Raise

Here’s where most companies get it wrong: they treat investment as a transaction. Money comes in, relationship ends.

But the real power of investomers reveals itself after the raise. These aren’t just names on your cap table—they’re your competitive moat. Happy investomers reinvest in follow-on rounds. They bring their networks to future opportunities. They create customer acquisition engines that can’t be easily replicated.

The Future is Community-Driven

We’re witnessing a fundamental shift in how businesses think about growth through investment crowdfunding. The companies that will thrive in the next decade won’t just have customers or investors—they’ll have communities of people who are both.

This isn’t about replacing traditional funding. It’s about recognizing that your customers might be your greatest untapped funding source. They already believe in your mission. They know your product works because they use it. They want to see you succeed because your success benefits them.

The question isn’t whether this trend will continue—it’s whether you’ll be part of it.

Your Move

Take a moment to think about your most loyal customers. The ones who consistently buy from you, refer others, and genuinely seem excited about your brand. Now imagine if those same people could invest in your growth through investment crowdfunding.

That’s not just a fundraising strategy—it’s a relationship strategy. And relationships, when done right, become the foundation for sustainable, community-driven growth that no competitor can easily disrupt.

The future belongs to companies that blur the line between customers and investors. Your customers already believe in you. Now give them a way to invest in your success.

If you want to know more about INVESTOMERS and how customer-investors are shaping the future of early-stage finance, get the book on Amazon. It’s a deep dive into the frameworks, case studies, and strategies that are transforming how businesses grow.

Why Can’t Venture Funds Use Investment Crowdfunding? The Absurd Gap in Our Capital Markets

Startups can raise millions from their communities on investment crowdfunding platforms like Republic, Wefunder, and StartEngine. They can tap into their networks, democratize investment opportunities, and build engaged investor communities that become customers and advocates.

But venture funds? We’re stuck in 1980.

The Problem Is Real

I recently tried to find an investment crowdfunding platform for our fund after launching through Carta. The answer was simple: they don’t exist.

While a startup can post their pitch online and raise from hundreds of investors through investment crowdfunding, venture funds are relegated to endless one-on-one meetings, cold LinkedIn outreach, and hoping someone in their network knows a family office that might be interested.

This isn’t just inefficient—it’s absurd.

The Regulatory Straightjacket

The current system forces VC funds into an antiquated fundraising model because of regulations designed for a different era. Funds can only raise from accredited investors, which immediately kills any “crowd” element. But here’s the thing: this doesn’t actually protect anyone.

Accredited investors are already sophisticated enough to evaluate risk. They’re the same people investing in hedge funds, private equity, and complex derivatives. Yet somehow, a regulated investment crowdfunding platform for VC funds—which could have standardized reporting requirements—is off the table?

What We’re Missing

Imagine if venture funds could use investment crowdfunding to:

- Post their investment thesis and track record online

- Allow qualified investors to browse and compare funds like they do startups

- Build communities around their portfolio companies

- Enable smaller check sizes to increase participation

- Provide real-time portfolio updates to their investor base

This isn’t just about efficiency—it’s about democratizing access to venture returns and creating more competitive fund markets.

A Modest Proposal for Venture Fund Crowdfunding

Here’s what could work within existing frameworks:

Phase 1: Allow accredited investors to discover and invest in funds through regulated investment crowdfunding platforms. Same investor protections, just better discovery and onboarding.

Phase 2: After a fund’s first year and annual report, open investment to non-accredited investors under Reg CF guidelines. Let retail investors see actual performance data—MOIC, portfolio progress, realized returns—before making decisions.

This gives funds a year to prove themselves while giving regular investors access to data-driven investment decisions.

And let’s be clear: putting up a fund doesn’t guarantee investment. If it did, every RegCF issuer would blow past their targets. Most don’t. The market is selective, and that’s the point.

Venture funds aren’t get-rich-quick schemes that attract impulsive money. They’re 10+ year commitments with capital calls, management fees, and carry structures that require serious consideration. Investors understand they’re locking up capital for a decade. This isn’t day trading—it’s long-term wealth building that naturally filters for committed investors.

Platforms could build in natural validation mechanisms—show total raised, number of investors, and let LPs opt-in to display their names publicly. When retail investors see “127 investors have backed this fund, including [Notable LP Names],” that’s powerful social proof and investor protection rolled into one.

The existing RegCF framework already has the tools we need: Bad Actor checks to keep fraudsters out, disclosure requirements, and regulatory oversight. We’re not reinventing the wheel—we’re just applying proven safeguards to a different asset class.

Why This Matters

The current system perpetuates inequality in two ways:

- Fund managers with the best networks raise easier, regardless of skill

- Regular investors are locked out of the asset class generating the highest returns

Meanwhile, the same regulatory framework that “protects” retail investors from VC funds happily lets them invest in penny stocks, crypto, and lottery tickets.

