Honeycomb – Debt Crowdfunding on a Hot Streak

Debt Crowdfunding may only make up 23% of all Regulation Crowdfunding offerings and 7.4% of all the capital raised, but its steady growth tells a compelling story of its rising importance in SME lending. In a time when banks are reducing their lending activities, small businesses, especially those facing financial challenges, are turning towards alternative funding sources. Debt crowdfunding is becoming a crucial support for many local businesses, providing a stable financial option during tough economic times.

The appeal of debt crowdfunding is clear and wide-ranging. It opens up access to funds, allowing businesses, even those seen as too risky by traditional lenders, to get the essential funding they need, which in turn supports innovation and new business ventures. Moreover, it creates a supportive relationship between businesses and the community; local businesses get the necessary funds to grow, while community members, now investors, get to be part of local economic development.

2023 has seen a notable increase in debt crowdfunding investors, attracted by an enticing average interest rate close to 11% and average loans rising to $140K, a 7.7% increase YoY. Platforms like Honeycomb are leading this movement, hosting an impressive 41% of all industry debt offerings this year. Our chat below with George Cook, CEO of Honeycomb Credit, sheds light on the forces powering this growing sector, exploring the detailed dynamics of debt crowdfunding and its vital role in supporting SMEs through economic challenges while also looking into its ability to enhance inclusivity, accessibility, and sustainable development in business financing.

Q. Please briefly describe Honeycomb for our readers who might not be familiar with it.

A. Honeycomb Credit is a website for anyone who wants to invest in vetted, locally-owned small businesses. Through our platform, investors can unlock fair funding for growing businesses while potentially receiving returns of 10-14% annually and supporting small businesses and communities that are important to them.

I come from a community banking background, and I saw that bank consolidation was leaving a lot of creditworthy small businesses behind. I co-founded Honeycomb to create a place to connect businesses that are being left behind by traditional lenders with everyday investors looking for high-yield investments that they can feel good about adding to their portfolios.

Q. We’ve noticed a significant uptick in debt offerings on Honeycomb. In fact, it appears you’re on track for a record-breaking year in terms of new offerings. What factors do you attribute to this surge?

A. Yes! Since the beginning of this year, we have nearly tripled the number of businesses we are working with on a monthly basis. Beyond Honeycomb getting better at reaching small businesses, there are a few larger factors at play. Firstly, we have been fortunate enough to receive some positive national press, including prominent coverage in a recent Wall Street Journal article and being named by CNBC as one of the top 200 FinTech’s in the world. This coverage helps to cement our leadership in debt crowdfunding while demonstrating the staying power of this new way to invest.

Secondly, following the banking crisis earlier this year, we have seen a sharp pullback in commercial lending from traditional bank lenders. This means highly creditworthy small businesses with long-standing banking relationships are not able to rely on their banks in the same way they could at the beginning of the year. Correspondingly, these businesses are increasingly looking for alternative ways to fund their growth, and community-sourced capital is an increasingly attractive option.

Q. With the recent moves by the Fed on interest rates, how has this impacted issuers on Honeycomb?

A. By definition, the Fed is raising rates to reduce the amount of capital being borrowed and we do hear from some businesses that they are postponing an expansion project until rates are lower. That said, we still see the cream of the crop in the market for capital. These are businesses who, despite higher inflation and economic uncertainty, are still finding profitable paths to growth. Coupled with the decline in bank lending, we are seeing more and more of these aspirational businesses joining the platform.

Q. While it seems like a positive trend for investors, what feedback or sentiments are you receiving from them?

A. Investors are thrilled with the higher rate environment, particularly from a fixed-income asset class that begins generating cash payments in months instead of years. We are seeing substantial growth in both first-time investors making modest $100 or $250 investments alongside high net-worth individuals who are looking to build $50,000+ portfolios on the platform. The beauty of our model is that it truly offers an opportunity to choose your own adventure, whether you are looking to make small investments in one or two businesses you know and love or if you want to build larger portfolios across industries and geographies.

