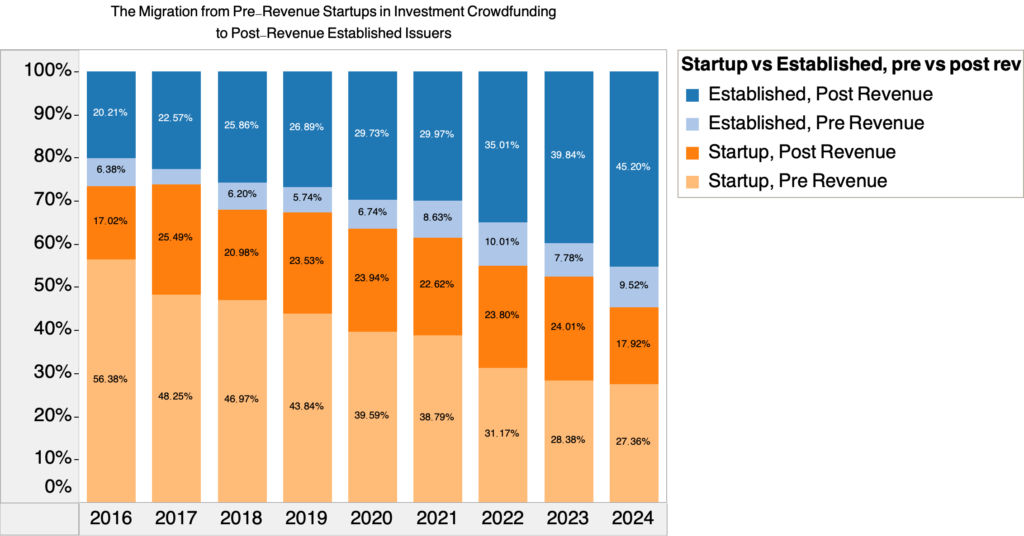

When Regulation Crowdfunding (Reg CF) was introduced in 2016, it created a new path for businesses to raise capital, connecting entrepreneurs with a broader pool of investors. Initially dominated by early-stage, pre-revenue startups, the industry has matured significantly over the past eight years. A closer look at the data reveals a striking trend: post-revenue issuers—both startups and established companies—have steadily grown their share of the market, culminating in 2024, where their combined total is at an all-time high.

The Data Tells a Story of Growth

The numbers show a profound shift in the composition of crowdfunding campaigns. In 2016, post-revenue issuers (startups and established) accounted for a combined 37.2% of all offerings. By 2024, that figure had climbed to an unprecedented 63.1%, representing a nearly 70% increase over eight years.

For established post-revenue issuers, the growth has been especially remarkable, doubling from 20.2% in 2016 to 45.2% in 2024. Post-revenue startups, while less dominant, have maintained a consistent presence, peaking at 25.5% in 2017 before settling at 17.9% in 2024. Together, these groups now form the majority of offerings, marking a dramatic pivot from the industry’s earlier reliance on pre-revenue startups.

Meanwhile, pre-revenue startups—the early pioneers of crowdfunding—have seen their share dwindle from 56.4% in 2016 to 27.4% in 2024. This reflects both the diversification of the crowdfunding ecosystem and the increasing competition for investor attention.

Why the Shift?

Several forces have driven this transformation:

- Crowdfunding Matures into a Serious Capital Source: The increase in the funding cap from $1 million to $5 million in 2020 allowed more established businesses to participate. These companies bring operational track records and revenue streams, making them more attractive to investors seeking reduced risk.

- Economic Conditions and Market Dynamics: A tightening venture capital market has pushed businesses to explore alternative funding sources. Crowdfunding, with its community-focused approach and flexible structures, has provided a lifeline for post-revenue businesses seeking growth capital or bridge financing.

- Savvier Investors: Crowdfunding investors are no longer the speculative pioneers of 2016. They’ve grown more sophisticated, favoring campaigns from businesses with clear revenue models and paths to profitability. This has naturally shifted demand toward post-revenue issuers.

- Platform Innovation: Crowdfunding platforms have adapted to accommodate larger, more complex issuers. Enhanced tools, better marketing strategies, and improved investor relations services have made it easier for post-revenue companies to engage successfully with the crowd.

The Implications of This Growth

The rise of post-revenue issuers has significant ramifications for investors, issuers, and the crowdfunding ecosystem at large:

- Lower Risk, Broader Appeal: Post-revenue businesses, particularly established ones, often present less risk to investors. This shift toward more stable issuers broadens the appeal of crowdfunding to a wider audience, including more conservative investors.

- A New Pathway for VCs: As venture capital markets ease, crowdfunding can act as a proving ground. Investors can observe which post-revenue issuers survive economic headwinds, providing VCs with vetted opportunities.

- The $20 Million Question: The current $5 million funding cap may soon become a bottleneck for larger issuers entering the space. Raising this cap to $20 million would open the door for even more mature companies to leverage crowdfunding for substantial growth initiatives.

- A Balanced Ecosystem: The industry’s evolution doesn’t mean the end for startups. Pre-revenue issuers still play an essential role in the ecosystem, providing innovation and high-risk, high-reward opportunities for investors. However, they must now compete in a more diverse, mature marketplace.

Looking Forward

The growth of post-revenue issuers—startups and established businesses alike—signals that crowdfunding is entering a new phase of maturity. In 2024, the combined dominance of these issuers highlights the platform’s potential as a mainstream funding mechanism. For investors, this means access to less risky opportunities with proven track records. For issuers, it demonstrates that crowdfunding can compete with traditional financing at every stage of business development.

But this growth also underscores the need for policy updates. With the industry attracting larger players, raising the funding cap to $20 million would unlock its full potential, enabling crowdfunding to serve as a vital tool for scaling businesses.

As we move into the next decade, it’s clear that crowdfunding is no longer just a stepping stone for startups—it’s a foundation for business growth and innovation across all stages.

Interested in the data behind this story? Reach out to data@theccagroup.com with your inquiry!