The Real Absurdity

We’ve created a system where:

A retail investor can put $10,000 into a single startup through investment crowdfunding (high risk, binary outcome)

But they can’t put $1,000 into a diversified fund of 30 startups (lower risk, portfolio approach)

The risk profile is backwards. The access is backwards. The entire system is backwards.

And we’re not just talking about diversification within a single fund. Imagine the power of choice when investors can diversify across multiple fund strategies: early-stage generalists, healthcare specialists, fintech-focused funds, or deep tech investors. Instead of being locked into whatever fund their network happens to know, investors could build portfolios that match their thesis, risk tolerance, and sector interests.

More funds in the market means more competition, better terms for LPs, and specialized expertise finding the best deals in each vertical. That’s how healthy markets work.

Join the Conversation

Fund managers: What’s been your biggest challenge in raising capital online?

Investors: Would you invest in VC funds if there was a transparent, regulated investment crowdfunding platform?

Regulators: (I know you’re not reading this, but…) It’s time to modernize these rules.

The technology exists. The demand exists. The only thing missing is the regulatory framework to make it happen.

What am I missing? Drop your thoughts in the comments.

Tokenization Meets Washington: What the Stablecoin Bill Means for Regulation Crowdfunding Issuers

Yesterday, President Trump signed the Stablecoin Bill into law.

While the headlines focus on stablecoins and digital dollars, for those of us who’ve spent over a decade building the infrastructure and rules around investment crowdfunding, this moment signals something bigger:

Washington is catching up to innovation.

And for the 50 Regulation Crowdfunding (Reg CF) issuers who have already tested the waters with token-based security structures, this could be the beginning of the clarity they’ve long been waiting for.

The Tokenized Pioneers of Regulation Crowdfunding

Since Reg CF went live in 2016, 50 issuers have used some form of token or token-adjacent structure to raise capital through Regulation Crowdfunding.

- 36 of them were funded.

- 14 didn’t make it.

- They spanned 16 states, across a mix of industries.

- The most common structures? Common Stock + SAFT (9), Simple Agreement for Future Token (SAFT) (6), Token (6), and Convertible Debt + SAFT (5)

These weren’t speculative ICOs. These were U.S. businesses raising capital from the crowd—legally—under SEC oversight through Regulation Crowdfunding, on platforms like:

- StartEngine (20 offerings)

- Republic (10 offerings)

- 7 platforms total supporting tokenized securities.

These entrepreneurs were early. In some cases, too early. But they laid important groundwork.

So What Does the Stablecoin Law Mean for Regulation Crowdfunding?

Let’s be clear: the new law focuses on stablecoins, not tokenized securities. But legislation like this does two things:

1. It signals a regulatory shift.

Congress and the White House are moving from “blockchain denial” to “blockchain design.” That’s a seismic shift for anyone using digital assets to represent ownership, raise capital, or build compliance-based infrastructure.

2. It creates momentum for follow-on rules.

At the SEC, there’s already a conversation around new exemptions for tokenization. This bill could accelerate that.

Why This Matters for Regulation Crowdfunding

If the SEC continues moving toward a framework for tokenized securities—especially under exemptions like Regulation Crowdfunding—here’s what’s likely to change:

- On-chain cap tables become viable.

- Secondary liquidity (a huge bottleneck) gets easier to imagine and eventually implement. (Blue Sky laws need to be addressed as well as ongoing disclosures for investor protection).

- Issuers can offer programmable securities with embedded logic for dividends, voting, and transfers.

- Intermediaries—funding portals and broker-dealers—gain confidence to support digital asset offerings more robustly.

That’s real innovation. And it’s built on the legal scaffolding we’ve been assembling since 2012.

But Let’s Not Get Ahead of Ourselves

There’s still no green light for issuers to tokenize equity and assume compliance. Regulation Crowdfunding still:

- Caps raises at $5M per 12 months. (This cap NEEDS to be immediately increased to at least $20M to replace Tier I of Regulation A).

- Requires Form C filings and ongoing disclosure.

- Prohibits most forms of secondary trading, unless structured through a registered exchange or ATS.

The Stablecoin Bill doesn’t fix these constraints, but it does open the door for what’s next in Regulation Crowdfunding.

Final Thoughts

As someone who helped write the original Crowdfunding Exemption Framework, I’ve always believed in the power of legal innovation to match technological innovation. We are finally seeing that take shape.

For the platforms and issuers who took early risks with token structures in Regulation Crowdfunding, this is validation.

For regulators, this is momentum.

And for investors? This could mean smarter, more transparent, and potentially more liquid crowdfunding opportunities.