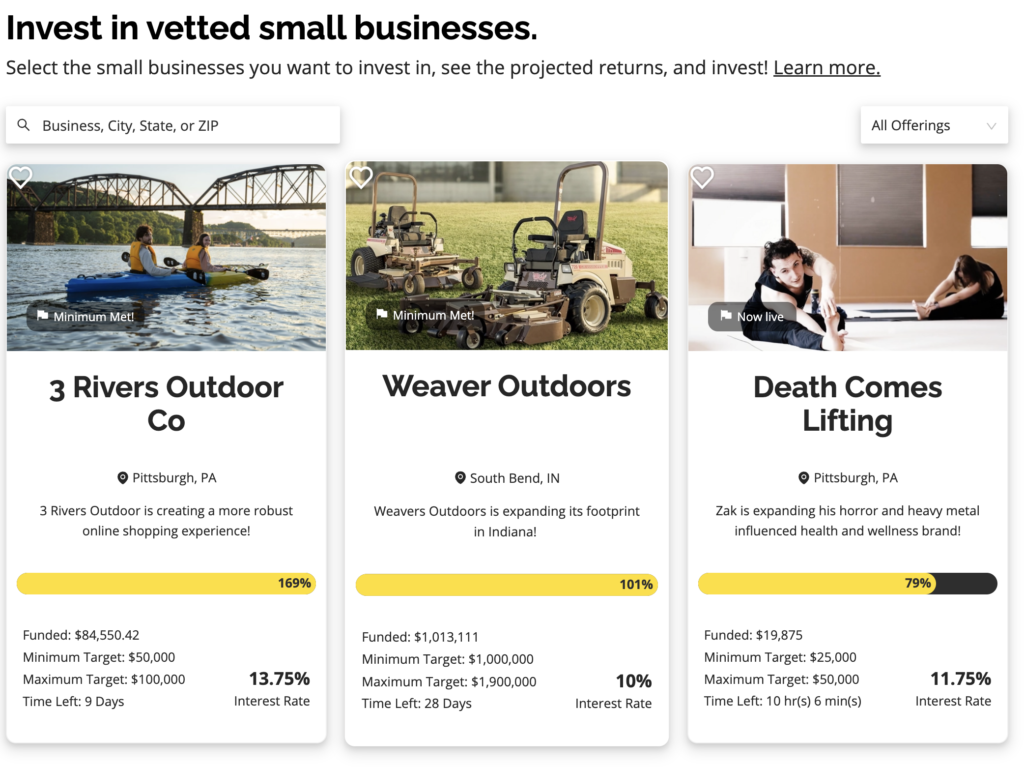

Q. It’s impressive to see that you’re set to break another record this quarter with capital raised, already surpassing last year’s figure by 157%. Is this growth primarily due to an increase in issuers, or are issuers seeking more capital than before?

A. We are seeing a small increase in average offering sizes, but we remain committed to serving Main Street businesses with relatively modest capital needs. The majority of the growth therefore is coming from the volume of offerings on the Honeycomb site. I believe this creates a really delightful experience for investors who often liken the experience of scanning our explore page to being a ‘shark’. They get to hear more and more of these incredibly passionate entrepreneurial stories and choose which they want to support.

Q. We’ve observed a notable presence of women and minority issuers on Honeycomb. Is this a natural occurrence, or is there a concerted effort on your part to engage these groups? Additionally, there seems to be a higher percentage of women/minority founders in debt offerings compared to equity. Why do you think this trend exists?

A. The team is very conscientious about making sure that funds are flowing to communities that are often overlooked by traditional lenders. It turns out that often correlates to a very diverse set of business owners – so far this year 72% of our business had a women owner, 59% had a BIPOC owner, and 12% were veteran-owned. These numbers are unheard of in small business lending.

We often think about entrepreneurship as what happens at glamorous high-tech startups in Silicon Valley, but the reality is that the overwhelming majority of entrepreneurial pursuits in the US are for brick-and-mortar, cash-flowing small businesses. These Main Street entrepreneurs are disproportionately women, people of color, and immigrants and it is only natural that they are reflected in our metrics accordingly.

Q. On average, what amount can issuers on Honeycomb expect to raise if their campaign is successful?

A. Our average offering is around $55,000. Our sweet spot is between $25,000 and $250,000.

Q. For potential issuers considering Honeycomb, what advice would you give them to ensure a successful offering?

A. Firstly, get your financial house in order – get a bookkeeper, manage the business to the numbers, and understand the levers that can help you grow your business to the next level. We often find businesses who would like to work with us but they don’t have their financials in order or they are unable to build a compelling business plan for their proposed expansion because they don’t fully understand their path to growth.

Secondly, build your audience – the majority of investment capital on Honeycomb comes from customers and fans of the business. And that’s a good thing! Getting your customers invested in your business means they will champion your success and will show unflappable loyalty for years to come. But, even if your customers love you, if you don’t have the channels to tell your customers about your offering – whether social media, email, foot traffic, etc – then it will be hard to share your offering with them.

Q. Looking ahead, where do you envision Honeycomb in the next few years?

A. Our mission at Honeycomb is to unlock financial opportunities to build vibrant, financially empowered communities. To do that, we are going to continue to make the idea of community capital a household concept and make it increasingly accessible to small businesses and investors. We have a lot of exciting features rolling out in 2024, including opportunities to more seamlessly bring the investment experience into the brick-and-mortar visit and products to allow investors to build portfolios of loans on the site more easily.

Much thanks to George and the team at Honeycomb! We firmly believe this side of the investment crowdfunding market will see significant traction over the next few years and we look forward to following their success.

Getting your hands on a full list of debt crowdfunding options can really make a difference for investors, businesses, and analysts. It’s not just about finding new investment chances. It’s also about having the right info to make smart investment choices and understanding what’s happening in the market right now. It helps businesses see where they stand and plan their next move in a growing market. For researchers and academics, it’s a great source of data to study the changing world of alternative financing and its effects on small and medium businesses.