The next wave of Reg CF won’t just be digital-first. It might be digital-native.

Let’s build it right.

—

📬 If you want to dive deeper into the data, we’ve tracked every token-based Reg CF deal through the CCLEAR database. For more, visit www.cclear.ai or reach out to data@theccagroup.com.

What If Americans Could Fund Laws Like They Fund Startups?

Every election cycle, we hear the same thing: “Washington is broken.” But maybe it’s not broken — maybe we’re just using the wrong tools to fix it.

The real issue isn’t dysfunction. It’s funding.

Today, policy is shaped by the few who can afford to influence it. Lobbyists cut the checks. Lawmakers respond. And for the rest of us? Participation stops at the ballot box. Trust in the process is at historic lows, and most Americans feel politically powerless between elections.

But there’s another way — and we’ve already built it.

Crowdfunding Changed Access to Capital. It Can Do the Same for Policy.

Over the last decade, Regulation Crowdfunding (Reg CF) has redefined how capital flows in America. What began as a policy idea under the JOBS Act has turned into a vibrant engine for entrepreneurship, inclusion, and community wealth-building.

The numbers tell a powerful story:

- More than 2,400 ZIP codes have hosted at least one Reg CF offering

- These communities represent over 22% of America’s voting-age population

- This spans roughly 69% of all U.S. Congressional districts

This isn’t a coastal niche or policy experiment. It’s a national movement — a new way to fund ideas that matter. And it’s working.

Proof That Crowdfunding Works

It’s Democratic. Tens of millions of Americans have seen, backed, or invested in startups through regulated crowdfunding platforms. This isn’t Wall Street. It’s Main Street.

It’s Inclusive. Nearly 1 in 2 offerings today are led by a woman or minority founder — a staggering departure from the traditional venture world.

It’s Generative. This isn’t just about startups. It’s about communities. As these companies succeed, they create jobs, pay local suppliers, and circulate money through neighborhoods that have long been excluded from capital access. That’s local economic expansion — and it’s measurable.

Most importantly: it shares the wealth. Not just with founders and employees, but with investors — both accredited and retail — who benefit from dividends, interest, and exits. Crowdfunding is making ownership possible for more Americans.

Imagine applying that same crowdfunding model to legislation.

What If We Crowdfunded Policy?

Let’s be honest: money drives politics. That’s not going to change. But what can change is who controls that money — and what it funds.

Instead of PACs and lobbyists shaping the legislative agenda, imagine millions of citizens pooling small contributions to support specific policy ideas through crowdfunding platforms.

You don’t back a politician. You back a bill. You don’t donate to a campaign. You pledge to an idea. And you don’t wait for someone else to act.

This isn’t about donating to a cause and hoping someone else takes it from there. It’s about giving citizens the power to surface an issue, crowdsource the legislation itself, and fund the public momentum that gives Congress a clear, trackable mandate.

With modern technology — from civic platforms to generative AI — drafting real, review-ready policy is no longer reserved for lobbyists and lawyers. It can begin with the people.

This isn’t about ideology. It’s about participation.

A Nonpartisan, Market-Driven Solution

This crowdfunding concept aligns with a wide spectrum of values:

For conservatives: it supports limited bureaucracy, local control, and transparent markets.

For progressives: it reinforces civic empowerment, equity, and public accountability.

This model doesn’t expand government. It expands ownership — of the policy process.

By shifting power from closed-door lobbying to open-source public funding through crowdfunding, we can create a more representative system. One where ideas compete on merit, and the crowd decides what deserves attention.

A More Transparent Legislative Process

Crowd-backed policies can drive a new kind of legislative integrity.

No pork. No partisan amendments buried in thousand-page bills. Just focused, single-issue legislation backed by clear public support.

With the right platform, this isn’t a hypothetical. It’s a functional next step in civic infrastructure.

How Civic Crowdfunding Would Work

Imagine a civic crowdfunding platform where:

- Policy ideas are proposed by citizens, think tanks, or advocacy groups

- Campaigns are launched — not for candidates, but for specific legislative proposals

- Individuals pledge financial support or cast verified votes of interest

- Lawmakers can see exactly what their constituents care about — and how much public momentum backs it

- Those who sponsor or champion these bills receive public recognition, not cash — but political capital in its purest form: trust

This doesn’t require new laws or federal mandates. We already have:

- Secure crowdfunding infrastructure

- Identity verification tools

- Compliance frameworks built from the success of Reg CF

What we need now is the will to scale this idea — and the coalition to launch it.

The Role of Crowdfund Capital Advisors

At Crowdfund Capital Advisors, we’ve spent over a decade at the intersection of policy and innovation. We helped shape Reg CF from a policy concept into a $2B+ capital market — and we’ve tracked every offering, every job created, and every community touched along the way.

We believe this next leap — applying crowdfunding to public policy — is not only possible, but necessary.

For those exploring how to build this vision responsibly, CCA is a resource. Whether you’re a policymaker, civic technologist, or coalition partner, our data and insights can help ground this effort in reality and compliance.

Learn more at CrowdfundCapitalAdvisors.com

For Those Who Want More

We’re preparing a detailed academic paper on this concept, including legal frameworks, use cases, and implementation strategies. If you’d like a copy, sign up using the form below.

👉 Request the policy paper or join the initiative

Join the Movement

We’re organizing the coalition now — not around a political party, but around a new way of doing policy.

By signing up, you can:

- Join a legislative advisory group

- Offer early financial support to help build the platform

- Be listed as a public supporter

- Stay informed as the idea develops

Together, we can shift from lobbying against progress to crowdfunding for it.

Let’s build the platform. Let’s fund the future — together. Click here to join the movement!

Compliance Note

This proposal complies with all applicable federal campaign finance laws. No funds would be used to support individual candidates or parties. All activity would be focused on issue-based civic engagement, transparency, and nonpartisan participation in the policy process.

The Rise of Investomers: Why the Future of Startup Funding Belongs to Customers

We’re entering a new era of capital formation—one where your customers don’t just buy your product; they buy into your company through investment crowdfunding.

In this article, I’ll unpack the rise of investomers—customers who become investors—and why community-led capital is no longer a fringe trend, but a fundamental shift in how early-stage businesses raise money, build loyalty, and scale.

What Is an Investomer?

An investomer is more than just a backer.

They’re a hybrid of investor and customer—someone who believes in your business so deeply, they put their money behind it, not out of charity, but conviction.

As I explore in my book, INVESTOMERS: How Customers Turned Investors Are Reshaping Early-Stage Finance, this is a new kind of stakeholder—part brand champion, part financial participant.

“When customers invest, they don’t just provide capital; they fuel your growth through word-of-mouth, brand loyalty, and evangelism.” — INVESTOMERS

The Old Model: VC-First

Traditional venture capital has played a crucial role in startup growth, but it comes with clear barriers:

- Selective and exclusive

- Time-consuming and complex

- High dilution and reduced control

- Limited community engagement

The New Model: Investment Crowdfunding and Community-First Capital

With Regulation Crowdfunding (Reg CF), the rules have changed—and the crowd now has a seat at the table through investment crowdfunding.

Raising from customers means:

- You fund faster

- You own your story

- You build a loyal community

- You reduce reliance on gatekeepers

According to data from CCLEAR.ai, nearly $3 billion has been invested via investment crowdfunding under Reg CF. Thousands of businesses are now tapping into their most passionate stakeholders—their customers—for capital.

From Grateful Parent to Investomer

In INVESTOMERS, I share the story of FLAVORx—a company I co-founded that helps children take their medicine by making it taste better.

After helping one family, a mother called and said: “My kid finally took their medicine! How can I invest in your company?”

That moment became the spark for a movement. A realization that your best investors might already be in your customer base.

Investomer Impact: What the Investment Crowdfunding Data Shows

The 2025 Investment Crowdfunding Annual Report and CCLEAR data confirm the trend:

- Reg CF-funded companies show faster raise velocity

- Community-funded campaigns outperform in loyalty metrics

- Follow-on rounds often include repeat investomers

- Investomer campaigns tend to close with stronger brand equity

These are not just investors. They’re multipliers.

How to Build with Investomers Through Investment Crowdfunding

If you’re thinking of raising capital through investment crowdfunding, here’s how to begin building your investomer movement:

Start Early – Use “testing-the-waters” (TTW) tools to ask your customers if they’d invest.

Tell a Mission-Driven Story – Values matter more than valuation.

Enable Referrals – Reward early backers for bringing others in. (Be transparent that you aren’t being paid to promote).

Engage Post-Raise – Keep them close with updates, perks, and transparency.

This isn’t about one transaction. It’s about building a tribe.

Final Thought

Community capital through investment crowdfunding is no longer experimental—it’s strategic.

Founders who embrace investomers don’t just raise money. They build movements. They scale loyalty. They share ownership.

“The future of finance is not just transactional; it’s about building engaged communities that support businesses they believe in.” — INVESTOMERS

Learn More

If this resonates with you:

📖 Read INVESTOMERS on Amazon 📊 Explore the data behind the movement at www.cclear.ai

About the Author

Sherwood Neiss is a principal at Crowdfund Capital Advisors and author of INVESTOMERS. He helped draft the crowdfunding legislation in the JOBS Act and leads the development of CCLEAR.ai, the most comprehensive dataset on Regulation Crowdfunding in the U.S.